Momentum Indicator

Momentum measures the rate of change in closing prices and is used to detect trend weakness and likely reversal points. It is often underrated because of its simplicity.

High Momentum readings (positive or negative) occur when a trend is at its strongest. Lower readings are found at the start and end of trends.

Overbought and oversold levels are set separately for each security, based on the performance of the indicator over past cycles.

Trading Signals

Different Momentum signals are used for ranging markets and trending markets.

Ranging Markets

First, you will need to set overbought and oversold levels based on your observation of past ranging markets. The levels should cut across at least two-thirds of the peaks and troughs.

Go long when:

- Momentum crosses to below the oversold level and then rises back above it; or

- On bullish divergences - where the first trough is below the oversold level.

Go short when:

- Momentum crosses to above the overbought level and then falls back below it.

- On a bearish divergence - with the first peak above the overbought level.

Trending Markets

First, identify the trend direction using Momentum or a trend indicator. Momentum tends to stay above zero during an up-trend and below zero during a down-trend.

Only take signals in the direction of the trend.

- Up-trend: go long if Momentum turns upwards when below zero.

- Down-trend: go short if Momentum turns downward when above zero.

Exit using a trend indicator.

Trend lines are also drawn on the Momentum indicator. A break in the trend line often occurs in advance of a similar break on the price chart.

Take profits on divergences and trend line breaks.

Example

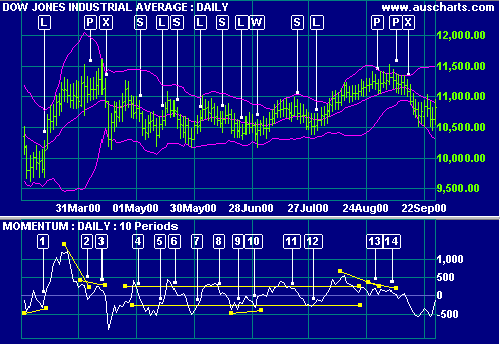

Dow Jones Industrial Average with 10-day Momentum indicator and Bollinger bands at 2.5 standard deviations around a 21-day exponential moving average.

Mouse over chart captions to display trading signals.

- Go long [L] when the MA turns upwards after a bullish Momentum divergence.

- Take profits [P] on a bearish divergence.

- Exit [X] when price closes below the MA.

- Price has started ranging, shown by the fluctuation of price around the MA and Momentum around the zero line. Set overbought and oversold levels based on observation of previous ranging markets. Go short [S] when Momentum turns back below the overbought line.

- Go long [L] when Momentum crosses back above the oversold line.

- Go short [S] again when Momentum crosses back below the overbought line.

- Go long [L].

- Go short [S].

- Go long [L] when Momentum crosses back above the oversold line. The long position is stopped out by a lower Low at [W].

- Go long again at [W] - the signal is supported by a bullish divergence.

- Go short [S].

- Go long [L]. Price then breaks out of the ranging market and stays above the MA. Switch to trending signals.

- Take profits [P] on a bearish divergence.

- Take further profits [P] on a bearish triple divergence. Exit [X] the trade when price closes below the MA.

Setup

The default indicator window is 12 days. To alter the default settings - see Edit Indicator Settings.

See Indicator Panel for directions on how to set up an indicator.

Formula

Momentum is calculated as:

Closing Price [today] - Closing Price [n days ago]

Example

| Day | Closing Price | Closing price [5 days ago] |

5 day Momentum [CP - CP 5 days ago] |

| 1 | 52.00 | - | - |

| 2 | 51.00 | - | - |

| 3 | 51.50 | - | - |

| 4 | 48.50 | - | - |

| 5 | 53.00 | - | - |

| 6 | 53.50 | 52.00 | 1.50 |

| 7 | 53.50 | 51.00 | 2.50 |

| 8 | 54.00 | 51.50 | 2.50 |

| 9 | 54.00 | 48.50 | 5.50 |

| 10 | 55.00 | 53.00 | 2.00 |

Note how an unusually low close on day 4 distorts Momentum on day 9 (when closing price is unchanged from day 8).