Twiggs® Proprietary Indicators

Proprietary Indicators are designed by Colin Twiggs to highlight different aspects of buyer/seller sentiment or enthusiasm.

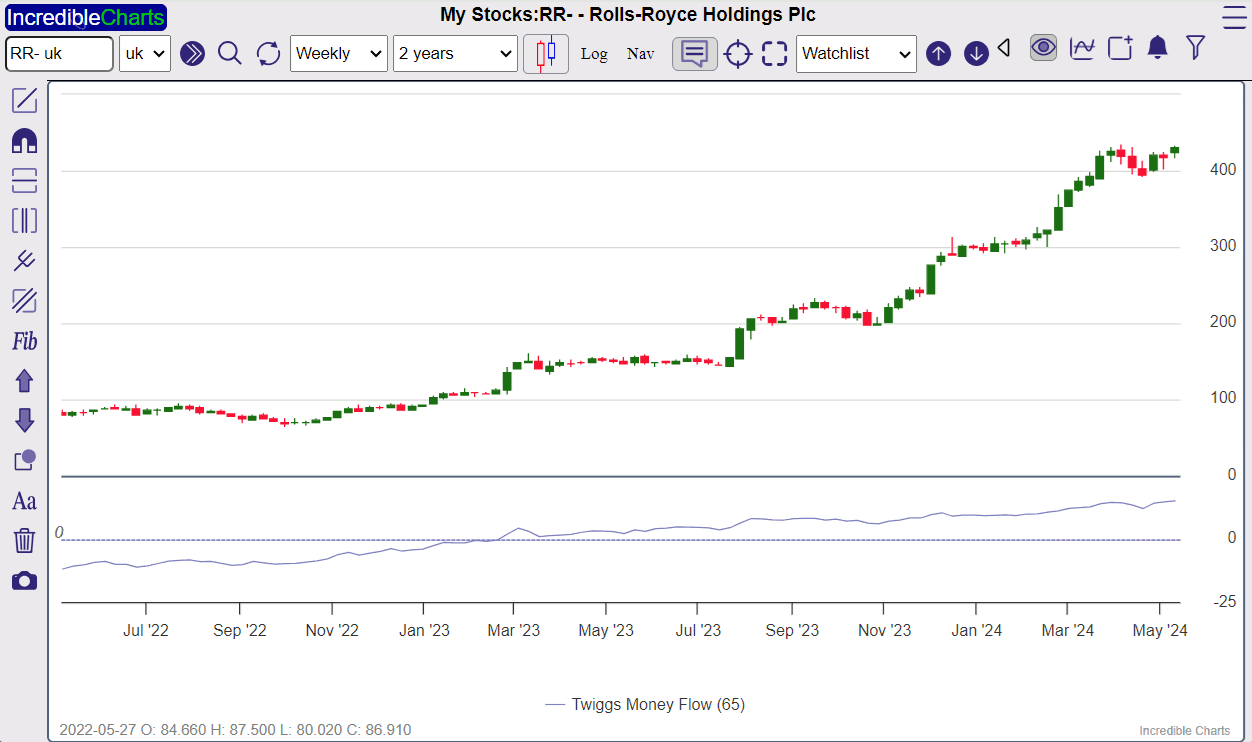

Twiggs® Money Flow

Twiggs Money Flow compares closing price to true range and combines the result with volume to highlight buying or selling pressure.

Twiggs® Trend Index

Twiggs Trend Index performs a similar function to Twiggs Money Flow but it uses volatility rather than volume to gauge the strength of market sentiment.

Twiggs® Momentum Oscillator

Twiggs Momentum is a smoother form of the traditional Momentum oscillator. Ideally suited to longer-term trends, Twiggs Momentum highlights changes in trend velocity (or momentum), offering advance warning of bullish or bearish trend reversals.

Twiggs® Smoothed Momentum

Twiggs Smoothed Momentum is an even longer-term version of the Twiggs Momentum oscillator.

Twiggs® Volatility

Twiggs Volatility uses average true range to measure volatility. This is not a directional signal. Unusual volatility normally warns of a rise in bearish sentiment but on occasion may also warn of a strong rise in bullish sentiment. The indicator should therefore only be used in combination with reliable trend direction indicators such as Twiggs Momentum, Twiggs Trend Index or Twiggs Money Flow.

Volume Twiggs® Standard Deviation

Volume Twiggs Standard Deviation uses standard deviation to highlight unusually high or low activity on the volume chart.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.