Relative Strength (Compare)

Similar to the Price Ratio indicator, Relative Strength plots the ratio between two stock, or index, prices as a line indicator. Price Ratio, however, calculates the ratio between two stocks from the start of the selected time frame, whether that be 1 month or 10 years. The plot line always starts at zero, no matter what the chart length. Relative Strength, however, plots the ratio from a fixed date, so the plot line will not always start at zero.

The advantage of Relative Strength (Compare) over Price Ratio is that the line does not reset every time you vary the chart length (Time Period on the chart menu). This is especially important if you are going to draw trendlines or captions.

Relative Strength Trading Signals

The Relative Strength indicator is not identical to, Relative Strength on Mansfield Charts, popularized by Stan Weinstein in his book Secrets For Profiting In Bull And Bear Markets. It is, however, very similar and can be used with Weinstein's long-term breakout system.

Example

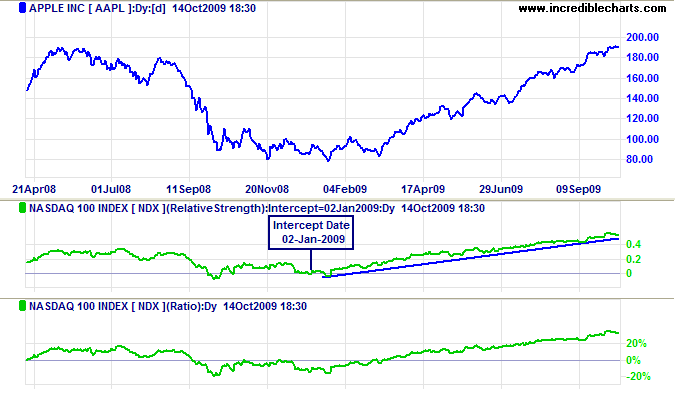

Apple is compared to the NASDAQ 100 index using Relative Strength and Price Ratio indicators.

Mouse over chart captions to display trading signals.

The two lines are the same, except that Price Ratio is zero at the start of the chart, while Relative Strength is zero at the intercept date (2-Jan-2009). The difference is that you can plot trendlines on the Relative Strength indicator.

Setup

Setup for the Relative Strength indicator is similar to the Price Ratio.

- Open the Indicator Panel

- Select Relative Strength (Compare) in the left column

- Select a second security or index from the drop-down menu

- Select Daily, Weekly or Monthly in the center panel

- Enter the Start Date or leave as Default

- Select Apply to Security or Apply to Project in the center panel.

Apply to Project applies the indicator to all securities in the current project.

Apply to Security applies the indicator to the current stock/index only. - Save the settings using the [>>] button.

Where no Start Date is selected, the intercept date is taken as the start of the shortest of the two data histories.

Relative Strength Formula

Relative Strength is calculated as follows:

- Determine the Intercept Ratio — the ratio between the closing price of the two data sets on the specified intercept date.

- Determine the closing price ratio on the current date (stock 1/stock 2).

- Multiply the result by the Intercept Ratio and subtract 1.

Relative Strength is plotted using the ratio of closing price to that of another stock or index, on the date specified or the default date, whichever is the later. The default date is taken as the earliest possible date (i.e. the commencement date of the shorter of the two data histories). For example, if we plot the price ratio of Microsoft against the S&P 500 the default date will be 01-Jun-1993, the start of the Microsoft data history, which is later than the 02-Jan-1980 start of the S&P 500 data series.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.