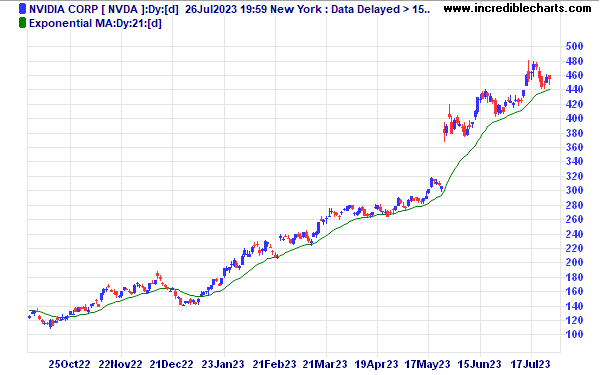

Exponential Moving Average (EMA)

Exponential moving averages are recommended as the most reliable of the basic moving average types. They provide an element of weighting, with each preceding day given progressively less weighting. Exponential smoothing avoids the problem encountered with simple moving averages, where the average has a tendency to "bark twice": once at the start of the moving average period and again in the opposite direction, at the end of the period. Exponential moving average slope is also easier to determine: the slope is always down when price closes below the moving average and always up when price is above.

Exponential Moving Average Formula

To calculate an exponential moving average (EMA):

- Take today's price multiplied by an EMA%.

- Add this to yesterday's EMA multiplied by (1 - EMA%).

If we recalculate the earlier table we see that the exponential moving average presents a far smoother trend:

| Day | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| Price ($) | 16 | 17 | 17 | 10 | 17 | 18 | 17 | 17 | 17 |

| 33.3% (or 1/3) EMA | 16.3 | 16.5 | 14.4 | 15.2 | 16.2 | 16.4 | 16.6 | 16.8 |

Exponential Moving Average Percentage

EMA% is the weighting attached to the current days value:

- 50% would be used for a 3-day exponential moving average;

- 10% is used for a 19-day exponential moving average; and

- 1% is used for a 199-day exponential moving average.

To convert a selected time period to an EMA% use this formula:

EMA% = 2/(n + 1) where n is the number of days

Example: The EMA% for 5 days is 2/(5 days +1) = 33.3%

Incredible Charts performs this calculation automatically when you select an EMA time period.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.