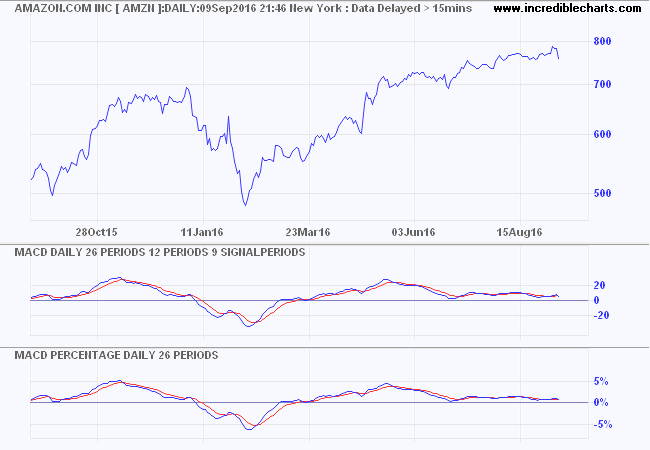

MACD Percentage Price Oscillator

The MACD Percentage Price Oscillator is a variation of the MACD indicator. The signal line crossovers are almost identical. The major difference is the percentage scale, which enables comparison between stocks at different prices.

Trading Signals

MACD Percentage Price Oscillator's trading signals are the same as for MACD:

MACD is primarily used to trade trends and should not be used in a ranging market. Signals are taken when the indicator crosses its signal line, calculated as a 9 day exponential moving average of MACD.

Trending Market

First check whether price is trending. If the indicator is flat or stays close to the zero line, the market is ranging and signals are unreliable.

- Go long when MACD crosses its signal line from below.

Signals are far stronger if there is either:

- a divergence on the MACD indicator; or

- a large swing above or below the zero line.

Unless there is a divergence, do not go long if the signal is above the zero line, nor go short if the signal is below zero. Place stop-losses below the last minor Low when long, or the last minor High when short.

The main advantage of MACD Percentage over MACD is the ability to compare indicator values across stocks.

Setup

The default setup is 26-day and 12-day exponential moving averages, with a 9-day signal line. Similar periods can be used for Weekly charts, though I prefer using 26, 13 and 9 weeks as 13 weeks matches a Quarter.

Select Indicators and MACD Percentage in the left column of the Indicator Panel. See Indicator Panel for directions on how to set up an indicator. To alter the default settings - Edit Indicator Settings.

Colors

Open the legend by clicking "L" on the toolbar or typing "L" on your keyboard. Adjust individual colors by selecting the color patches next to each indicator line in the legend.

MACD Percentage Price Oscillator Formula

MACD is calculated as the difference between the fast and slow moving averages:

MACD = 12 Day exponential moving average - 26 Day exponential moving average

The signal line is calculated as a 9 day exponential moving average of MACD.

The only difference with MACD Percentage Price Oscillator is that the difference between the fast and slow moving averages is calculated as a percentage of the slow moving average:

MACD = (12 Day EMA - 26 Day EMA) / 26 Day EMA

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.