Directional Movement v. Weinstein

An often-discussed system for tracking trends is the Directional Movement System set for weekly, rather than daily, directional movement. We compare performance to Stan Weinstein's breakout model, which combines a 30-week weighted moving average with trendlines and support/resistance.

Time Frames

Normal settings are 11-week Directional Movement. This is sometimes combined with Parabolic SAR to act as an additional filter. I have opted for a simpler system, entering on the next pull-back after the DI/ADX signal.

Trading Signals

DMS makes frequent whipsaws when not in a strong trend; so it is important to have an additional filter. My preference is Alexander Elder's system, where ADX must be rising before the signal is taken:

Go long when +DI is above -DI and either:

- ADX rises while +DI and ADX are above -DI; or

- ADX turns up from below +DI and -DI.

Exit when +DI crosses below -DI.

Go short when -DI is above +DI and either:

- ADX rises while -DI and ADX are above +DI; or

- ADX turns up from below +DI and -DI.

Exit when -DI crosses below +DI.

Further fine-tuning:

- Enter on the first pull-back (on the DI line) after the above signal;

- Exit if ADX turns down when above 50.

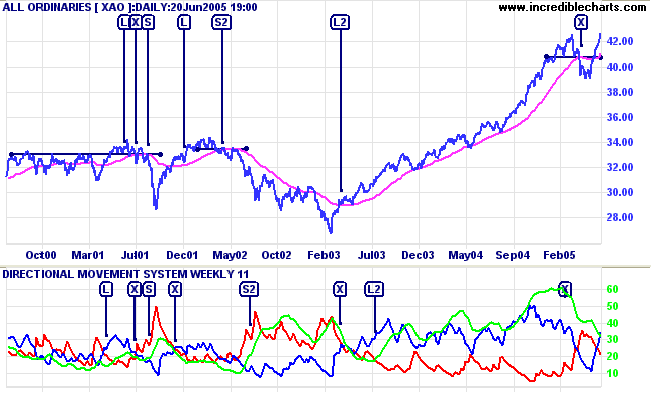

Example 1

Entry and exit signals from Stan Weinstein's breakout model ("SW") are plotted on the ASX All Ordinaries price chart below: [L] for long entries; [S] for short entries; and [X] for exits.

- [L] is a poor entry: a pull-back respects the new support level after the breakout (and above 30-week WMA) but later is stopped out at [X].

- The index respects resistance from the breakout and 30-week WMA at [S]. The exit point is debatable with such a sharp downward spike.

- [L] is just as late as the index rebounds in late 2001.

- Another good entry signal at [S2] when the pull-back respects resistance from the breakout and the 30-week WMA. The exit is slightly late at [L2].

- The long entry [L2] is taken when the index respects the WMA after breaking the downward trendline (not shown). This is a strong up-trend and the 30-week WMA keeps you in until the downward breakout at [X].

Compare the results to the 11-week Directional Movement System below the price chart.

The filters help to avoid most of the whipsaws evident in

2000/2001 and again in mid-2002 and mid-2003.

Signals on the DMS indicator:

- [L] is earlier than SW but possibly more risky as it occurs prior to

breakout.

The exit point is similar (to SW). - The entry for [S] is identical: the first pull-back that respects the resistance line. The DMS exit is way too late; the index is already back at 3200.

- Entry for [S2] at 3200 is also a lot later than SW (when price forms a

double top below the resistance line at 3350).

Exit points are similar. - The long entry [L2] is again later than SW (when price forms a double-bottom above the 30-week WMA), though the exit comes up trumps as ADX turns down while above 50 right at the trend peak.

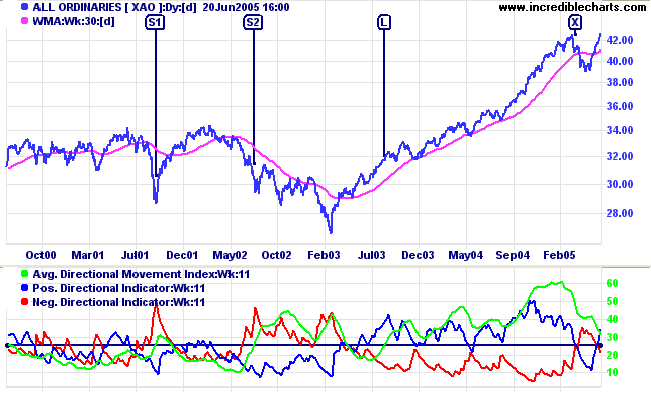

If we had to use the ADX filter (ADX > 25), the signals appear even later:

- [S1] is at the bottom of the sharp downward spike in 2001.

- [S2] is close to the dip below 3000.

- [L] is even slower than the highly reliable Coppock indicator.

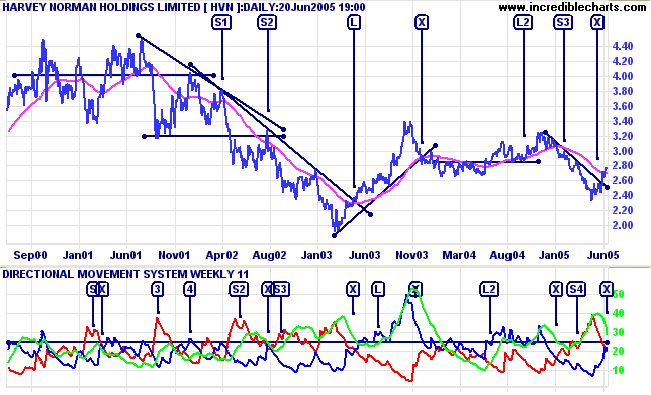

Example 2

Entry and exit signals from Stan Weinstein's breakout model ("SW") are plotted on the Harvey Norman [HVN_AX] price chart below:

- [S1] is the first pull-back that respects both resistance at 4.00 and the 30-week WMA. Additional condfirmation is provided by the trendline.

- [S2] is a second entry point, respecting resistance at 3.20, the trendline and 30-week WMA.

- The exit occurs when price breaks the second trendline at [L].

- Go long at [L] when the second pull-back respects the 30-week WMA after breaking the downward trendlline.

- The stock enters an accelerating (blow-off) up-trend exposing an SW weakness: the exit [X] is late, almost 20% below the high.

- Price then forms a base before a long entry at [L2], possibly with a whipsaw just before. The exit is before [S3] when price falls below the WMA.

- Lastly [S3] provides a good short opportunity, with a pull-back that respects the trendline and 30-week WMA. The exit [X] is when HVN breaks the downward trendline.

Signals on the DMS indicator:

- [S] provides a poor entry point at the bottom of a correction.

- Further poor entries at [3] and [4] are avoided as there was no pull-back on which to enter.

- [S2] is signaled at the start of a consolidation pattern. Stopped out by the short spike at [X].

- [S3] provides a better signal, on the pull-back after a downward breakout. The exit is similar to SW.

- The long entry [L] is again late but the exit signal comes up trumps: ADX turns down while above 50, straight after price has peaked.

- [L2] is a good early signal while the exit is similar to SW.

- [S4] is late.

Conclusion

Late Directional Movement signals are not compensated by increased reliability.

The one aspect of the DM system that I was impressed with was the ADX down-turn from above 50. It provides early signals for the expiry of strong trends, with roughly a 2:1 success rate when the signal occurs. Most of the misfires take you out of the trend too early; so it could be used as a signal to move your stops up to below each consecutive swing low (similar to how Stan Weinstein alters his stop-loss rules when the MA flattens out).

That may be a useful addition to Stan Weinstein's breakout model which is often exposed by late exits from blow-off trends. Despite this flaw, I have yet to find a better trend following system.