Trend Attributes

In our discussion we will focus on uptrends and their attributes.

Downtrends share many of the same characteristics, just in reverse. They also tend to move a lot faster than uptrends, with steeper falls. Fear is a bigger motivator than greed.

Uptrends

Uptrends normally possess the following attributes:

- An initial surge in momentum as the stock breaks through resistance and establishes an uptrend.

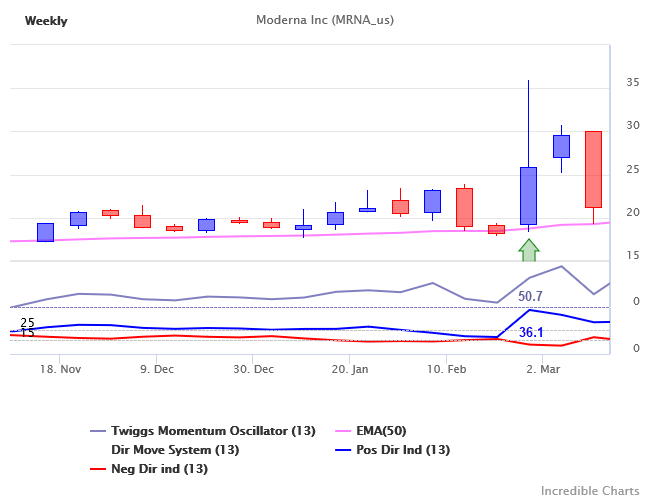

Figure 1: Moderna (MRNA) breaks out above recent highs at the start of the 2020 pandemic, TMO climbs to 50.7 and DI+ to 36.1 points above DI-.

- Some stocks fail to hold above the new support level and the trend almost immediately collapses.

- Others establish an uptrend, with strong advances and weak corrections — the holy grail of trend-trading.

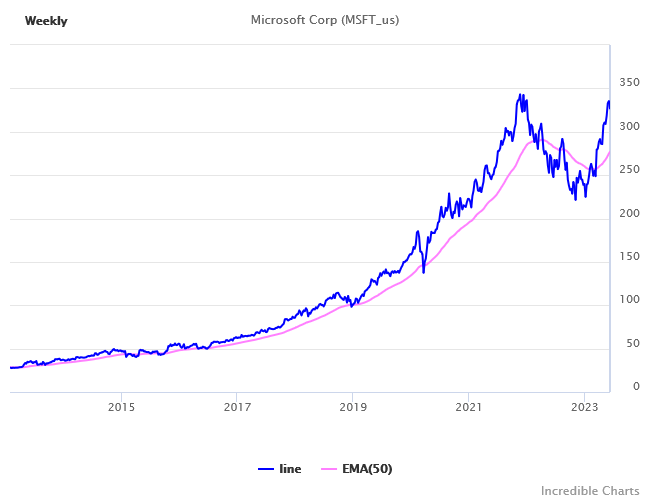

Figure 2: Microsoft (MSFT) in a long-term uptrend.

- Eventually, advances weaken and corrections grow stronger as the stock loses momentum.

- Finally, support is broken and the trend will reverse.

Figure 3: ASML Holdings (ASML) loses momentum after a strong uptrend.

- Alternatively, advances will accelerate to an exponential uptrend — commonly known as a blow-off — followed by a steep drop as support gives way.

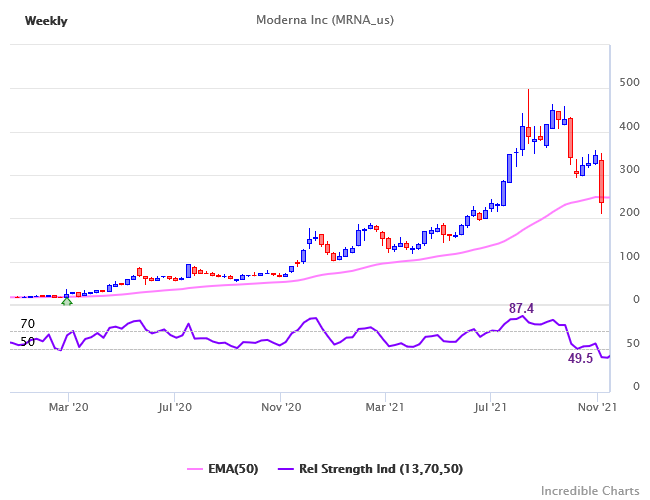

Figure 4: Moderna (MRNA) blows off after gaining almost 2000 percent, with bearish divergence and RSI falling below 50.

Conclusion

Uptrends normally display an initial surge in momentum. Some fail to hold above their new support level while others commence an uptrend with strong advances and weak corrections.

The trend draws to an end when corrections grow stronger and advances weaken or there is a blow-off, when advances accelerate exponentially followed by a sharp drop.

Disclaimer

Please note that stocks shown are for illustration purposes only and are not recommendations. Readers should conduct their own research.

Read our full disclaimer.