Stop Loss Orders

Stop loss orders ("stops") are limits set by traders at which they will automatically enter or exit trades - an order to buy or sell is placed in the market if price reaches a specified limit.

The first discipline that any trader should master is to always limit your losses.

A stop loss order is set to limit a trader's potential loss. The stop loss is placed below the current price (to protect a long position) or above the current price (to protect a short position).

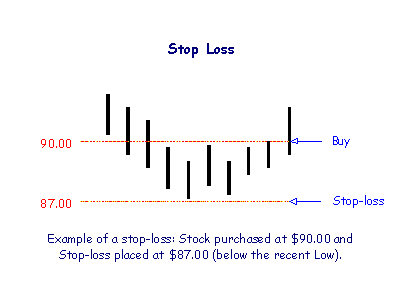

Example: If you purchase 1,000 IBM at $90.00 you may decide to place a stop loss as follows:

SELL 1,000 IBM IF price is less than or equal to $87.00

If price falls to $87.00 your order will be activated.

Your loss is limited to $3.00 per share (plus brokerage).

As a rule: avoid markets with low liquidity where extreme price fluctuations are possible.

Stop Loss Order Types

- Market Stop Orders

This is a conventional stop loss order - the stop activates a market order to sell (or buy) at the prevailing market price. - Limit Stop Orders

The limit stop activates an order to sell at the prevailing market price but not below a specified limit (or buy at the prevailing price up to a specified limit). - Fixed Price Stop Orders

The stop loss activates an order at a fixed price. Some exchanges refer to these as limit stop orders so check that you are using the correct stop loss order.

Limit stop orders are recommended for entering a trade: they have a greater chance of success than fixed price orders but are not as open-ended as market orders (where your order will be executed no matter what the market price is).

Market stop orders should be used to exit trades: to ensure that the order has the best possible chance of execution. Never hold on to securities if price falls sharply - in the hope that they will recover. Edwin Lefevre sums up the predicament in Reminiscences of a Stock Operator:

It was the same with all. They would not take a small loss at first but had held on, in the hope of a recovery that would "let them out even." And prices had sunk and sunk until the loss was so great it seemed only proper to hold on, if need be a year, for sooner or later prices must come back. But the break "shook them out," and prices just went so much lower because so many people had to sell, whether they would or not.

Steps Required to Set a Stop Loss

- First, determine your maximum acceptable loss;

- Set stop loss order levels based on sound technical levels;

- Adjust your stop loss levels over time to lock in profits;

- Use trailing stops to time your entry and exit from the market.

1. Maximum Acceptable Loss

Set the maximum loss that you are prepared to accept on any single trade. This is usually expressed as a percentage. Avoid trades where the difference between your entry level and the stop-loss exceeds the maximum acceptable loss.

Consider the following factors when determining your maximum acceptable loss:

- Whether you are investing or trading;

- The time frame that you are trading in;

- Whether you are trading on margin;

- Your overall risk profile; and

- Your level of diversification.

A long-term investor/trader with reasonable risk diversification may find 6%, or even 10%, an acceptable limit. A short-term trader may set a limit of only 2%.

2. Set Stop Loss Order Levels

Stop loss order levels need to be technically consistent, otherwise they will cost you money. Arbitrary levels are likely to be activated by the normal cycle.

Base your stop losses on technical levels, such as:

- Support/resistance levels,

- Above/below the most recent peak/trough,

- Above or below reversal signals; or

- At the crossing of moving averages.

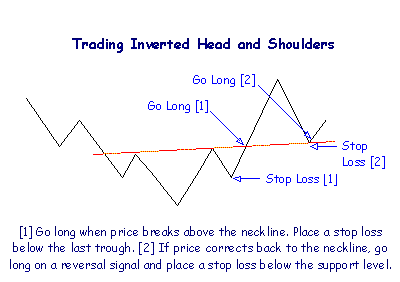

Example

This example illustrates the use of 2 different technical levels for stop losses:

- The first stop loss is placed just below the level of the most recent trough.

- The second stop loss is placed below the support line (on a reversal signal above the support line).

Support and Resistance Levels

Avoid placing your stop loss exactly at the support or resistance level for two reasons:

- Trends often reverse at these levels and you may be stopped out unnecessarily;

- A large number of stops may be set at the support or resistance level, especially where it has formed at a round number.

Rather set your stop loss one or two ticks below a support level or one or two ticks above a resistance level. For example: If a support level has formed at $20.00, set the stop loss at $19.90 so that you are only stopped out if the support level is penetrated.

3. Adjusting Stop Loss Orders

Adjust your stop loss orders, over time, in the direction of the trend being traded:

- In an up-trend move your stop loss up to below the Low of the most recent trough.

- In a down-trend move your stop loss down to above the High of the last peak.

Only a break in the trend (or large correction) will stop you out.

Using Moving Averages

An alternative approach, that may prevent you from being shaken out of a trend too early, is to use a long-term moving average in conjunction with the above. Stan Weinstein (Secrets for Profiting in Bull and Bear Markets) suggests using a 30 week moving average. This is suitable for investors following the primary trend, adjust the length of the moving average if trading in a shorter time frame.

In an up-trend move your stop loss to below:

- the Low of the most recent trough, or

- the moving average, whichever is lower.

In a down-trend move your stop loss to above:

- the High of the most recent peak, or

- the moving average, whichever is higher.

Example

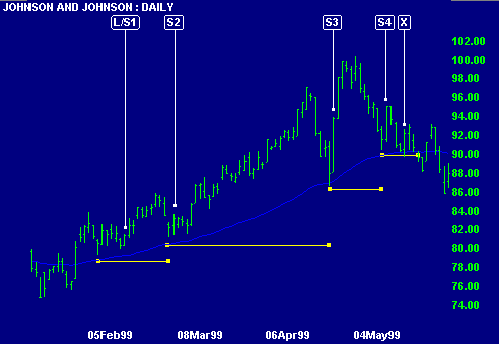

Johnson & Johnson is charted with a 63 day exponential moving average. Stop loss order levels are depicted by horizontal trendlines.

- Go long [L]. The signal is taken when price respects the moving average. A stop loss order is placed at [S1], below the Low of the most recent trough or below the moving average, whichever is lower (shown by the start of the trend line).

- At [S2] move the stop loss up to below the moving average at the next trough.

- At [S3] move the stop loss to below the Low at the next trough (this is lower than the moving average).

- At [S4] move the stop loss to below the moving average at the next trough.

- The stop loss order is activated [X] when the next correction falls below the previous trough.

Ranging Market

In a ranging market adjust your stop loss based on the cycle in one time frame shorter than the cycle being traded. For instance, if trading an intermediate cycle (in a ranging market), move your stop loss orders up or down in accordance with the short cycle.

4. Trailing Stop Loss Orders

Trailing stop loss orders have three uses:

- To limit your losses,

- To protect your profits, or

- To prevent you from entering (or exiting) a trade too early or on a false signal.

Stops can be based on the high/low of the daily trading range or on a trailing percentage. Welles Wilder's Parabolic SAR is a further form of trailing stop.

The rules below are based on Screen 3 of the Triple Screen trading system, described by Alexander Elder in Trading for a Living.

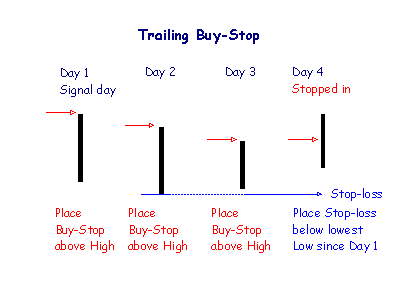

Buy-Stop

When you get a signal to go long - place a buy order one tick above the High on the signal day. If price rallies, you will be stopped in on the next day. If price falls, the buy order will remain untouched. Move the buy order down to one tick above the High on the second day. Continue to lower the buy order on each subsequent day until price rallies and you are stopped in.

When you are stopped in, place a stop loss below the Low of the recent down-trend (the lowest Low since the signal day).

Sell-Stop

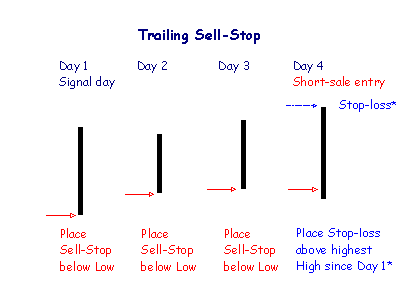

When you get a signal to go short - place an order to sell short one tick below the Low on the signal day. If price falls, you will be stopped in on the next day. If price rallies, the buy order will remain untouched. Move the sell-stop up to one tick below the Low on the second day. Continue to raise the sell-stop on each subsequent day until there is a correction and you are stopped in.

When your sell-stop is executed, place a stop loss above the High of the recent up-trend (the highest High since the signal day).

* Day 4 makes a new High and a new Low. If the High was made before the sell-stop is reached, the stop-loss will be placed as shown. If the sell-stop was activated before the new High was made, then the stop-loss would have been placed above the High of Day 3 and the trade would have been stropped out on making the new High.

Example

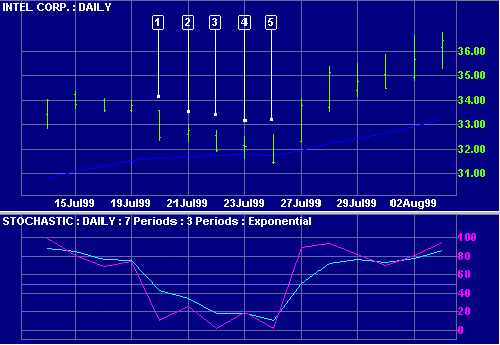

Intel Corporation is shown with a 21 day exponential moving average and 7 day Stochastic %K and %D.

- %K falls below 20. Place a trailing buy-stop just above the day's High of $33 1/2.

- Move the buy-stop down to $33, above the High of day 2.

- Move the stop down to above the High of day 3.

- Move the stop down to $32 1/2 - one tick above the High on day 4.

- The day opens with a new Low of $31 3/8 and then rises until we are stopped in at $32 1/2. Place a stop-loss below the Low (i.e. the lowest Low since day [1]). Thereafter, price falls back to the day's Low, but fails to activate the stop-loss one tick below.

Inside Days

The rules for sell and buy stops are sometimes varied by excluding inside days:

- no adjustment is made to a buy-stop if the day does not make a new low;

- no adjustment is made to a sell-stop on days that do not make a new high.

Evaluation of Stop Losses

Stop loss orders do not always work perfectly. If a major support level is breached, a large number of stops may be activated at the same time. Sellers will far exceed buyers, causing price to fall sharply and leaving sell orders unfilled. In extreme cases there may be no buyers at all for a security -- not at any price.

Imperfect as they are, stops are still an effective mechanism for limiting risk and protecting capital.

If stops are not accepted in a market, set your own limits and place buy or sell orders when the price is reached. Use SMS alerts if they are available from an online broker. Self-discipline is required to execute stops without hesitation.

Author: Colin Twiggs is a former investment banker with over 30 years experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary newsletter.

Colin also writes The Patient Investor newsletter which focuses on the global economic outlook and key macro trends.

In addition, he founded PVT Capital (AFSL No. 546090) which offers investment strategy and advice to wholesale clients.