Reversal Days

Reversal signals may be formed by a single bar relative to the preceding bar. The signals vary greatly in strength: weak signals may only signal a peak or trough in the short cycle while extreme signals may indicate a change in the primary trend.

Signal Strength

There are 4 major factors that affect signal strength:

- Reversal signals are most reliable if they occur after a strong trend:

a strong trend = a strong reversal signal.

If the trend is weak, so is the signal. - Days that spike.

- Wide-ranging days - days with a very wide range.

- Unusually high volumes.

- Signal patterns:

- Open-Close reversals are powerful signals;

- Closing Price reversals are very strong;

- Hook reversals are weaker, formed on an inside day;

- Key reversals do not occur often but are potent signals;

- Pivot Point reversals and Complex Pivot Points are the most common signals;

- Island reversals and Island Clusters are powerful signals, formed with gaps.

Other reversal and continuation patterns are identified under gaps and candlesticks.

Example

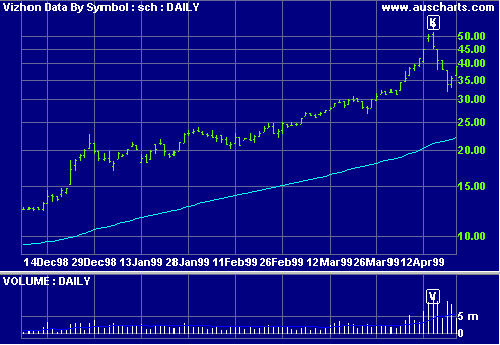

Charles Schwab with 150-day moving average and 20-day volume exponential moving average.

The Key Reversal at [K] comes after a strong up-trend and exceptionally high volume activity [V]. Price gaps up, opening above the High of the previous day, then falls sharply to make a key reversal on a wide-ranging day.

The reversal signals a change in the primary trend. Compare this to earlier, weaker reversal signals that merely signaled a change in the short cycle.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.