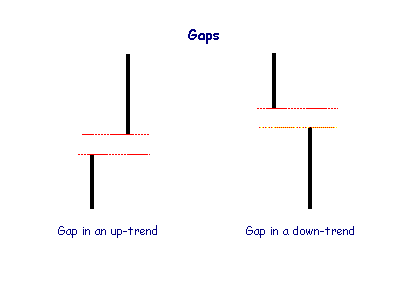

Gaps

Gaps occur when the lowest price traded is above the high of the previous day or, conversely, when the highest price traded is below the previous day's low.

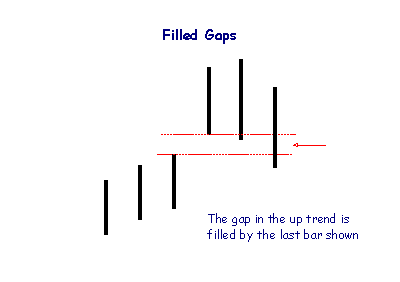

A gap is filled when the range of subsequent bars closes the gap.

There are two basic rules:

- Avoid trading common gaps, and

- Only trade gaps when they are confirmed by volume.

Equivolume charts highlight the interaction of price and volume.

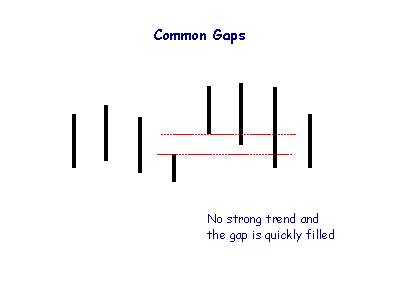

Common Gaps

Common gaps occur in markets without a strong trend. They are not followed by new highs or new lows and are quickly closed in subsequent days' trading.

Some gaps are caused by events and should be ignored:

- Ex-dividend gaps occur as price adjusts on the day after a dividend becomes payable;

- New share issues; and

- Expiry of futures contracts.

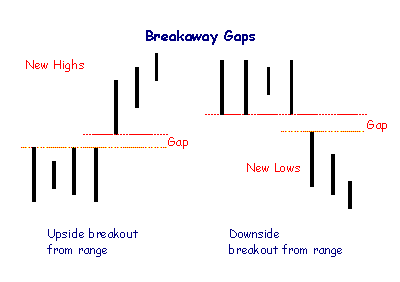

Breakaway Gaps

Breakaway gaps are normally accompanied by heavy volume and occur when prices break out of a trading range. They are usually followed by a series of new highs in an upside breakout or, a series of new lows in a downside breakout, and are seldom closed.

Trading Rules

Upside Breakaway

If the gap is accompanied by heavy volume, go long and place a stop-loss at the lower end of the gap.

Downside Breakaway

If the gap is accompanied by heavy volume, go short and place a stop-loss at the upper end of the gap.

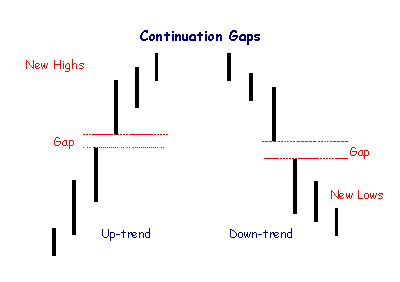

Continuation Gaps

Continuation gaps occur near the middle of strong trends and are useful in projecting how far the trend will continue. They are followed by new highs in an up-trend or new lows in a down-trend, which distinguishes them from exhaustion gaps. They are not normally closed.

Trading Rules

If volume is strong (up at least 50%), trade as for breakaway gaps. Enter the trade early and wait for new highs (or new lows in a down-trend) to confirm the pattern. If there are none in the next few days then exit immediately — it could be an exhaustion gap.

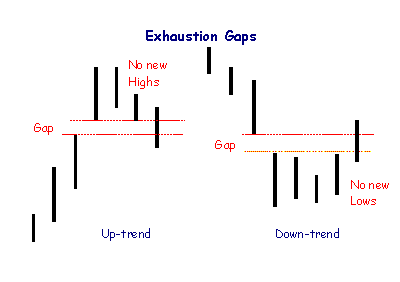

Exhaustion Gaps

Exhaustion gaps occur at the end of a strong trend and are the last surge before the trend expires, normally on heavy volume. They differ from continuation gaps in that they are not followed by new highs (in an up-trend) or new lows (in a down-trend) and are closed shortly afterwards.

Trading Rules

Upward Exhaustion Gap

Sell short (or close your long position) and protect yourself with a stop above the last high.

Downward Exhaustion Gap

Go long (or close your short position) with a stop below the latest low point.

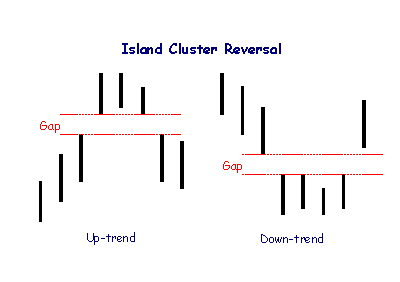

Island Clusters

Look out for island clusters, identified by an exhaustion gap followed (after a few days) by a breakaway gap in the opposite direction, they are powerful reversal signals.

Trading Rules

Trade in the same way as exhaustion gaps.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.