Trading Diary

January 3, 2002

These extracts from my daily stock

trading diary are intended to illustrate the techniques used in

short-term share trading and should not be interpreted as

investment advice. Full terms and conditions can be found

at

Terms of Use .

USA

An hour before the close, the Dow was up 0.5% on reasonable

volume. There may well be a test of the 10200

resistance level before the close. The bearish MACD

divergence continues.

The Nasdaq climbed almost 3% to reverse

the down-trend

- a higher trough followed by a break above the level of

the previous peak.

Tech gains lift the market

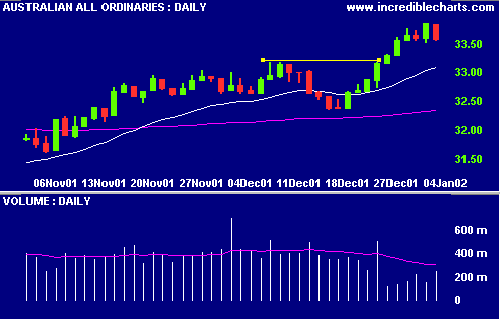

Australia - ASX

The All Ords closed down at 3359 on light volume. It

appears that the big money is at the cricket and will only

return to the market next week (or maybe by Friday afternoon -

the way the South Africans are playing).

I am still anticipating a downward correction after the

bearish MACD

divergence.

Conclusion

Here we go again:

Short-term: Tighten up on stop

losses and avoid new entries.

Long-term trades: Wait for a correction on the

secondary cycle.

Colin Twiggs

Please forward this to your friends and colleagues.

To be included on our mailing list, reply to

this Email adding MAIL ME to the subject title. All

details submitted are protected by our

Privacy Policy.

Back Issues

Back Issues

Access the Trading Diary Archives.