Moving Average Systems

The Two Moving Averages system is particularly useful for identifying trends. The fast moving average should be about 5 or 7 days. The slow moving average should be varied according to the cycle you intend to trade (see Indicator Time Frames for details). Try 50 or 63 days for the secondary cycle and 120, 150 or 200 days for the primary cycle.

Exponential moving averages are more responsive and not prone to "bark twice" as with simple moving averages.

Use the slow moving average as a directional filter: only go long if the moving average is rising.

This makes a simple but effective trading system when combined with Stop Losses. Adjust the stops over time in the direction of the trend. Stan Weinstein's Breakout Model provides a useful variation where the stops are only moved above the slow moving average if the moving average stops rising.

Example

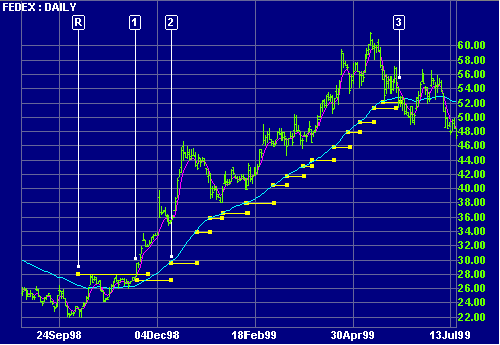

FedEx is shown with 5-day and 63-day exponential moving averages.

Mouse over chart captions to display trading signals.

- Enter when the fast moving average rises above the slow moving average and the slow moving average starts rising. Wait for the breakout above the $28.00 resistance level [R] and volume confirmation. Place a stop-loss below the Low of the signal day [1].

- Stops are adjusted upwards with each successive trough in the short cycle. Do not raise the stop above the slow moving average if it is rising. If the slow moving average is no longer rising, adjust the stop to just below the latest trough.

- Exit when the fast moving average crosses below the slow moving average or price falls below the latest stop level [3].

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.