Trading Diary

June 14, 2002

These extracts from my daily

trading diary are intended to illustrate the techniques used in

short-term trading and should not be interpreted as investment

advice. Full terms and conditions can be found at Terms

of Use .

USA

The Dow penetrated the 9500 support level,

falling to 9260 before recovering to 9474 on strong volume.

The break completes a broad head and shoulders pattern and signals the start of a primary bear-trend.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

The break completes a broad head and shoulders pattern and signals the start of a primary bear-trend.

Chartcraft's NYSE Bullish % Indicator has given a bull correction signal, warning investors to adopt defensive strategies.

The Nasdaq Composite closed up 0.5% at

1504.

The primary and secondary cycles trend downwards.

The S&P 500 fell to 981 before recovering

to close 2 points down at 1007.

Primary and secondary cycles trend downwards.

Consumer confidence

June consumer confidence fell

to 90.8, from 96.9 in May. The biggest decline since last

September. (more)

Sprint PCS

The No.4 US wireless carrier

cut fourth-quarter new subscriber estimates by 60%.

(more)

Money flows into bonds

Investors switching from

equities to bonds drove the yield on 10-year treasury notes down

to 4.8%. (more)

ASX Australia

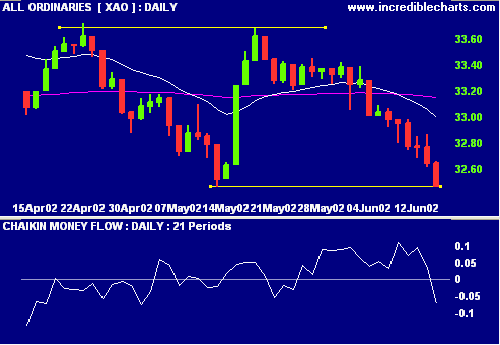

The All Ordinaries fell to 3246 on average

volume, equaling the May low. A break below this level will

signal the start of a primary bear trend.

Chaikin Money Flow has crossed below zero,

signaling distribution.

MACD (26,12,9) and Slow Stochastic (20,3,3)

are below their signal lines.

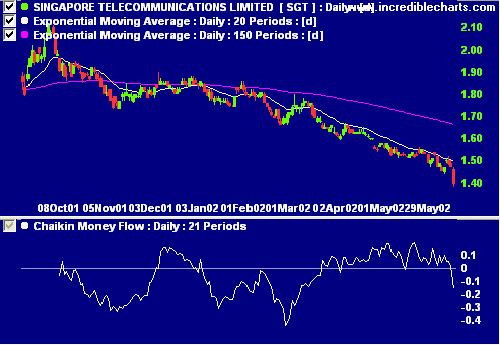

SingTel likely to be dropped from ASX 200

[SGT]

Singapore Telecommunications and Hutchison

Telecommunications are likely to be dropped from the ASX 200

when Standard & Poors switches to free float measurement.

(more)

Chaikin Money Flow has shown strong

accumulation over the last 2 months, before yesterday's drop

below zero. Relative Strength (price ratio: xao) and MACD

remain weak.

Foodland [FOA]

The High Court of New Zealand set aside

the order preventing FOA from proceeding with acquisition

of Woolworths NZ. Rival, Foodstuffs, threatens further

legal action. (more)

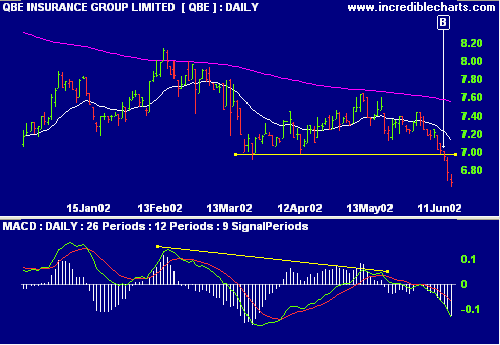

QBE Insurance [QBE]

Sectors: Insurance

Merrill Lynch cut their profit forecast

for QBE, citing a poor investment environment, renewed

terrorism fears and the rising dollar. (more)

QBE has penetrated the $7.00 support level [B] and Chaikin Money Flow has crossed below zero. Relative Strength (price ratio: xao) and MACD are weak.

QBE has penetrated the $7.00 support level [B] and Chaikin Money Flow has crossed below zero. Relative Strength (price ratio: xao) and MACD are weak.

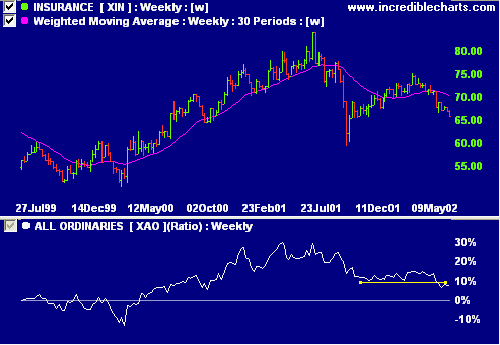

The insurance index (XIN) is signaling a

bear trend, with weakening Relative Strength (price

ratio: xao) and falling 30-week weighted moving

average.

Sectors: Gold

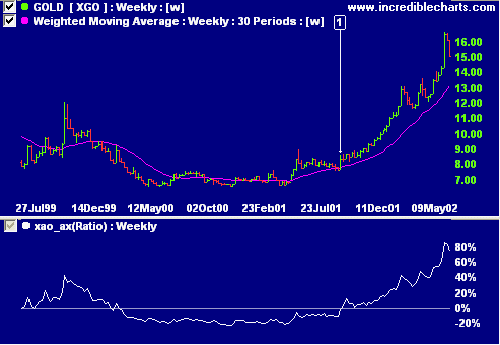

The correction on the gold index (XGO)

continues with a fall of 10% from the recent high. The

primary bull-trend is still strong.

Conclusion

Short-term: Avoid long and short. There is a

good chance of a rally at the 3250 support level.

Medium-term: Wait for the All Ords to signal a

reversal.

Long-term: Wait for a bull-trend on the Nasdaq

or S&P 500 (primary cycle).

Colin Twiggs

Please forward this to your friends and

colleagues.

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.