Alexander Elder's 6 Percent Rule

When you find yourself in a hole, quit digging. ~ Will Rogers.

In Come Into My Trading Room Alexander Elder suggests adding a second risk management rule, applied at the portfolio level, to be used in conjunction with the 2% rule which is used to manage risk on individual stocks or trades.

The 6% Rule:

NEVER LOSE MORE THAN 6 PERCENT OF YOUR CAPITAL IN ANY ONE MONTH.

The rule helps to prevent traders from taking increased risk in an attempt to make up recent losses. It requires traders to use stop losses to restrict the total risk on all open positions to just 6% of their capital and to stop trading or lock in profits if net losses reach 6.0% in any one month.

How to Apply the 6 Percent Rule

- Calculate 6 percent of your trading capital balance at the last month-end.

- Calculate the risk on all open positions:

- Subtract your stop loss level for each stock from its closing price at the last month-end;

- Make allowance for brokerage and slippage (not all stop losses are likely to be executed exactly at the stop loss limit);

- Multiply the risk margin by the number of shares held; and

- Sum the risk exposure for all stocks in your portfolio.

- If risk exposure is above 6.0% of month-end value, adjust your stop loss levels to reduce the risk.

- If your net losses in any one month exceed 6% of the last month's capital balance, you have two options:

- Stop placing new trades until the start of a new month and close open positions or move up your stops to eliminate the risk of additional losses; or

- Reduce your net loss by taking profits on other positions, or moving up stops to lock in profits, so that you can place new trades without exceeding the 6.0% monthly limit.

Example: 6% Rule

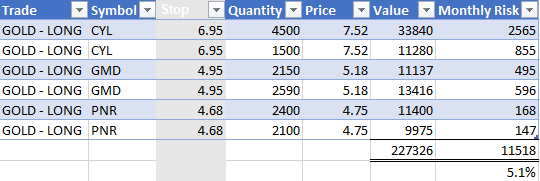

The example below shows risk exposure (Monthly Risk) calculated at the month-end.

The Monthly Risk column is calculated by multiplying the difference between month-end Price and the Stop level by the Quantity. Sum Monthly Risk and check whether it is below 6.0% of total Value. Allow at least 0.5% for brokerage and slippage.

Adjusting Stop Losses

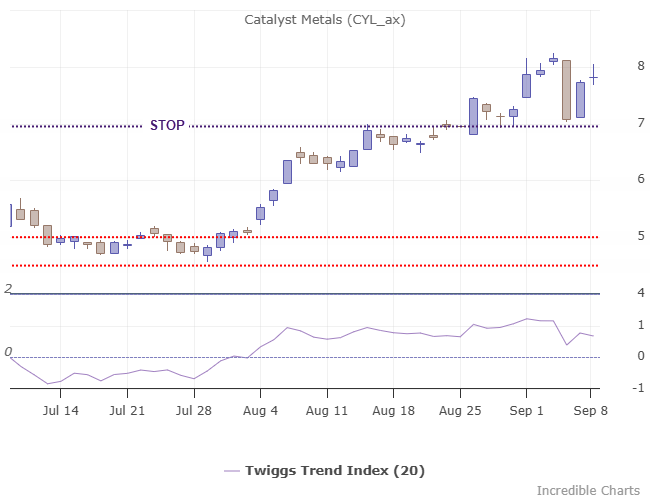

Stop losses should always make sense, positioned below recent support, or above resistance for short trades. Catalyst Metals (CYL) made a recent low at 7.00 in the example below and we position our stop a few points below at 6.95.

Adapt the 6% Rule to your Trading Style

If you are in a particularly strong uptrend, update your balances every week to ensure that you are comfortable with the increased value at risk. It may not always be practical to adhere to the 6% rule on a weekly basis, but at least you will be aware of the additional risk exposure.

Conclusion

Applying the 6.0% rule teaches traders how to apply professional risk management: setting and adjusting stop losses to limit capital at risk, and avoiding an emotional reaction to losses which would increase the percentage of capital at risk.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.