Euro Strengthens

By Colin Twiggs

April 1, 2008 4:00 a.m. ET (8:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

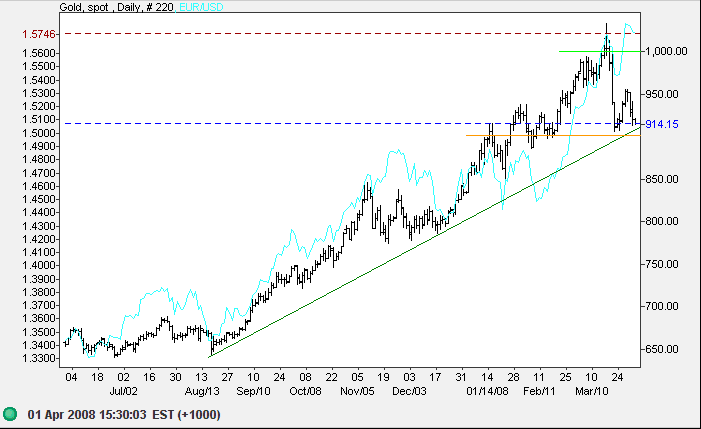

Gold

Spot gold is again testing support at $900. Gold and the euro have been moving in sync since 2006 and the relationship is expected to continue — with gold resuming its strong up-trend. Breakout below $900, however, would breach the rising trendline and signal weakness in the primary trend.

Source: Netdania

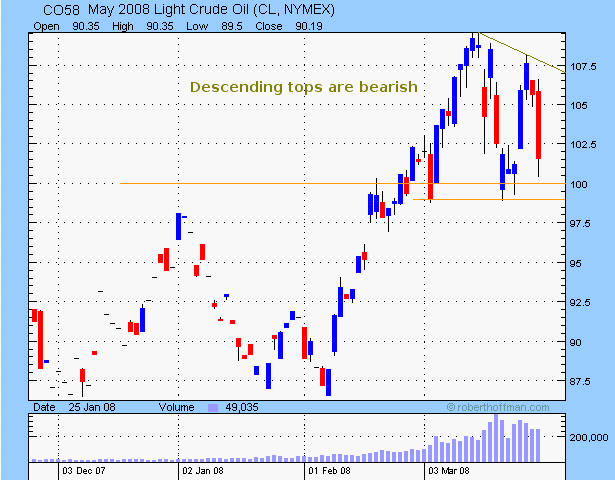

Crude Oil

May 2008 Light Crude shows a series of descending (lower) tops — a bearish sign during a consolidation. Breakout below $99 would signal a test of primary support at $86, while respect of support would need to rally above the previous high at $108 before it could be interpreted as a longer term positive sign.

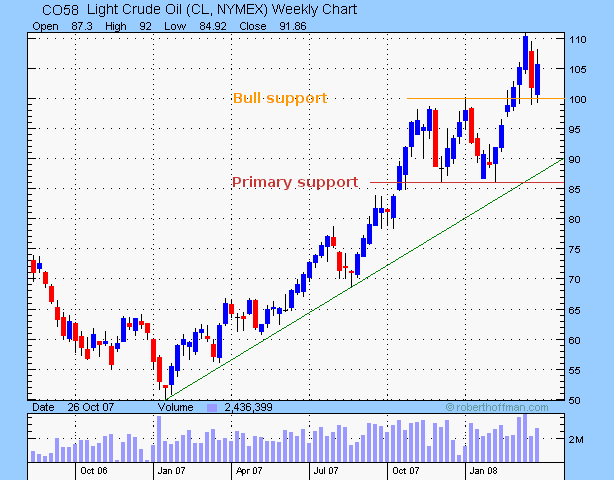

The strong primary up-trend on the weekly chart continues. A break of the rising green trendline, while not expected, would signal that the up-trend is weakening.

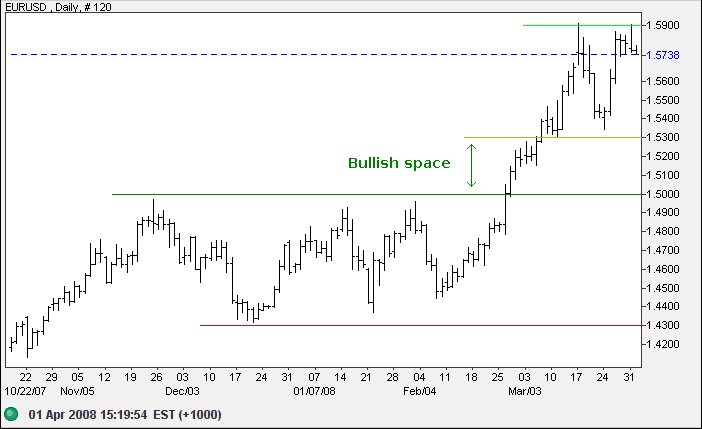

Currencies

The euro is forming a bullish narrow rectangle below resistance at $1.59. Breakout would offer a short-term target of 1.59+(1.59-1.53)=$1.65. The space between short-term support at 1.53 and longer term support at the previous high of 1.50 signals a strong up-trend.

Source: Netdania

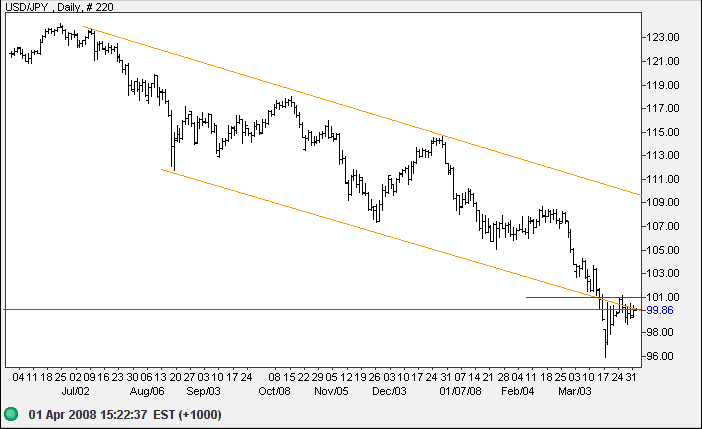

Further narrow consolidation of the dollar below short-term resistance at 101 yen would be a bullish sign, promising a test of the upper border of the trend channel. The strong primary down-trend continues, however, with a target of the all-time low at 80.

Source: Netdania

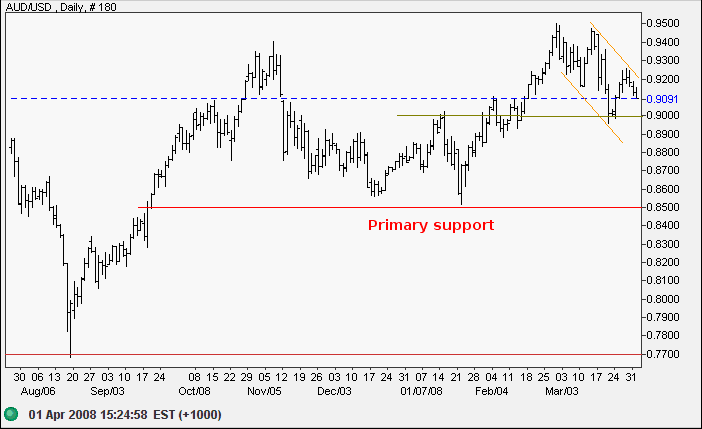

Breakout of the Australian dollar below $0.90 would confirm the secondary correction and a test of primary support at $0.85. Respect of $0.85 would confirm the primary up-trend, while failure would signal a test of $0.77.

Source: Netdania

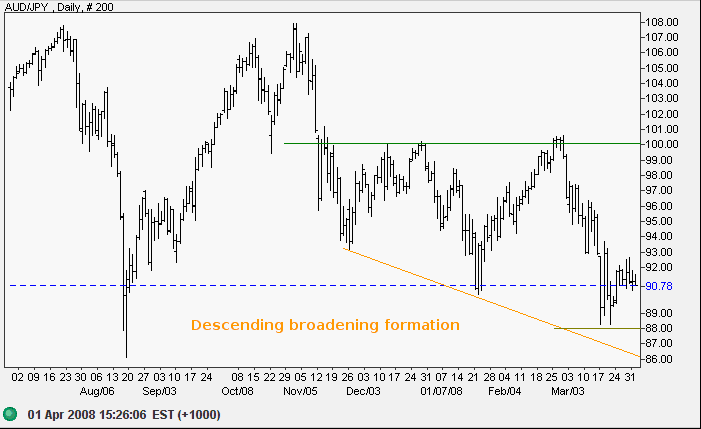

The Aussie continues to display a descending broadening pattern against the yen, with strong resistance at 100. Reversal below 88 would complete a failed up-swing, signaling long-term weakness. Breakout below key support at 86 would offer a long-term target of 86-(108-86)=64.

Source: Netdania

It's absolutely clear that there are human rights abuses in

Tibet. That's clear-cut. We need to be up-front and absolutely

straight about what's going on....... I think it would be

appropriate for the Chinese government to engage the Dalai Lama

or his representatives in an informal set of discussions about

future possibilities.......

~ Australian Prime Minister Kevin Rudd: March 28,

2008.

To understand my approach, please read Technical Analysis & Predictions in About The Trading Diary.