Membership subscriptions

We want to thank existing members for their support and offer a reduced subscription to all

who subscribe by 15 February 2003.

The reduced subscription is $180 for the year (or $18 per month). Normal subscription will be $270 (or $27 per month).

There will be a free trial period for all members to evaluate the new services.

Please give us your feedback and suggestions

at the Chart

Forum.

Trading Diary

December 19, 2002

These extracts from my daily trading diary are

intended to illustrate the techniques used in short-term trading

and should not be interpreted as investment advice. Full terms

and conditions can be found at Terms

of Use .

USA

The Dow trends down on increasing volume,

closing 1% lower at 8364. The down-trend may still re-test the

7500 and 7200 support levels, establishing a broad base.

The primary trend is down and will only reverse up if the average rises above 9130.

The Nasdaq Composite rallied at the opening, but soon lost impetus to close 0.5% down at 1354.

The primary trend is up.

The S&P 500 is down 7 points at 884. The index is ranging between 965 and 768, establishing a base.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (December 18).

The primary trend is down and will only reverse up if the average rises above 9130.

The Nasdaq Composite rallied at the opening, but soon lost impetus to close 0.5% down at 1354.

The primary trend is up.

The S&P 500 is down 7 points at 884. The index is ranging between 965 and 768, establishing a base.

The primary trend is down.

The Chartcraft NYSE Bullish % Indicator appears stuck at 50% (December 18).

Iraq

Market jitters increased when UN chief weapons inspector Hans Blix said that he is not satisfied with Iraq's weapons declaration and that it failed to answer many questions. (more)

Gold

New York: Spot gold continues to climb, up 120 cents at $US 345.30.

Market jitters increased when UN chief weapons inspector Hans Blix said that he is not satisfied with Iraq's weapons declaration and that it failed to answer many questions. (more)

Gold

New York: Spot gold continues to climb, up 120 cents at $US 345.30.

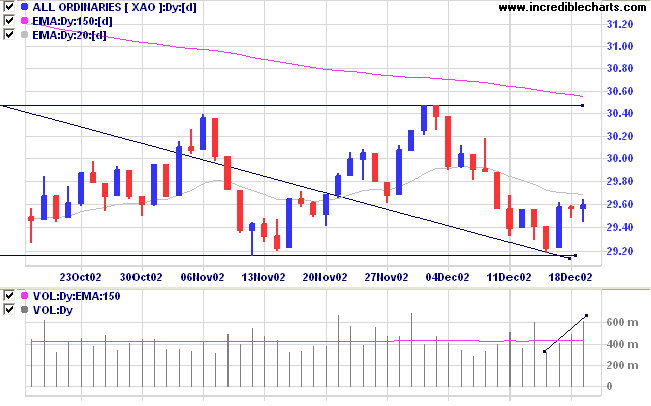

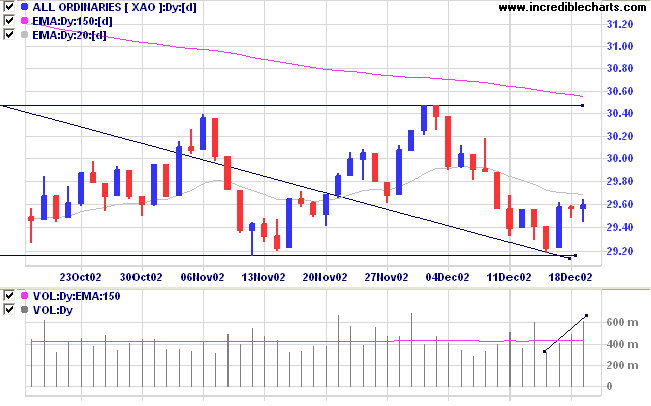

ASX Australia

The All Ordinaries formed another doji, failing to confirm the

doji

star reversal from Thursday. The doji signals indecision

and a close below 2940 will still be bearish. The index closed

2 points up at 2959 on higher volume.

The market is ranging between 2915 and 3050, building a broad base in the process.

The Slow Stochastic (20,3,3) is above its' signal line; MACD (26,12,9) is below. Twiggs money flow is rising.

The market is ranging between 2915 and 3050, building a broad base in the process.

The Slow Stochastic (20,3,3) is above its' signal line; MACD (26,12,9) is below. Twiggs money flow is rising.

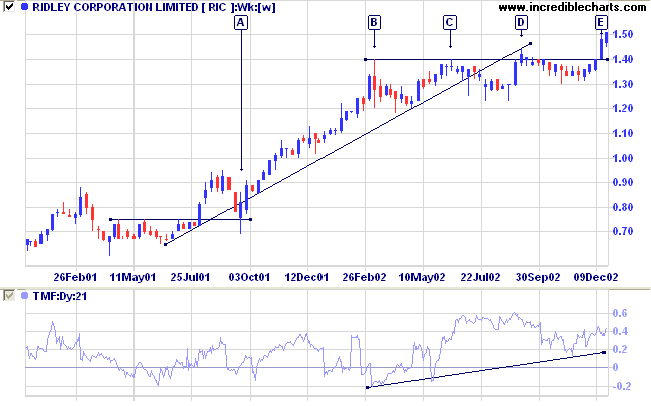

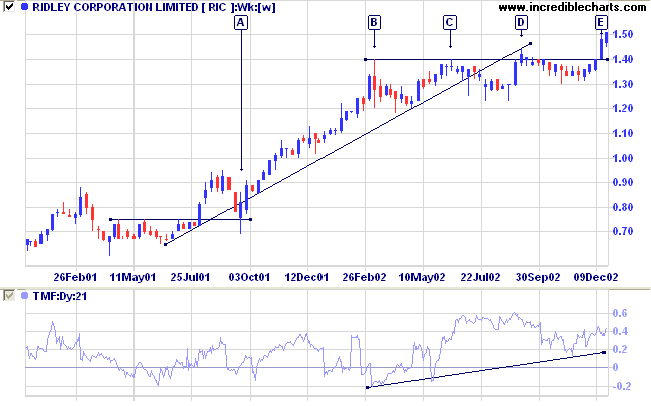

Ridley Corporation [RIC]

Last covered on September 05.

Last covered on September 05.

After a false downward break at [A] RIC entered a strong

up-trend before a sideways congestion pattern after [B]. Price

respected resistance at [C] before a false break at [D] and

then a more convincing breakout at [E]. Successive higher

troughs are a strong bullish signal - forming an ascending

triangle between [B] and [E].

Relative strength (price ratio: xao) and MACD are bullish. Twiggs Money Flow signals strong accumulation.

Relative strength (price ratio: xao) and MACD are bullish. Twiggs Money Flow signals strong accumulation.

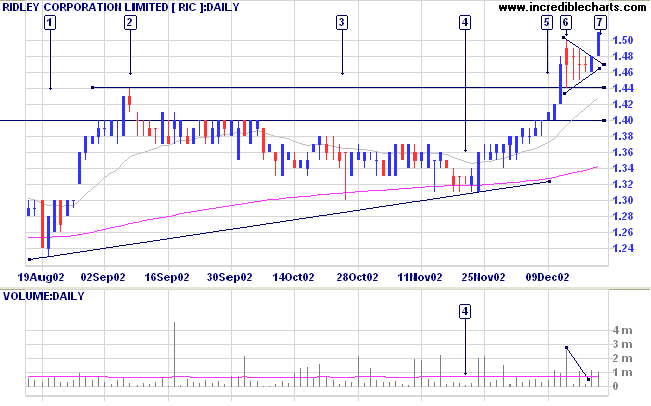

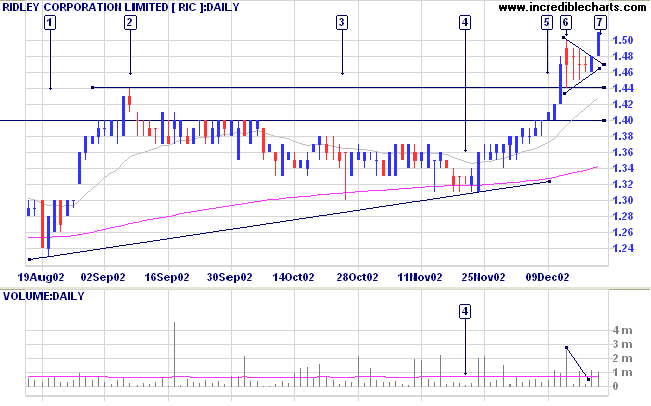

The false break at [D] can be seen at [2] on the daily chart -

note the low volume. Swing traders may have entered at [4]

after the successive higher troughs on the weekly chart. Volume

had tried up at the low [4] and on a narrow daily range. Entry

would be taken with a buy-stop above the day's high.

Longer-term traders may have entered at [5], when price broke

above resistance at 1.40. But RIC presented a further

opportunity when price formed a pennant after the high at [6].

Pennants and flags are strong continuation signals in a trend

and entry could be made on a break above the pennant at [7].

Again volume had dried up as the pennant formed, confirming the

pattern.

Going back to the weekly chart, the mid-point congestion

pattern at [B] to [E] points to a target of 2.10 (1.40 + (1.40

- 0.70)).

Market strategy

For further guidance see Understanding the Trading Diary.

For further guidance see Understanding the Trading Diary.

Short-term: Avoid new entries. The Slow Stochastic and MACD are

on opposite sides of their respective signal lines.

Medium-term: Avoid new entries.

Long-term: Wait for confirmation of the

bottom reversal signal.

Colin Twiggs

If we value independence,

if we are disturbed by the growing conformity of knowledge,

of values, of attitudes, which our present system induces,

then we may wish to set up conditions of learning which make for uniqueness,

for self-direction, and for self-initiated learning.

- Carl Rogers

if we are disturbed by the growing conformity of knowledge,

of values, of attitudes, which our present system induces,

then we may wish to set up conditions of learning which make for uniqueness,

for self-direction, and for self-initiated learning.

- Carl Rogers

Back Issues

Click here to access the

Trading Diary Archives.

Back Issues

Access the Trading Diary Archives.