Trailing Percentage Stops

Trailing percentage stop orders are offered by some online brokers. The stop order works with a ratchet effect - it trails price movements by a set percentage, but only in the direction of the trend. If price reverses direction, the stop remains at its previous level and will be activated if price reverses by more than the trailing percentage.

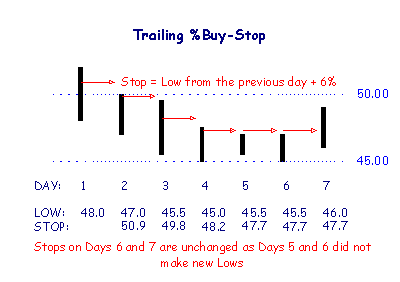

Buy-Stop

Buy-stops are used to enter long positions or to close short positions.

In the example below, the trailing stop is set at 6%. The trader will be stopped in if price rises 6% above the lowest Low.

The buy-stop ratchets down on each day that price forms a new low. The stop loss for each day is set at 6% above the lowest Low since the signal (Day 1).

Note that the stop loss remains unchanged if the previous day does not form a new Low.

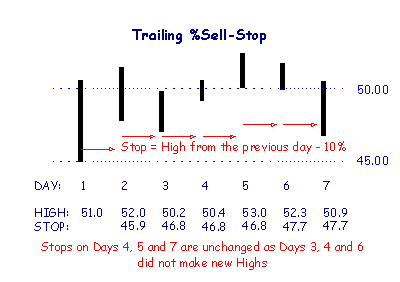

Sell-Stop

Sell-stops are used to exit long positions or to enter short positions.

Compare the 10% trailing stop, in the example below, to a 6% trailing stop. With a 6% sell-stop the trade would have been exited at 48.9 on Day 3 (52.0 - 10%).

Setting the Trailing Percentage Stop

When setting the trailing percentage, consider the following factors:

- If the stop losses are being used to limit your losses, decide on your maximum acceptable loss beforehand.

- Determine the magnitude of the intra-day cycle - you do not want your stop loss to be activated by normal intra-day fluctuations. Use intra-day charts or in-depth information from an online broker.

A Word of Caution

Check how your broker calculates trailing stops!

Many brokers calculate trailing stops on the last close and do not adjust on an intra-day basis. If price runs up from $20.00 to $28.00 during a single session and then falls back to close at $21.00, you will not be stopped out with a 5% trailing stop calculated on this basis, because price is still above yesterday's high, even though it has fallen 25% intra-day!

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.