Pump and Dump

(Tricks of the Trade)

Also referred to as ramping, this is an old trick often perpetrated by sly old hands who prey on newcomers.

The Ingredients

- One penny stock. Either a former high flier that has fallen from grace or a newer issue that failed to attract investor interest. It is important that the stock has been flat-lining at a few cents for the past 6 to 12 months.

- No institutional following. This is a key ingredient -- too many cooks may spoil the broth. Our chef does not want outside interference.

- Low liquidity. Often large tranches of stock in small companies are tied up in the hands of controlling interests, management, family interests or other connections who are not ready sellers.

- An industry that has the capacity to generate excitement - gold mining is the tried and trusted favorite but there are a number of new variations: dotcom, telecom, biotech, the list is endless. Basically anything that will make a good storyline.

- A large supply of mug punters, invited to the feast without realizing that they are the main course.

- A complete lack of conscience.

Preparation

Our chef will scan penny stocks until he finds a prospective target with a suitable storyline. A quick study of existing shareholders will reveal the float of stock that is available for purchase. He slowly accumulates a sizeable portion of the free float, careful not to give the game away. Bidding the price up too quickly would alert other traders before he is ready. When he has built up a sufficient line, our chef is ready to add the main ingredient.

Having cornered a sizeable chunk of the free float our chef befriends a few punters and lets them in on his find. He posts messages across all the popular investment forums, with headings like "The next ..." mentioning some recent stock that has taken off into the stratosphere. He will burley the water with "inside information" about new contracts in China or a gold strike in Indonesia. He will post several times a day, on the same thread. There will be much reference to "having gone into this in detail" -- thereby saving you the time -- and having an intimate knowledge of the company -- hinting at inside information. With little or no technical analysis, or else some shaky assertions about a double bottom, a broad base or a breakout, price targets are pulled out of thin air. If the stock is trading at 8 cents, we may see a claim that "this could go to $1.50" or similar extravagance.

The Recipe

Every time that our punters dive into the stock, the price goes up -- because our chef has cornered the free float and created a shortage. The more price rises, the more excited the punters become. Our hero is now acclaimed as a stock guru and his advice is eagerly sought on other new finds.

The rising price attracts more and more punters, eager to get in on the action, until there is a veritable feeding frenzy. At this stage our chef starts selling into the face of the rally, steadily offloading his line at a profit of several hundred percent. Buying is strong, so initially no one notices. Price no longer spurts ahead as before, but it still edges upwards, albeit on very heavy volume. Some of the volume and money flow indicators start to tick downwards. By this time our chef is cleaning out the remaining few stragglers before heading off for fresher pastures. He goes silent or, if he has a malicious streak, announces that he is "taking profits".

With buying support dissipated there is a rush for the exits. The stock tanks — falling back to the previous trading range and leaving our band of punters cursing their luck.

Examples

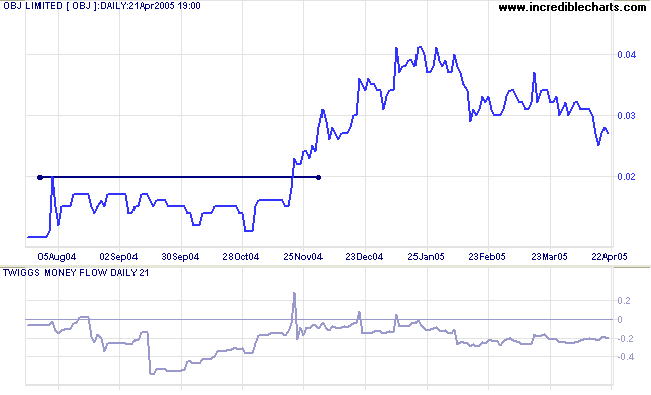

Despite huge trading volumes on this tiny software company, 21 day Twiggs Money Flow failed to cross into positive territory. Someone was selling a sizeable parcel of stock into the rally.

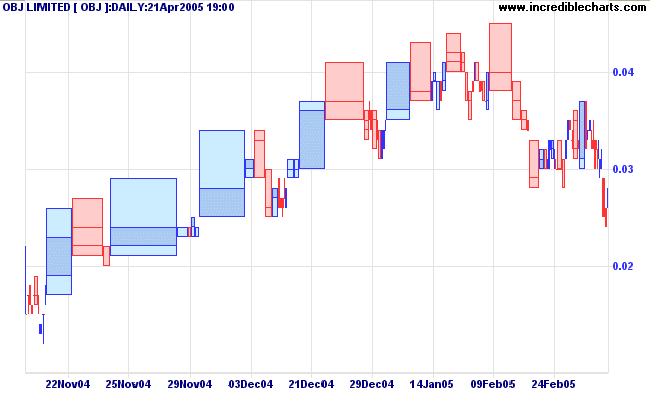

The equivolume chart tells the full story. Note the broad bars (width signifies volume) and tall shadows (weak closes) in the up-trend.

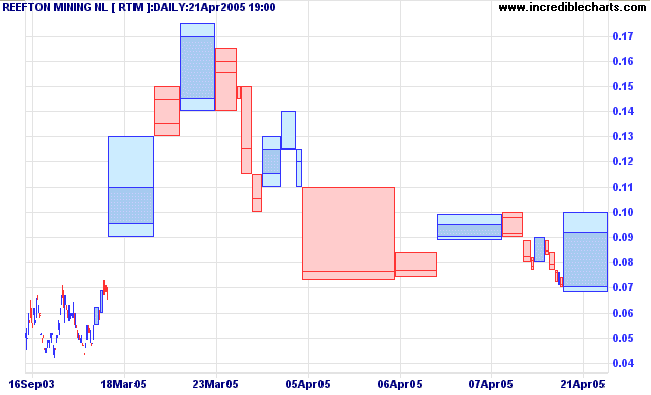

Gold mining is a perennial favorite. This small gold and nickel exploration company shows similar activity.

The Moral of the Story

Stay out of small caps until you are wise to the tricks of the trade.

Do your own research and treat everyone else's with a healthy skepticism:

If it sounds too good to be true — it usually is.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.