How to Read Trends

Trend Attributes

In our discussion we will focus on uptrends and their attributes.

Downtrends share many of the same characteristics, just in reverse. They also tend to move a lot faster than uptrends, with steeper falls. Fear is a bigger motivator than greed.

Uptrends

Uptrends normally possess the following attributes:

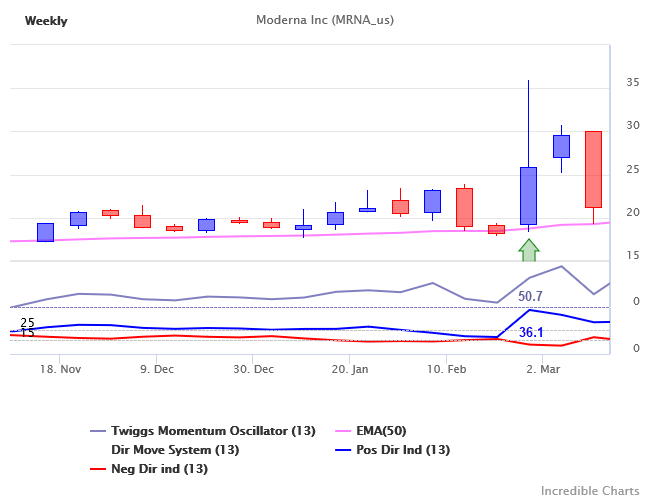

- An initial surge in momentum as the stock breaks through resistance and establishes an uptrend.

- Some stocks fail to hold above the new support level and the trend almost immediately collapses.

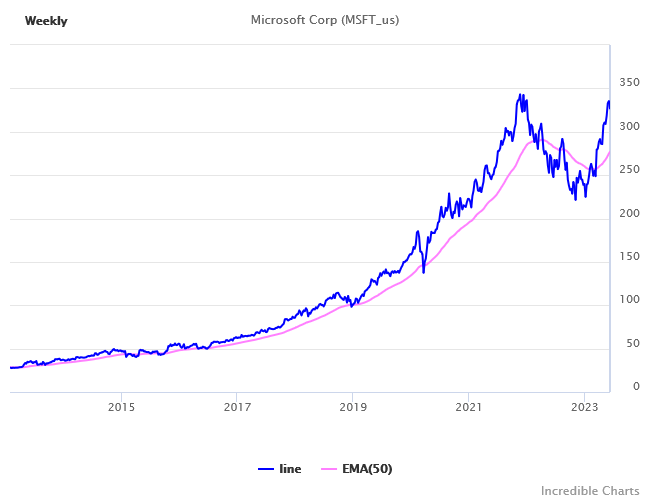

- Others establish an uptrend, with strong advances and weak corrections — the holy grail of trend-trading.

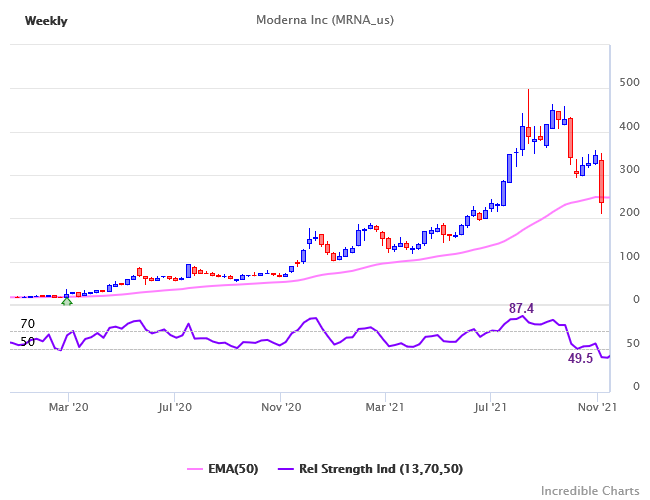

- Eventually, advances weaken and corrections grow stronger as the stock loses momentum.

- Finally, support is broken and the trend will reverse.

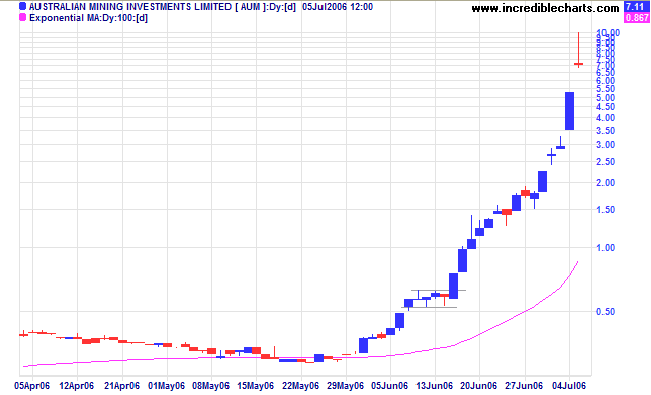

- Alternatively, advances will accelerate to an exponential uptrend — commonly known as a blow-off — followed by a steep drop as support gives way.

Conclusion

Uptrends normally display an initial surge in momentum. Some fail to hold above their new support level while others commence an uptrend with strong advances and weak corrections.

The trend draws to an end when corrections grow stronger and advances weaken or there is a blow-off, when advances accelerate exponentially followed by a sharp drop.

Trend Strength on a Stock Chart

There are three main indicators of the strength of a trend:

- Movement in the direction of the underlying trend;

- Correction or consolidation before the primary trend resumes; and

- Support and resistance at the preceding high.

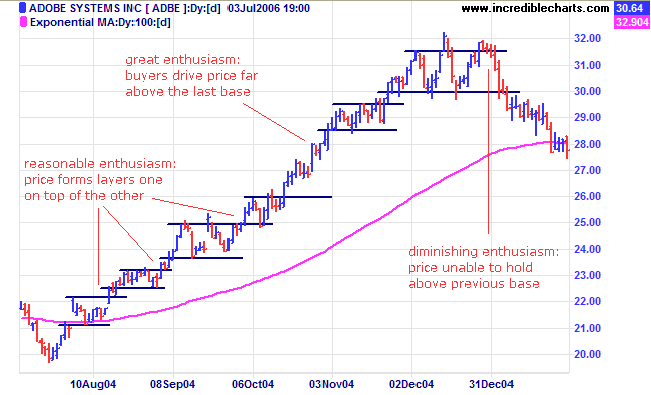

Trend Movement

The magnitude of the move above the previous base indicates buyers' enthusiasm. The more bullish buyers are, the further they will be willing to venture above the safety net of the previous correction or consolidation.

Buyers below have thrown caution to the winds. Spikes like this often end with a sharp reversal as there is no clear support level.

Correction or Consolidation

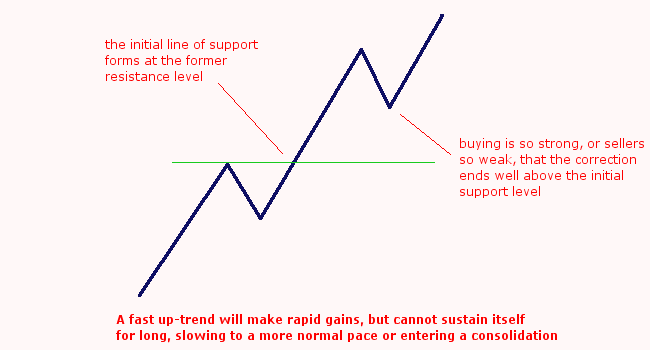

Short corrections and narrow consolidations also reflect trend strength. A short correction indicates that buyers have overwhelmed sellers or simply that sellers are disinterested. In either case this is a positive sign for the underlying trend.

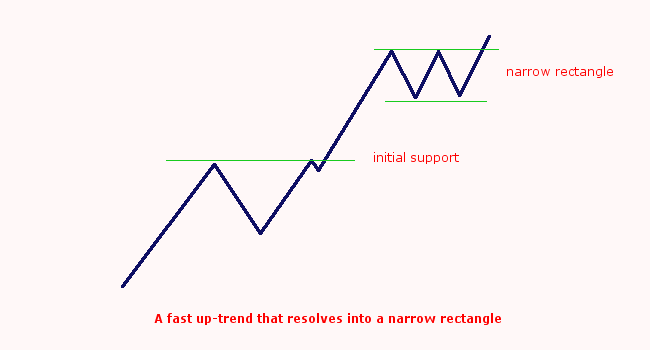

Narrow consolidations or rectangles are similarly a bullish continuation signal in an up-trend. Sellers may be present in reasonable force but buying support is sufficient to prevent a correction.

Support and Resistance

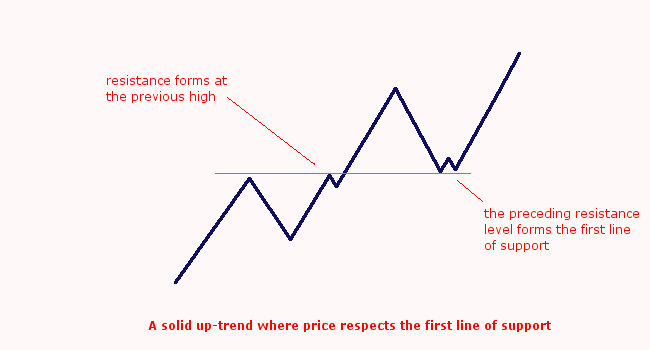

When price breaks above its preceding high, resistance at the earlier high becomes support for the new breakout, with buyers likely to accumulate should price retrace near the breakout level. The new support level will be relatively weak compared to support at the previous low; so when the new level holds it indicates a strong up-trend.

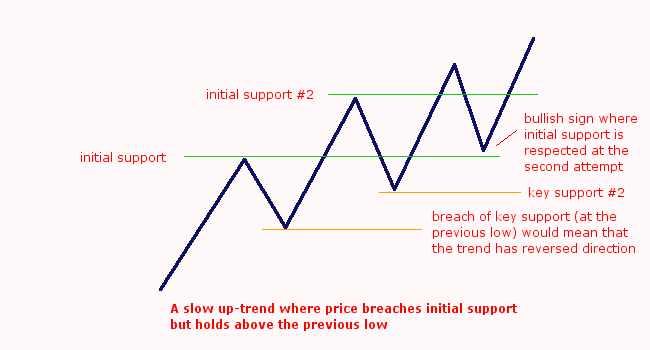

Weaker Support

If initial support does not hold at the first attempt, buyers and sellers may be more evenly matched and the up-trend is likely to be slower and more uncertain. If price later respects the initial support level, that is a sign that trend strength may be increasing.

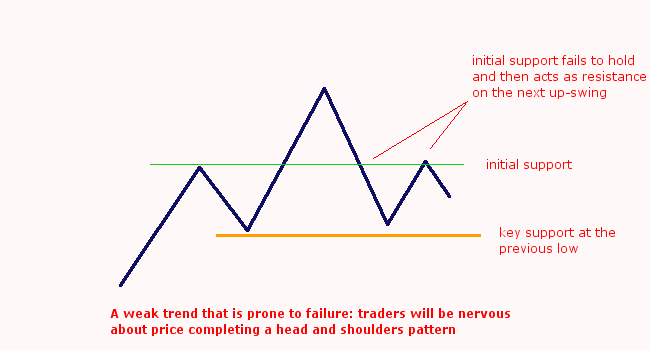

Support Becomes Resistance

If the initial support level is breached and then acts as resistance on the next up-swing, the trend is precarious. Any penetration of key support (from the previous low) would complete a head and shoulders reversal, triggering a spate of selling.

Summary

Most traders will want to trade fast or reliable trends, where retracements respect the initial line of support. Slow up-trends can be traded in a similar fashion to a ranging market, using swing trading tactics, while I do not suggest that you trade weak trends at all.

Author: Colin Twiggs is a former investment banker with over 30 years experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary newsletter.

Colin also writes The Patient Investor newsletter which focuses on the global economic outlook and key macro trends.

In addition, he founded PVT Capital (AFSL No. 546090) which offers investment strategy and advice to wholesale clients.