Double Bottom Pattern

What is a Double Bottom Pattern?

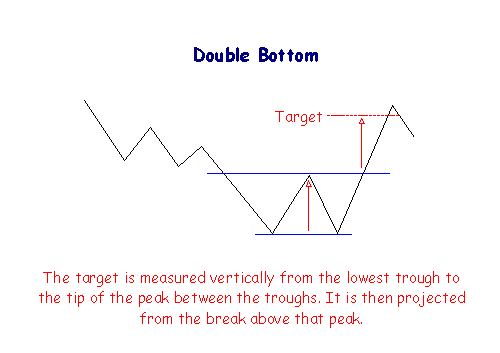

A Double Bottom pattern is identified by measuring from the lowest trough to the level of the intervening peak. It is then projected up from the break out above the resistance line.

Double bottoms are treacherous to trade, in part because of the similarity to triple bottoms and trading ranges.

Volume Confirmation

Reduced volume on the second trough followed by increased volume on the break above the resistance line.

Trading Signals

Go long on a break above the resistance line.

Place a stop-loss just below the last trough.

Price often corrects back to the resistance line which then acts as a support level. Go long on a reversal signal and place a stop-loss just below the support level.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.