Sector Analysis

After market risk, the most influential factor in the performance of a stock is the sector performance (or sector risk).

Stan Weinstein (Secrets for Profiting in Bull and Bear Markets, page 338) recommends that you:

- first determine the direction of the market;

- then select the top-performing sectors; and,

- finally, select the best stocks from within those sectors.

Sector Indexes (or Indices)

A pre-set project file is available for Australian traders:

- Select the Watchlist: [Sectors - ASX 200].

- On the File menu, place your mouse over Open File

and select [Sectors - ASX 200] - The file is pre-set with the 30-week weighted moving average and relative strength (to the ASX 200).

Switch to weekly view.

Sectors Comparison Chart

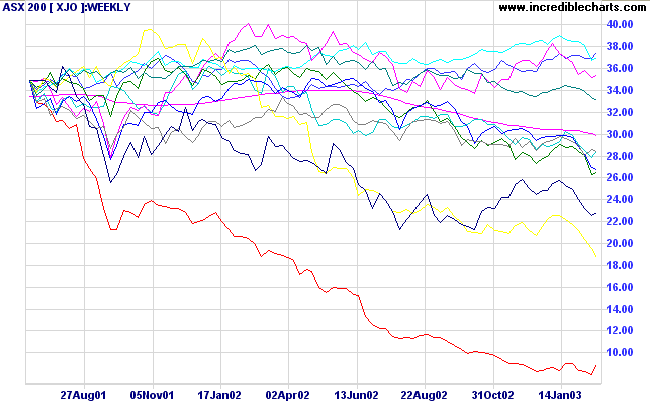

Sector comparison gives you a broad overview of relative performance of the various sectors. On the chart below you can see that Utilities and Property Trusts are the only two positive sectors, while Information Technology and Health Care are the weakest.

To create a Sector Comparison chart:

- Open a new file - the chart places a heavy load on your PC resources and you do not want this happening every time that you open Incredible Charts;

- Open the XJO weekly chart;

- Open the Indicator Panel;

- Select PRICE COMPARISON in the left column;

- On the drop-down menu, open the [Sectors - ASX 200] watchlist;

- Select the first sector index in the Watchlist, then check WEEKLY and APPLY TO SECURITY in the center panel, before saving (>);

- Repeat step (6) for each index;

- Then close (X) the Indicator Panel.

Sector Watchlist Chart

You can create a similar chart for each sector, comparing the major component stocks to the sector index. Please note that there are limitations on the number of stocks (6 to 8) that can be added to a single chart.

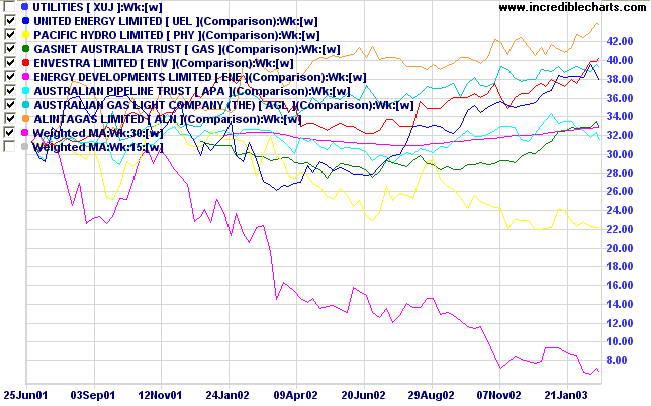

On the chart below, AlintaGas, Envestra, Australian Gas Light and United Energy are the strongest performers.

To create a Sector Watchlist chart:

- Use the Stock Screen to create a watchlist of ASX 200 stocks in the required SECTOR;

- Open the Sector Index (eg. XDJ);

- Repeat steps 3. to 8. from the Sector Comparison list above, but use the new watchlist that you created.