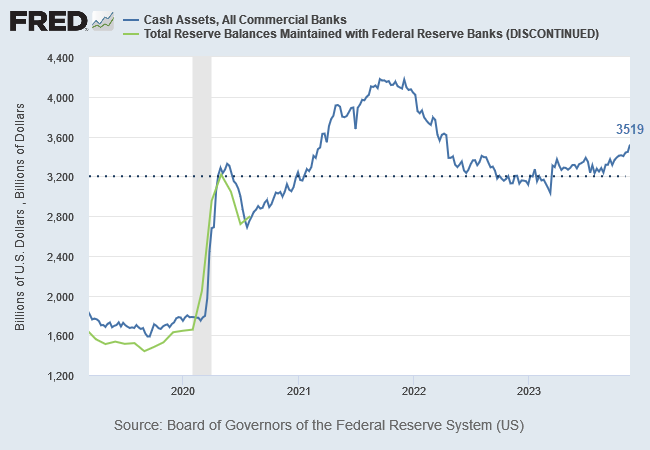

Fed stealth liquidity may presage early rate cuts

Commercial bank cash assets, representing reserves held at the Fed, reversed its down-trend after September 2022 -- when the UK gilt crisis occurred -- and is now edging higher, reflecting stealth liquidity support from the Fed and Treasury.

Fed QT is reducing liquidity at the rate of $95 billion per month but the effect of discount lending and reduction of RRP facilities means that net liquidity is increasing...

Market Analysis Subscribers

Everything contained in these newsletters, related websites, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

You, the Reader, need to conduct your own research and decide whether to invest or trade. The decision is yours alone. We expressly disavow all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.