Why this time is different

First, please read the Disclaimer.

The four most expensive words in the English language are: "This time it's different." ~ Sir John Templeton

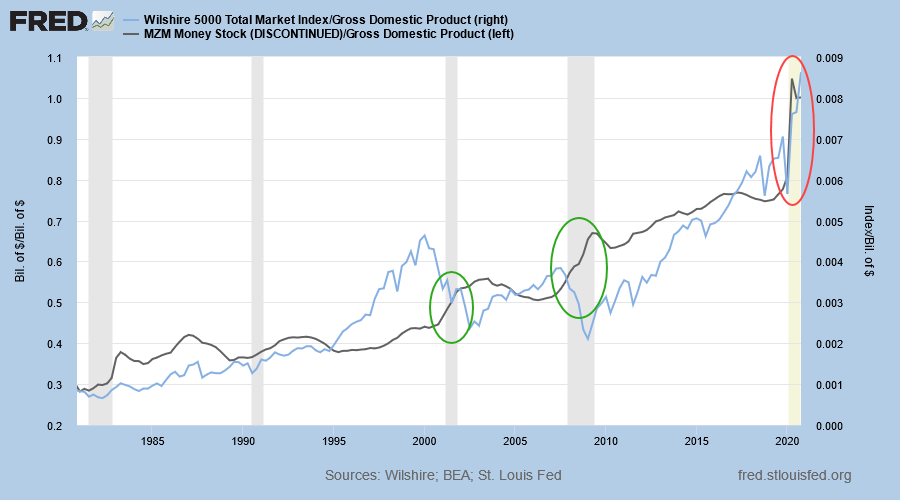

The chart below compares the Wilshire 5000 broad market index (light blue) to the money supply (MZM or "at call" money). The previous two recessions show a surge in the money supply (green circles) as the Fed injects liquidity into financial markets to forestall a deflationary spiral. In both cases, stocks took more than two years to react, with the low-point reached 8 quarters after the Fed started to inject liquidity in Q1 2001 and 9 quarters after liquidity injections commenced in Q3 of 2007.

It took almost 13 years for the index to make a new high after its Q1 2001 Dotcom peak and 5.5 years after its Q3 2007 peak (values are plotted relative to GDP).

The recovery in 2020 was quite different. The index formed a low two quarters after the Fed started to inject liquidity and had recovered to a new high in the next quarter.

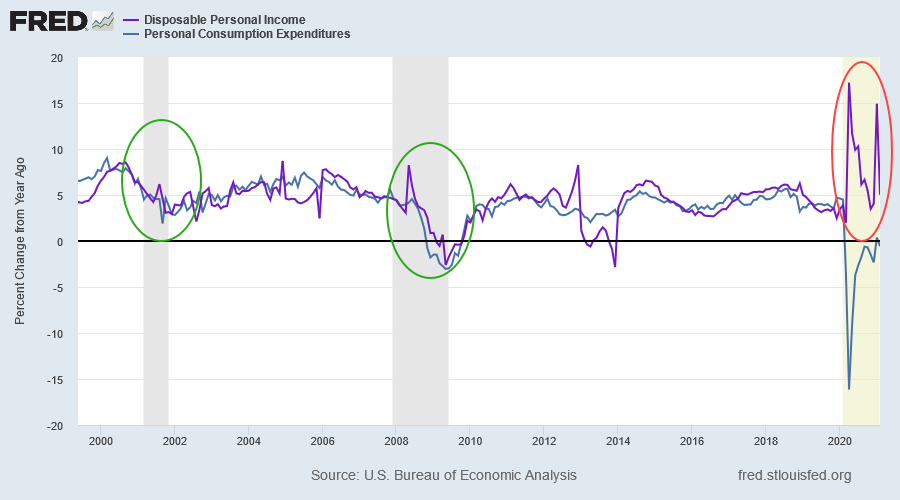

While the recovery from the Dotcom crash took an unusually long time — because of the extreme valuations — we can still conclude that the latest recovery was exceptional. The massive government stimulus caused a surge in disposable incomes, rather than a fall as seen in previous recessions.

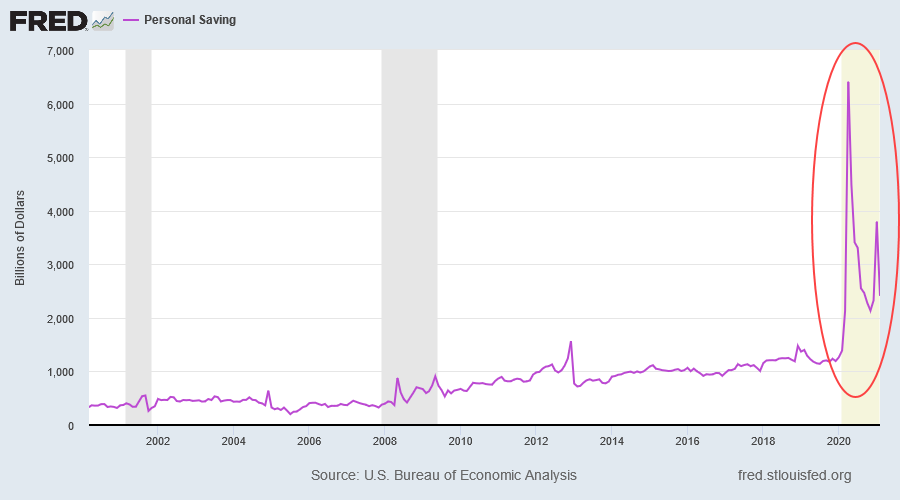

The surge in disposable income combined with a sharp fall in consumption caused a massive spike in personal saving. Much of this flowed into the stock market.

The massive inflows caused a surge in stock prices, which in turn led to similar exuberance to the Dotcom bubble of 1999-2000.

Conclusion

While the government attempt to prevent a fall in personal disposable income during the pandemic is laudable, their overreaction caused a massive spike in personal saving — spreading the contagion to the stock market. Stocks are now trading at precarious levels relative to earnings, with no easy way for authorities to engineer a soft landing.

We are not sure for how long the Fed can prop up the stock market but are certain that it will end badly for investors who ignore the risks.

Quote for the Week

This is the only time in my 88 years when I saw technology stocks go to 100 times earnings; or, when there were no earnings, 20 times sales. It was insane, and I took advantage of the temporary insanity.

~ Sir John Templeton, interviewed in 2001.

Notes

Sir John Templeton (1912-2008) was an American-born value investor, banker, fund manager, and philanthropist. He founded the Templeton Growth Fund in the UK in 1954, which averaged more than 15% p.a. over 38 years.

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

- Iron ore surges but miners fall

- Orocobre – Galaxy proposed merger

- S&P 500 bullet proof at present

- Gold rallies as Treasury yields fall

- ASX buoyant on softer interest rates

- Using the yield curve to predict future growth

- S&P 500: Fairly-priced or loaded for bear?

- What assets perform best when inflation is high?

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.