The Challenge Facing Australia

First, please read the Disclaimer.

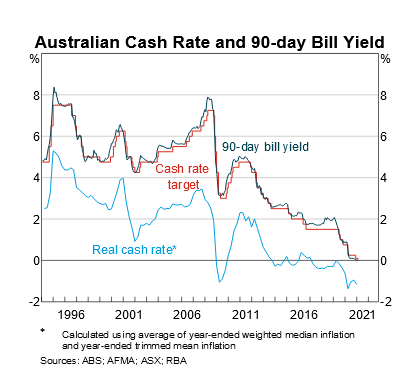

Interest rates are at record lows.

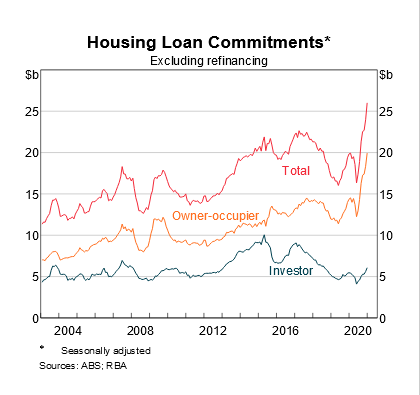

New housing loans are soaring, with commitments at record levels.

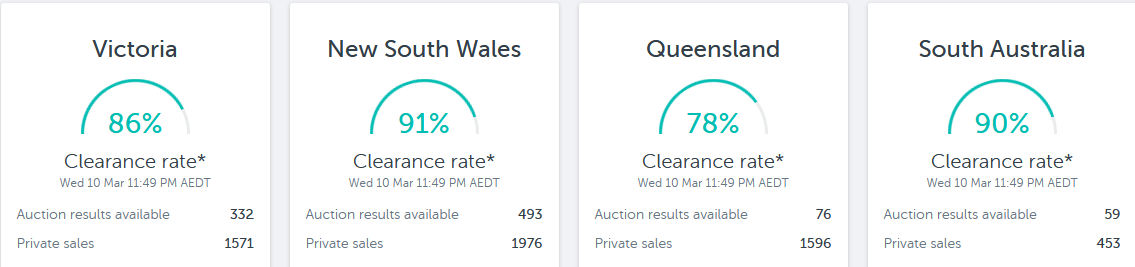

Auction clearance rates are climbing.

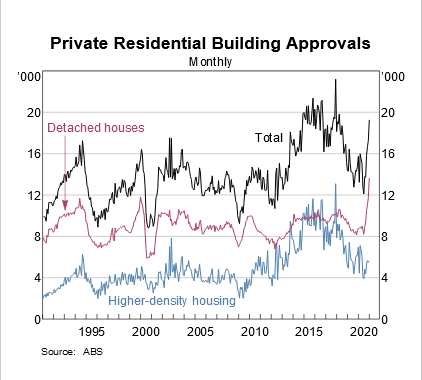

While private residential building approvals have taken off.

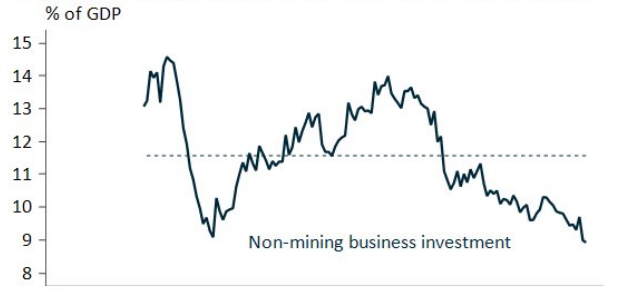

But non-mining business investment is plunging.

Ultra-low interest rates have boosted demand for housing. Especially with major banks projecting a 20% increase in house prices by the end of next year. Banks, inundated with record numbers of new mortgage applications, are happy to splash out in the housing market with house price inflation expected to bail them out of any poor lending decisions.

Business applications are unlikely to be met with the same enthusiasm. An uncertain economic climate and recent high default rates make it likely that only the most blue chip of investments win approval.

The problem is that as business investment withers, so does growth.

Productivity requires new investment in more efficient plant, equipment and processes in order to grow (the old analogy of 20 workers with shovels versus one with a bulldozer comes to mind).

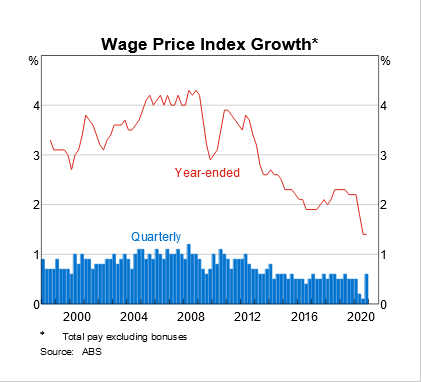

New investment creates new jobs, so job growth slows if there is no investment. Then wages growth slows, completing the trifecta.

Conclusion

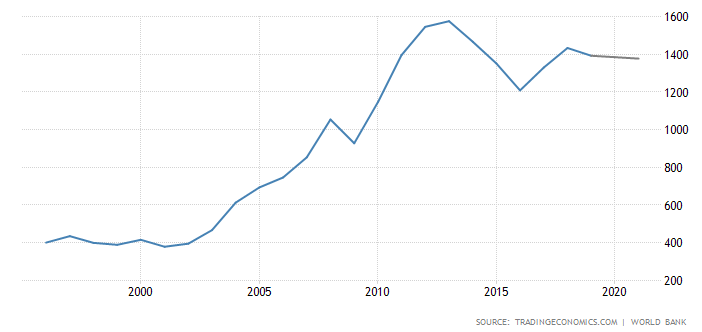

The focus of the whole economy needs to change from housing to business investment. If we don't make capital investments to improve efficiency and productivity we will fall increasingly behind. Unable to compete in the global economy -- other than digging holes to supply China and other modern economies with commodities needed to run their manufacturing industries.

Quote for the Week

~ Stephen Pastis

Acknowledgements

Hat tip to IFM economist Alex Joiner for the chart on non-mining business investment.

Updates for Market Analysis Subscribers

Please take advantage of our $1 special offer for the first month. Cancel at any time.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.