Buybacks are hurting growth

By Colin Twiggs

July 19, 2019 11:00 p.m. EDT (1:00 p.m. AEST)

First, please read the Disclaimer.

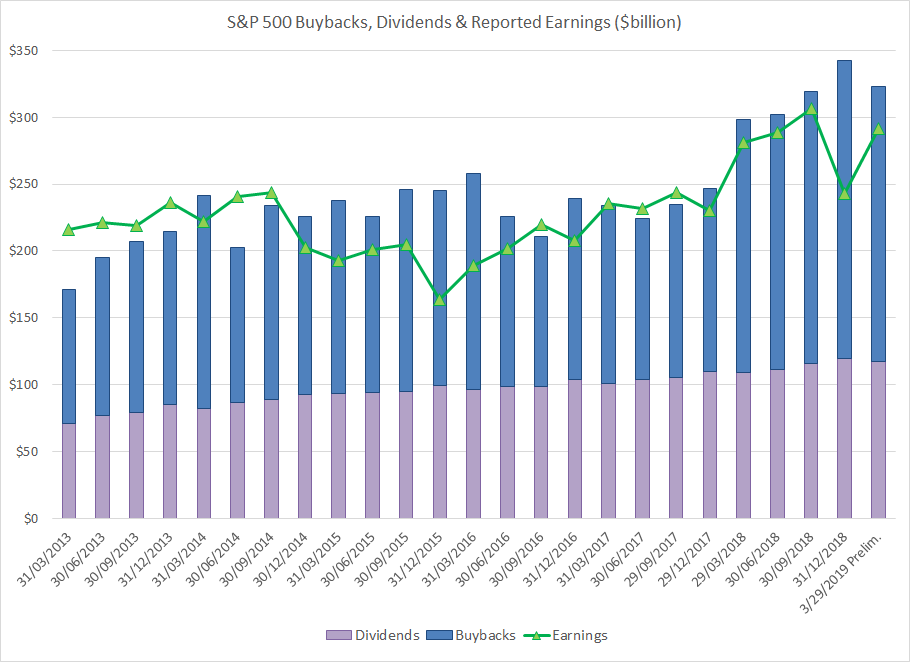

Preliminary Q1 results from S&P Dow Jones Indices show S&P 500 dividends and buybacks continue to exceed reported earnings in the first quarter of the current year.

While this could be a spill-over of offshore funds repatriated as a result of the 2017 Tax Cuts and Jobs Act, companies have distributed more than they earned since 2014 (Q4). That leaves nothing in reserve for new investment or increases in working capital, both of which are necessary to support growth.

In my last post I highlighted that before-tax corporate profits, adjusted for inflation, are below 2006 levels and declining. Reported earnings for Q1 2019 on the above chart (preliminary results) are only 3.5% higher than the same quarter in 2018. If we strip out inflation, estimated at 2.0%, that leaves only 1.5% real growth.

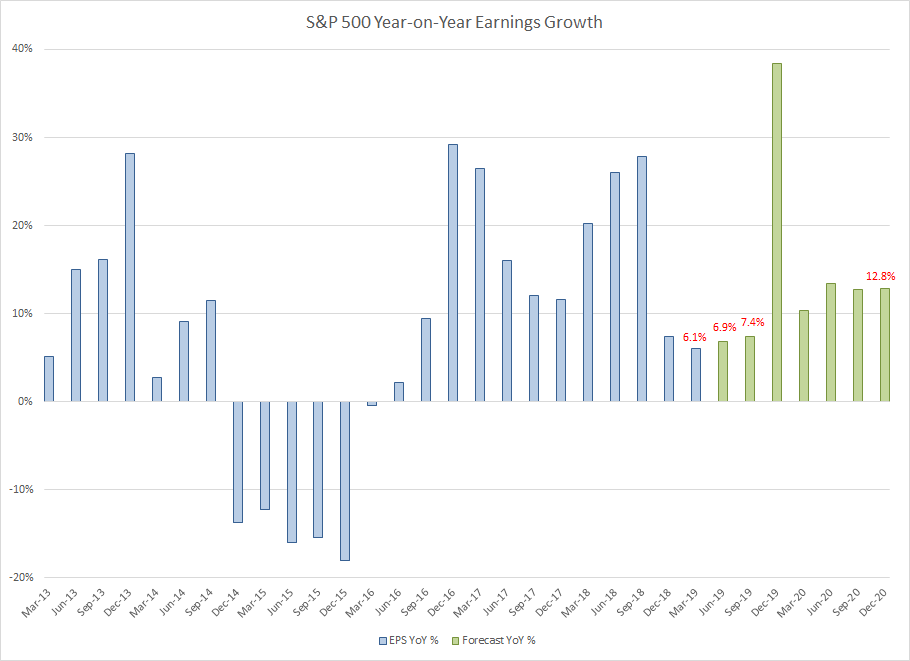

S&P 500 earnings per share growth for Q1 2019 is marginally better, at 6.1%, because of stock buybacks.

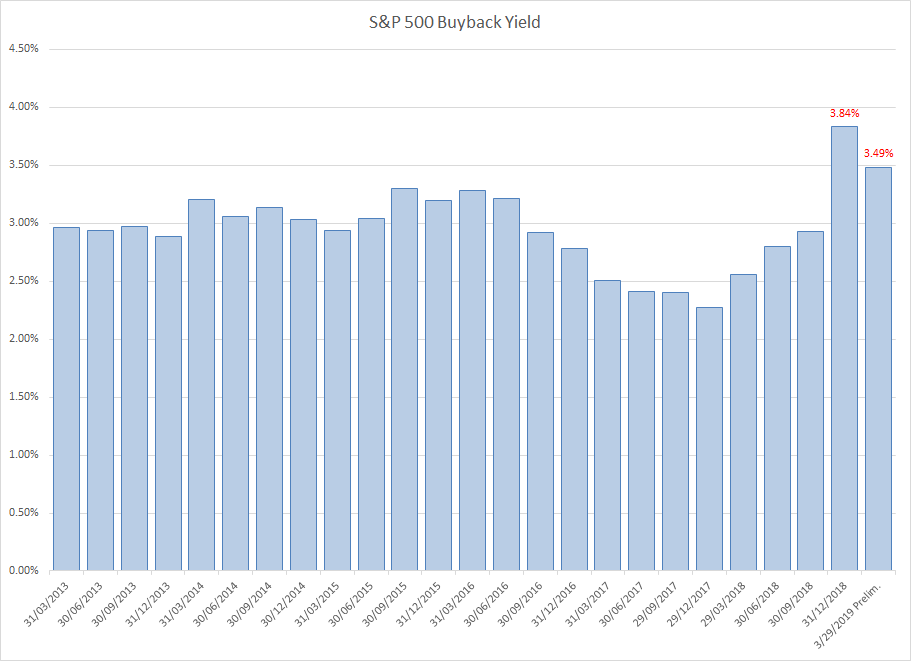

But the S&P 500 buyback yield is 3.49% (Source: S&P Dow Jones Indices). On its own, that should boost eps growth by 3.6% (1/[1 - 0.0349] - 1 for the quants). There seems to be 1.0% missing.

Warren Buffett has pointed this issue out repeatedly for the past 20 years:

"...We will repurchase stock when it falls below a conservative estimate of its intrinsic value. We want to be sure that when we repurchase shares that the remaining shareholders are worth more the moment after we repurchased the shares than they were before."If stock is repurchased at above intrinsic value then shareholders will be worse-off. The company receives a poor return on its investment in much the same way as if it had over-paid for an acquisition.

Here is a simple example:

If a company is trading at 100 times earnings and achieving 20% organic earnings growth per year, it is most likely over-priced. Now that company buys back 10% of its own stock (numbers are exaggerated for illustration purposes). Earnings will stay the same but earnings per share (eps) increases by 11.1% (the inverse of 90%).

If the same funds used for the buyback had been invested in a new project with a modest 5% initial return on investment, earnings would have increased 50% (and eps likewise).

The larger the buyback yield, the more that growth is likely to deteriorate — especially when earnings multiples are dangerously high.

"Be fearful when others are greedy and greedy only when others are fearful."

~ Warren Buffett

Latest

-

ASX 200

Iron ore tailwinds continue. -

Australia

How to break the downward spiral. -

The long game

The long game

Why the West is losing. -

Gold

Every cloud has a Silver lining. -

S&P 500

Secondary selling pressure. -

S&P 500

Rate cuts and buybacks — the emperor's new clothes. -

S&P 500

A good time to be cautious. -

PEmax

Why you should be wary of Robert Shiller's CAPE -

Portfolio

Investing in a volatile market - April 2018

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.

Please read the Financial Services Guide.