Volatility Continues

By Colin Twiggs

April 27, 2017 4:00 p.m. EDT (6:00 a.m. AEST)

First, please read the Disclaimer.

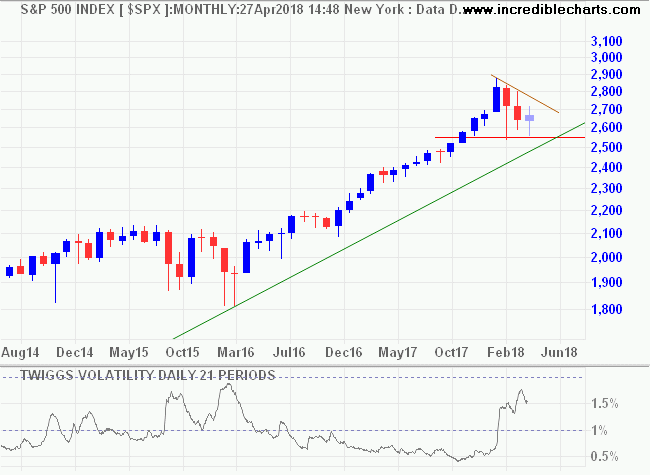

The S&P 500 is forming a bearish descending triangle with a base at 2550. Twiggs Volatility remains elevated, in the amber zone between 1% and 2%. Another rally to test resistance at 2800/2850 is likely and the key for me will be the behavior of the Volatility Index over this period. A fall below 1.0% would indicate normal business has resumed, but a trough that respects the 1.0% line, as in late 2015, would warn that risk remains elevated and more downside is likely to follow. While 2016 is not exactly a market crash, I believe that the down-turn would have been a lot worse if not for large stock buybacks by major corporations, supporting their stock prices.

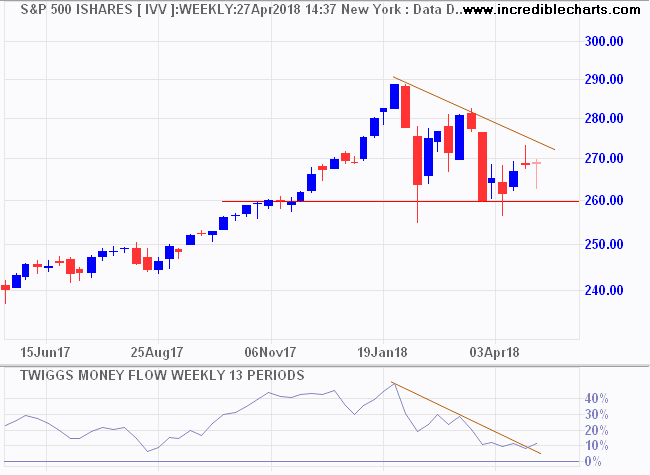

Today's Ishares chart (IVV) shows the index bottoming out from a strong secondary correction, with Twiggs Money Flow respecting the zero line.

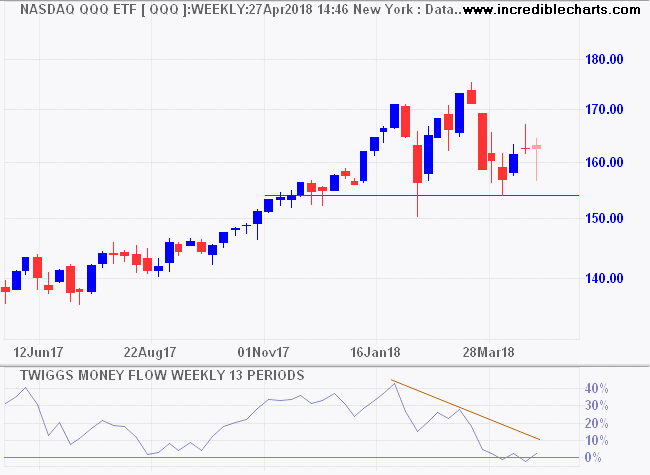

The Nasdaq 100 is slightly weaker with Twiggs Money Flow (on QQQ) forming a trough at the zero line.

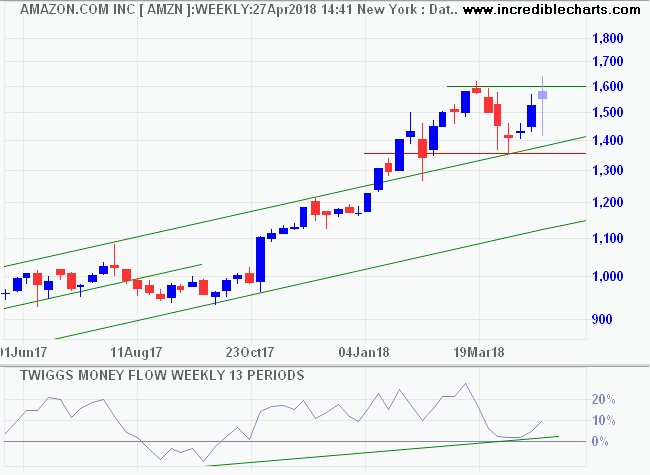

Market leader Amazon (AMZN) has formed a healthy trough above zero, signaling strong buying support. Earnings reported for Q1 2018 were an impressive $3.27 EPS, with 51,042 revenue compared to Wall Street consensus estimates of $1.22 and 50,175 respectively.

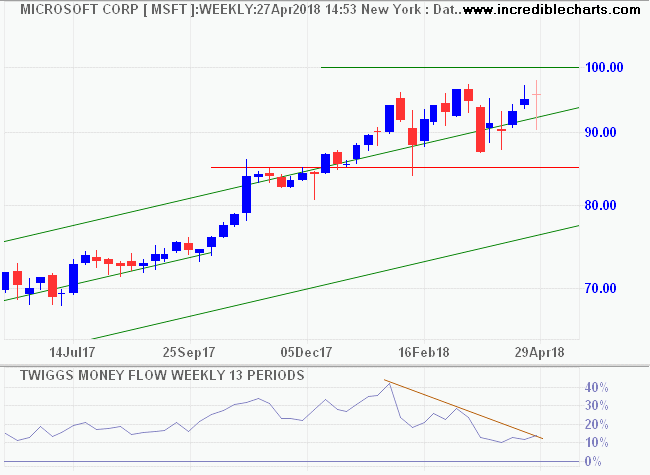

Microsoft (MSFT) was more modest at $0.95 and 26,819 compared to Wall Street's $0.85 and 25,706.

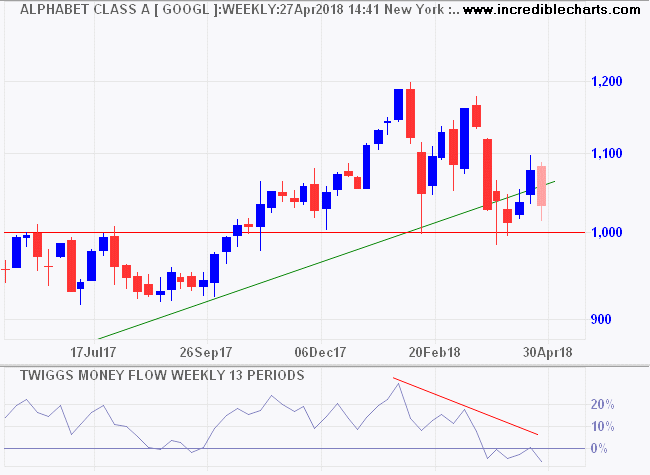

Alphabet (GOOGL) also impressed, with earnings of $9.93 and revenue of 24,858 compared to Wall Street estimates of $9.21 and 24,288, but the stock is still suffering from "Facebook fallout."

It is unlikely that the market will capitulate when presented with such strong earnings. But not impossible.

The stock market remains an exceptionally efficient mechanism for the transfer of wealth from the impatient to the patient.

~ Warren Buffett

Latest

-

Life Left in US stocks

Plenty of good news. Concerns seem overblown. -

ASX 200

Miners and Banks versus the Rest. -

Gold

Australian gold stocks rally despite stronger Dollar. -

Commodities

Commodities show signs of recovering. -

Investing in a Volatile Market

Managing downside risk.

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.