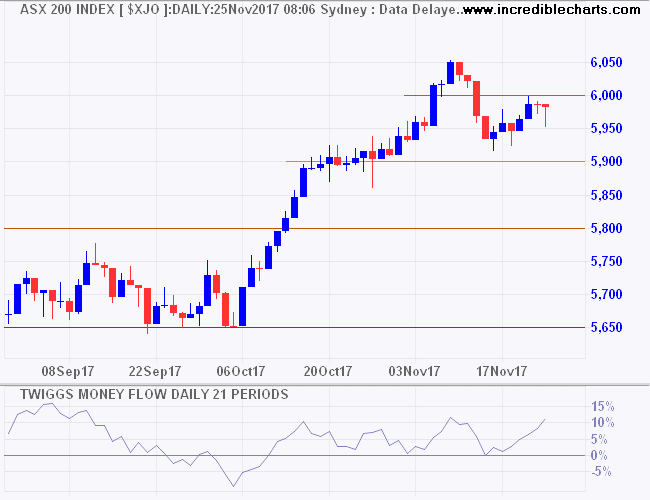

Australia: ASX 200 faces resistance at 6000

By Colin Twiggs

November 24, 2017 8:30 p.m. EDT (12:30 p.m. AEST)

Please note changes to the Disclaimer.

The ASX 200 faces resistance at the key 6000 level. Money Flow is forming troughs above zero, indicating buying pressure. Recovery above 6000 would signal another advance. Failure of support at 5900 is less likely but would warn of a strong correction.

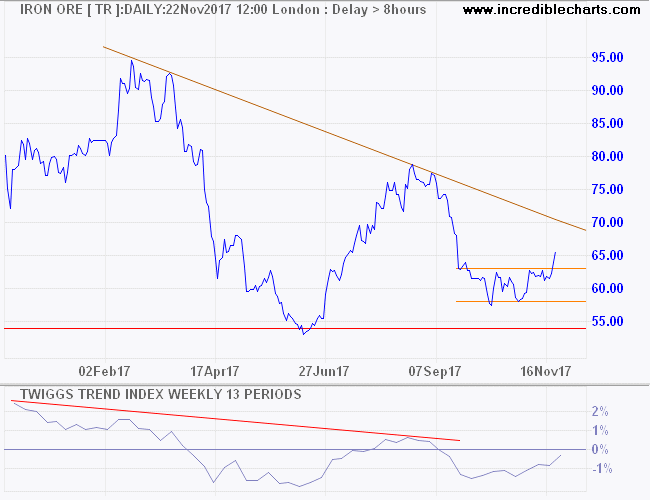

Iron ore prices are strengthening and likely to test the descending trendline at 70. Breakout above 80 would signal reversal to a primary up-trend but that still seems a long way off.

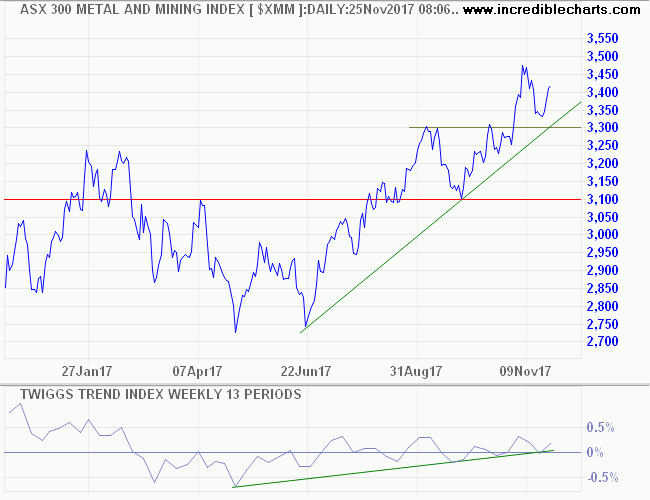

Miners responded with another rally, the ASX 300 Metals & Mining Index respecting support at 3300.

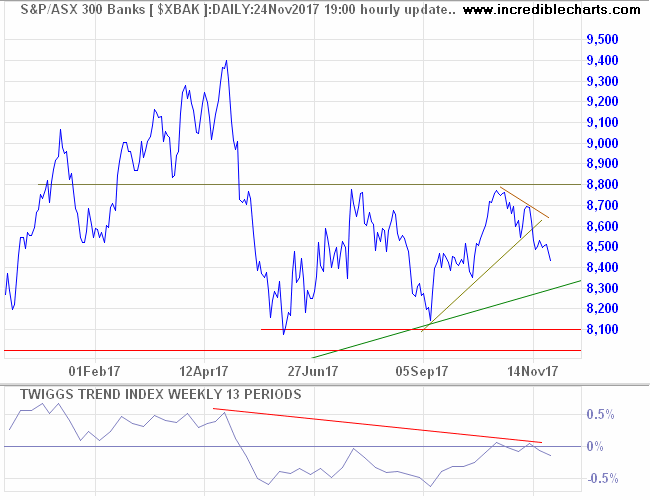

So why the hesitancy? Banks are the largest sector in the ASX 200, with Financials representing 37.2% of the broad index. The ASX 300 Banks index is retreating and expected to test the band of support between 8000 and 8100. Trend Index peaks below zero warn of long-term selling pressure.

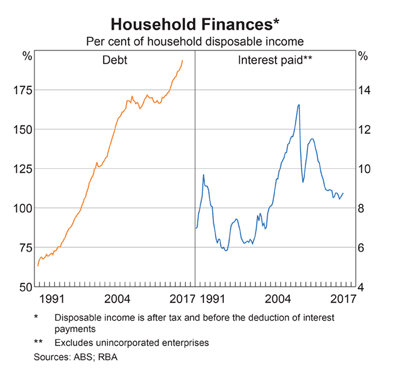

The outlook for banks is not that rosy . Household debt is growing faster than disposable incomes, placing finances in an increasingly precarious position. Interest payments are still manageable at 8% of disposable income but that could change if interest rates rise.

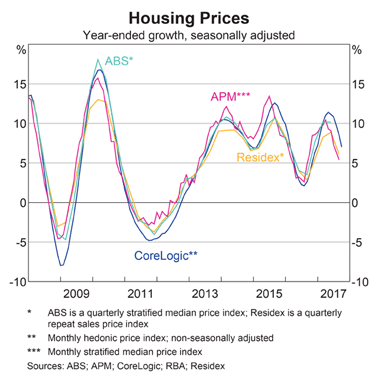

The housing cycle appears to have peaked, with growth now falling. A function of tighter controls by APRA over investor lending and a Chinese crackdown on capital outflows.

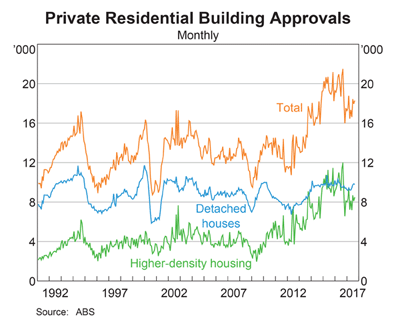

Building approvals for detached houses remain steady but approvals for higher-density housing are falling.

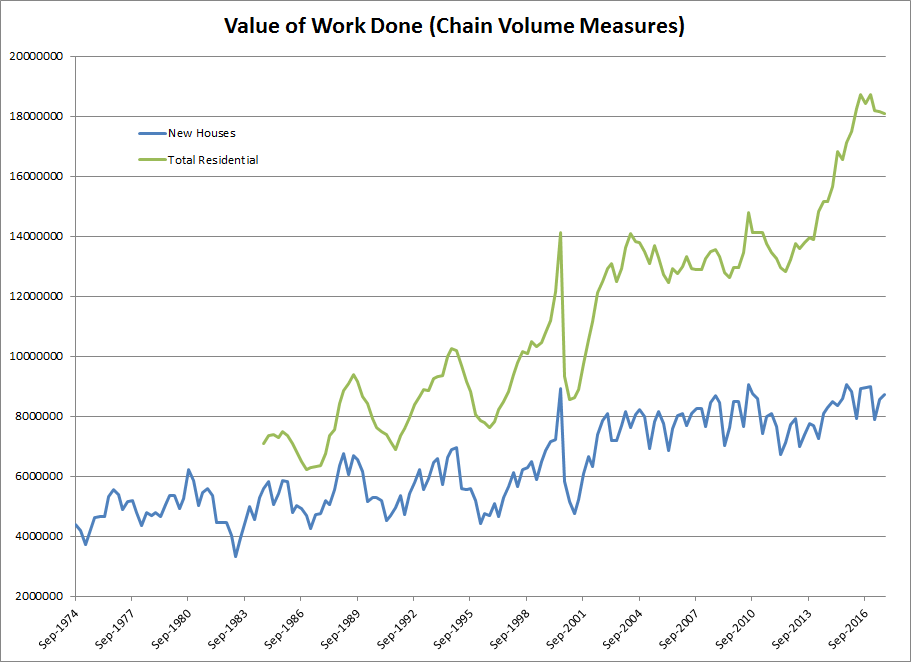

A boom in construction of high-density housing has provided a strong tailwind to the economy over recent years, illustrated by the sharp spike in total residential construction compared to new houses in the chart below.

But the downturn in apartment prices and falling building approvals is likely to turn that tailwind into a headwind as apartment construction falls. This would affect not only the construction sector but the entire economy.

Political uncertainty over the continuation of favorable tax treatment for housing investors could also impact on new housing investment and strengthen the headwinds facing the economy.

If I hadn't made money some of the time I might have acquired market wisdom quicker.

~ Jesse Livermore

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.