Dow Stage 3 as Industrials set a new high

By Colin Twiggs

October 20, 2017 10:30 p.m. EDT (1:30 p.m. AEST)

Please note changes to the Disclaimer.

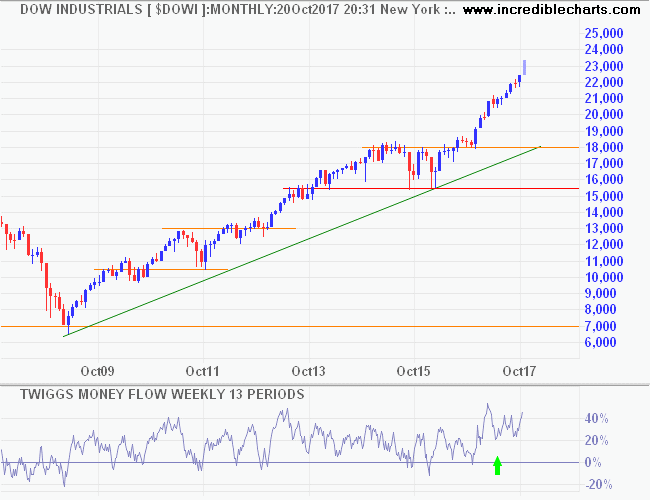

Stage 3 of a bull market is normally identified by excessive speculation and the appearance of inflationary pressures according to classic Dow Theory. Neither of these are evident, so why stage 3?

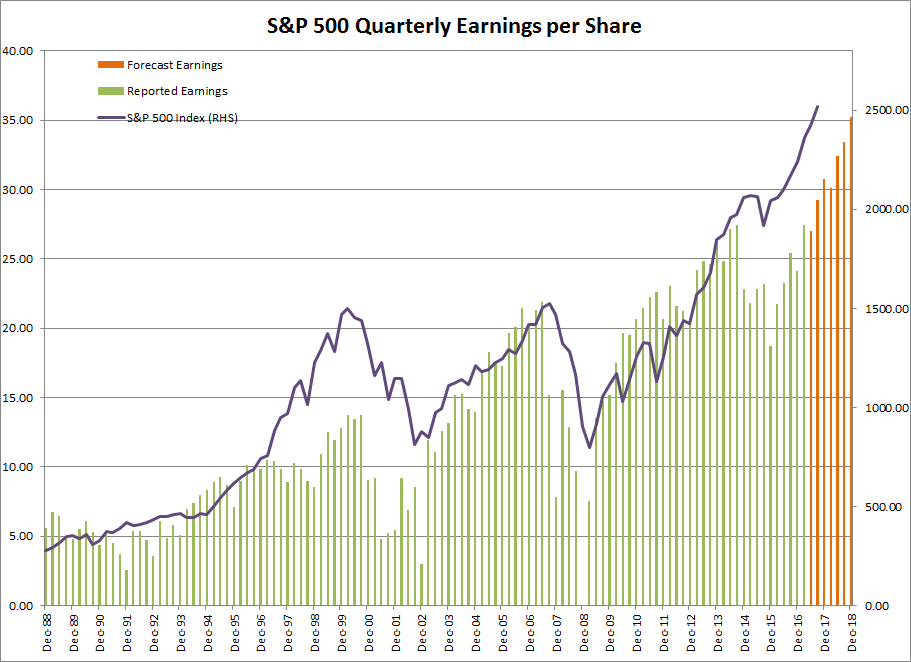

Prices are advancing at a faster rate than earnings, as they did in the Dotcom bubble of the late 1990s. Stage 2 is synonymous with prices advancing in line with earnings, as in 2011 to 2014 on the chart below. But the index then continued its advance while earnings retreated, commencing stage 3.

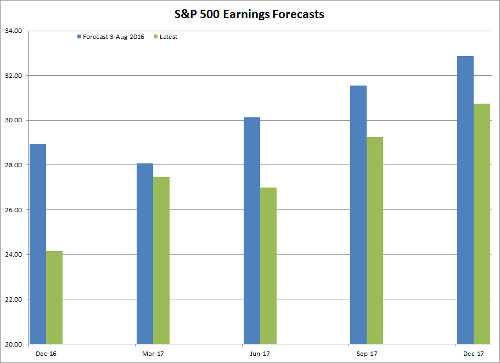

The earnings recovery is forecast to continue in 2018 but, if the last three quarters are anything to go by, forecasts are likely to be revised downward as the reporting season approaches.

The Dow broke 23,000 for the first time this week, logging an impressive 260% gain since its March 2009 low. Apart from the occasional setback, like General Electric, most stocks are meeting or exceeding expectations and further growth is likely.

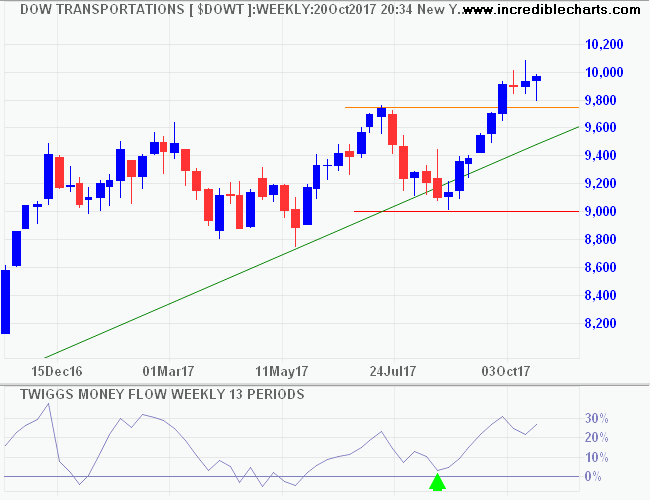

The Transport Average is also making new highs after a sharp down-turn in 2015/2016.

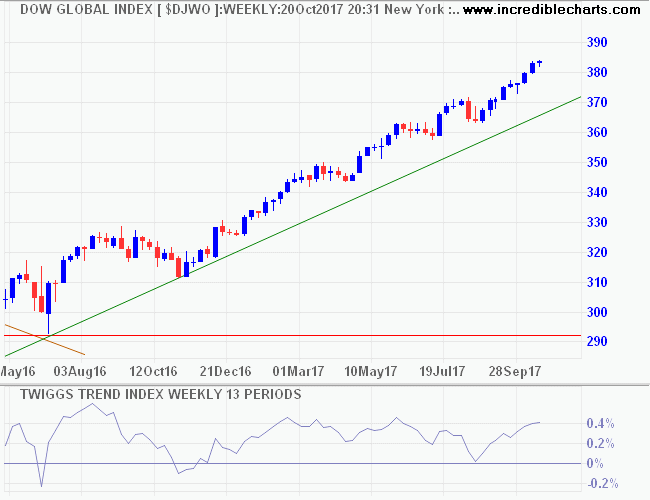

Dow Jones World Index displays similar growth, reflecting a broad recovery.

Stage 3 is likely to continue until earnings falter.

They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side.

~ Jesse Livermore

Disclaimer

Colin Twiggs is director of The Patient Investor Pty Ltd, an Authorised Representative (no. 1256439) of MoneySherpa Pty Limited which holds Australian Financial Services Licence No. 451289.

Everything contained in this web site, related newsletters, training videos and training courses (collectively referred to as the "Material") has been written for the purpose of teaching analysis, trading and investment techniques. The Material neither purports to be, nor is it intended to be, advice to trade or to invest in any financial instrument, or class of financial instruments, or to use any particular methods of trading or investing.

Advice in the Material is provided for the general information of readers and viewers (collectively referred to as "Readers") and does not have regard to any particular person's investment objectives, financial situation or needs. Accordingly, no Reader should act on the basis of any information in the Material without properly considering its applicability to their financial circumstances. If not properly qualified to do this for themselves, Readers should seek professional advice.

Investing and trading involves risk of loss. Past results are not necessarily indicative of future results.

The decision to invest or trade is for the Reader alone. We expressly disclaim all and any liability to any person, with respect of anything, and of the consequences of anything, done or omitted to be done by any such person in reliance upon the whole or any part of the Material.