The correction we had to have

By Colin Twiggs

January 24th, 2013 7:00 p.m. ET (11:00 a:m AEDT)

These extracts from my trading diary are for educational purposes. Any advice contained therein is provided for the general information of readers and does not have regard to any particular person's investment objectives, financial situation or needs and must not be construed as advice to buy, sell, hold or otherwise deal with any securities or other investments. Accordingly, no reader should act on the basis of any information contained therein without first having consulted a suitably qualified financial advisor. Full terms and conditions can be found at Terms of Use.

US markets were overdue for a correction and continuation of the advance for much longer would have resulted in instability, from an imbalance between buyers and sellers.

At Research & Investment we do not attempt to time entries and exits on secondary corrections. Our research shows that this is expensive and erodes performance. What we do pay a lot of attention to, on the other hand, are macro-economic and volatility indicators of market risk, exiting to cash when risks become elevated.

With a long-term view of the market, secondary fluctuations are relatively insignificant, but they do present opportunities to increase investment in the market.

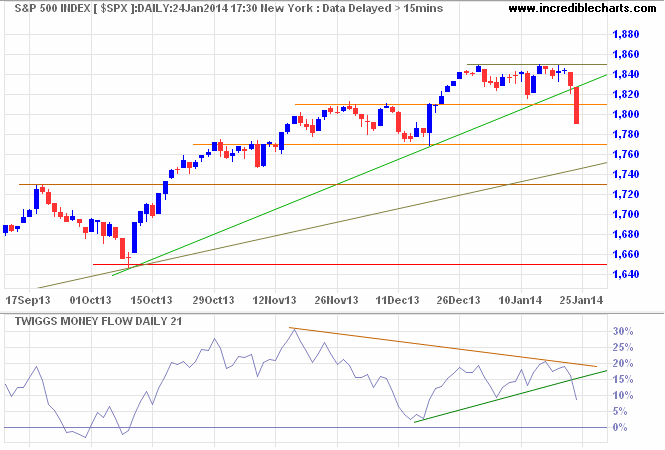

The S&P 500 broke support at 1810, signaling a correction. Bearish divergence on 21-day Twiggs Money Flow strengthens the signal. Expect support at the Setember 2013 high of 1730.

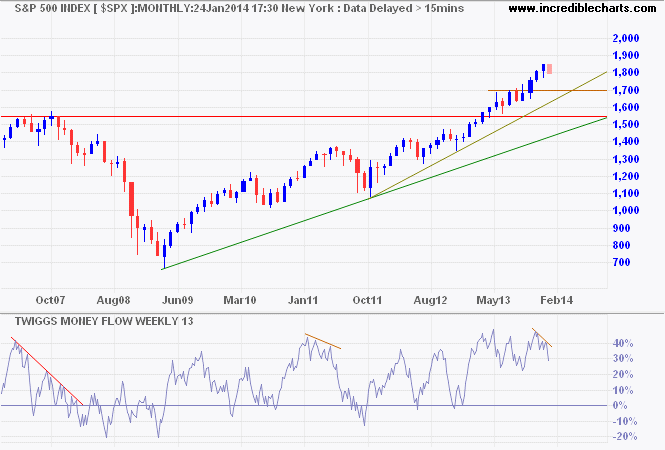

A monthly chart places the latest breakdown in perspective. Respect of support at 1700 — and the secondary trendline — would confirm a healthy primary up-trend. A 13-week Twiggs Money Flow trough above zero would again strengthen the signal.

* Target calculation: 1800 + ( 1800 - 1700 ) = 1900

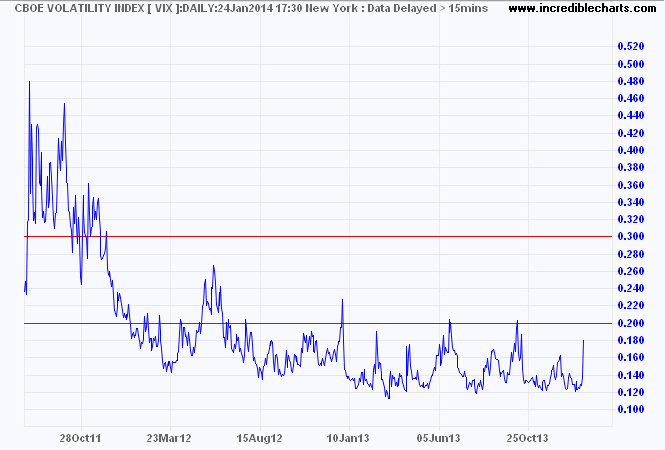

The VIX is rising steeply, but continues to indicate low risk and a bull market.

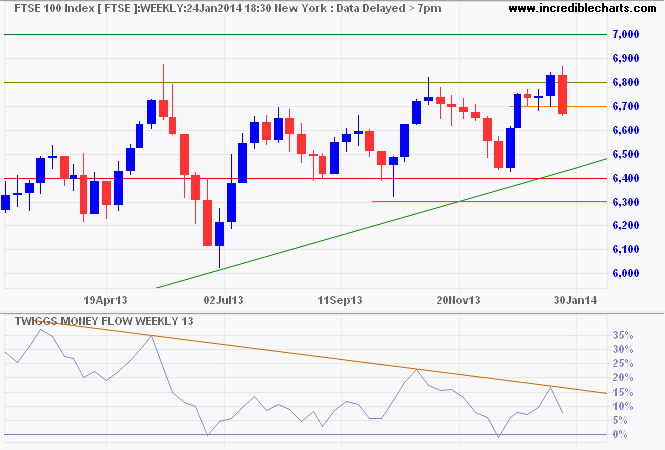

The FTSE 100 retreated below short-term support at 6700 after a false break above 6800, signaling a correction to test primary support at 6400. Bearish divergence on 13-week Twiggs Money Flow warns of long-term selling pressure. Recovery above 6800 is unlikely, but would signal a fresh advance.

* Target calculation: 6800 + ( 6800 - 6400 ) = 7200

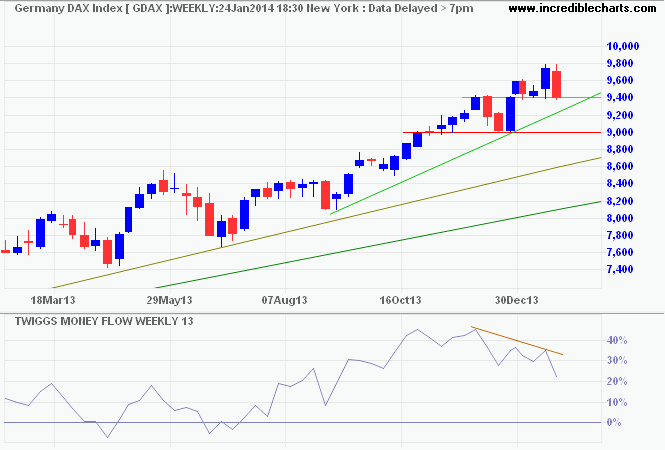

Germany's DAX shows medium-term selling pressure, with bearish divergence on 13-week Twiggs Money Flow. Breach of support at 9400 — and the latest rising trendline — would warn of a correction to 9000. Respect of 9400 is unlikely, but would signal a primary advance to 10200*.

* Target calculation: 9800 + ( 9800 - 9400 ) = 10200

The quality of a person's life is in direct proportion to their commitment to excellence, regardless of their chosen field of endeavor.

~ Vince Lombardi