No such thing as a free lunch

By Colin Twiggs

April 16, 2011 4:00 a.m. ET (6:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

In my last commentary on the economy, I discussed why austerity drives to cut government spending have to be balanced with increased infrastructure investment — in order to avoid a double-dip similar to 1937. This week I would like to re-visit the root causes of banking crises and discuss how we can avoid a repeat of the recent global financial crisis (GFC).

Low Interest Rates

Several years after its 1913 formation the Federal Reserve discovered the effectiveness of treasury purchases in driving down short-term interest rates. Open market operations were originally conducted by purchases (or sales) of Treasurys but have since been expanded to include other financial instruments. Fed purchases effectively inject fresh money into the financial system, lowering the interest rate that borrowers are willing to pay for new loans. This is commonly referred to as "printing money" or "the Fed's printing press", although the Fed no longer issues physical notes to pay for its purchases. It merely issues a check which commercial banks present for credit to their account with the central bank. Sales of Treasurys by the Fed have the opposite effect, drawing money out of the system and effectively raising interest rates.

The discovery appeared a wonderful tool, enabling the Fed to lower interest rates and stimulate the economy with few side effects. Only later did the full consequences of their actions become evident. The injection of new money began to cause inflation: increasing the supply of money in the economy without an increase in the supply of goods causes a general increase in prices. The effect is not immediate but tends to lag the fall in interest rates by several months as the market takes time to adjust — initially creating the illusion of a "free lunch".

Anyone who has been in business will be familiar with the maxim "there is no such thing as a free lunch". Deals that seem too good to be true usually are. Unfortunately central bankers do not seem to share that skepticism.

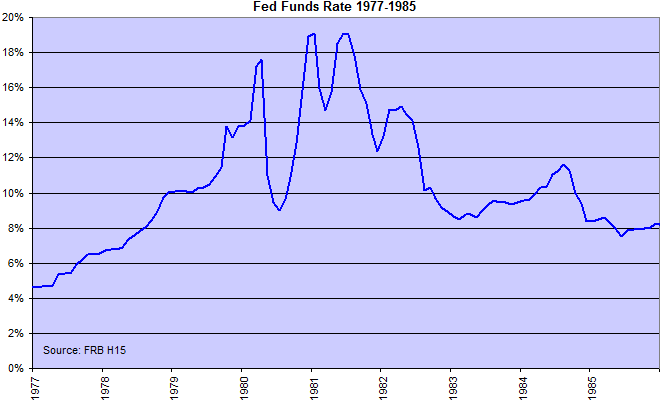

After the initial "honeymoon period", prices rise to balance demand with supply. A one-off rise in prices was probably acceptable to the Fed, and could be justified by the positive effects of the stimulus. But on-going suppression of interest rates caused inflation to become entrenched: wage demands, commercial leases and long-term contracts began to recognize the shrinking purchasing power of the dollar. So even when the Fed decided that stimulus was no longer needed and began to withdraw the extra money from the system, prices continued to rise. This came as a nasty surprise. And the only solution was to "shock" the economy out of its malaise, raising interest rates above normal levels until inflation expectations were well and truly dead. In the early 1980s, Paul Volcker had to raise short-term rates as high as 19% to get the dragon back in its cave.

These interest rate shocks caused tremendous hardship, sending many sound businesses — who had borrowed at cheap interest rates to fund expansion — to the wall. And destroying millions of jobs. When the good times roll for too long, management start to believe they will continue indefinitely; and take on more risk than they can handle when the cycle turns.

Blowing Bubbles

After several boom-bust cycles another long-term effect began to emerge. When the Fed prints money, whether through QE or traditional open market operations, smart investors have learnt that inflation is sure to follow. They sell bonds at a handsome profit (when interest rates are low, bond prices are high) and purchase real assets as a protection against inflation: stocks, real estate and commodities such as gold or copper.

Rising Debt

Increased demand for real assets causes prices to rise. Speculators enter the market, borrowing at low interest rates and taking large positions. Soaring debt fuels the asset bubble, expanding demand and driving up prices — which in turn attracts new speculators to the party.

The debt bubble sets up the economy for a banking crisis. Banks compete to satisfy the speculative demand for debt, taking ever larger positions in inflated asset markets — with smaller and smaller margins. When the bubble inevitably collapses, asset prices fall by 50% or more, leaving banks with inadequate security to cover their exposure. Reserve ratios cannot cope with such large-scale losses and many banks fail. The spread of panic amongst depositors and bond-holders threatens to bring down the entire banking system — and the government has no choice but to intervene.

Fed Culpability

The Fed itself is the chief cause of the credit bubble according to Professor Anna Schwartz, co-author with Milton Friedman of A Monetary History of the United States.

There never would have been a sub-prime mortgage crisis if the Fed had been alert. This is something Alan Greenspan must answer for.

~

Anna Schwartz

And the credit bubble caused the GFC. The frankest admission of Fed culpability came recently from retiring board member Thomas Hoenig when he recently conceded that holding interest rates at 1.0% in 2003-2004 began "an extended credit expansion and housing boom", the long-term consequences of which "are now well known".

Reaction to the Crisis

The US government was forced to increase its fiscal deficit to correct a savings-investment mis-match that would have caused a deflationary spiral similar to the 1930s. Deposit insurance, quickly introduced in other countries like Australia, prevented a general run on banks. And the Federal Reserve supported banks caught in a liquidity trap, issuing new money through the discount window to tide them over.

Fed Stimulus

But the Fed's next action, printing additional money and lowering interest rates to "stimulate" the economy, had as much effect as "pushing on a string". Borrowers with collapsed asset values and large outstanding debts and are not prepared to borrow and invest additional capital, even at low interest rates. Richard Koo refers to this as a "balance sheet recession" — when company balance sheets are not strong enough for them to borrow money, nor for banks to consider lending to them.

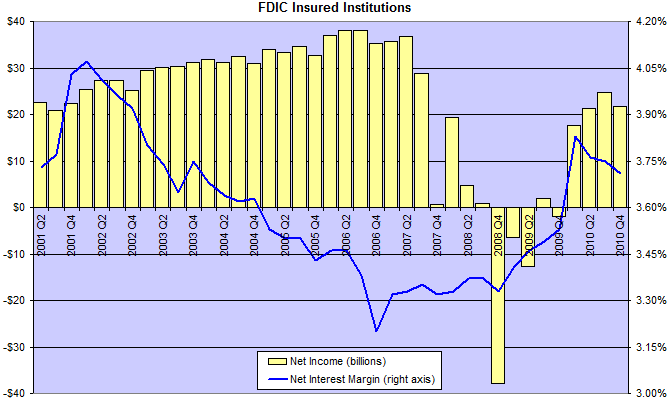

The broader economy does not benefit from the "stimulus" but banks do. Zero interest rates are a highly effective bank subsidy, and enabled them to rebuild their balance sheets after the crash. With depositors earning zero return on short-term money, banks channel these deposits into car loans, mortgages and other assets earning substantially higher rates of interest. Increasing bank interest rate spreads by a few percentage points may not seem much, but when you consider that the bank assets/liabilities are roughly 10 times the size of equity, an extra 0.50% interest margin amounts to 5.00% of total bank equity.

Who Is Paying For the Free Lunch?

If the Fed is laying on a free lunch for the banks, who is paying for it? The public of course. And not only depositors. Low rates are passed on to the public in a variety of guises: higher insurance premiums, lower pension fund performance, etc. And not only are their earnings reduced, but their capital will be eroded when the money supply starts to expand.

Why are Stocks Rising?

Stocks are rising. Investors are selling bonds and piling into real assets in expectation of higher inflation. With the real estate market still on the ropes, the smart money is buying stocks and commodities — laying the foundation for another bubble.

Interesting that the Fed claims rising stock prices are a sign that its QE program is working. I would have thought that this is the last thing they want: low interest rates funding another speculative bubble — instead of funding an increase in capital investment that would create new jobs.

The Fed's Dual Mandate

The cause of the Fed's behavior is confusion about their role in the economy. In 1913 the Fed was created to supervise the banks and act as lender of last resort, but in 1978 the Humphrey-Hawkins Act extended their mandate to "promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates". The Fed had been co-opted to manage the economy. The dual mandate means the Fed can justify inflation in the interests of creating full employment.

Fed Performance

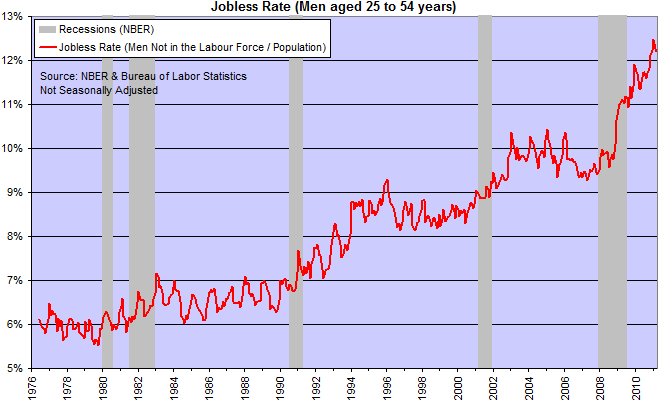

If we evaluate Fed performance, however, we find that they have failed to achieve full employment. The jobless rate has doubled over the last 3 decades.

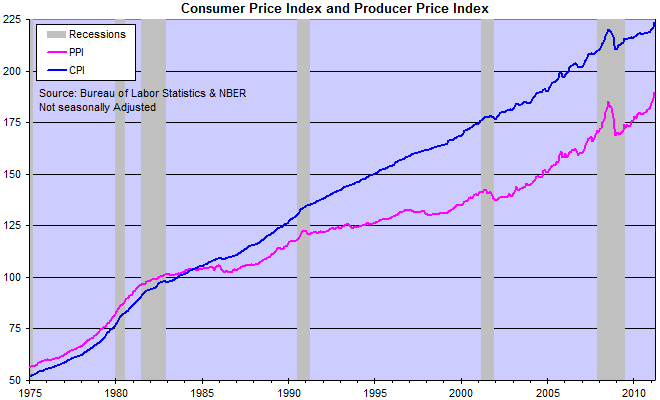

Nor, according to the consumer price index, has the Fed achieved stable prices.

The Fed has achieved neither full employment nor stable prices. And apart from failing to fulfill the dual mandate, their efforts were the primary cause of the GFC.

Destruction of the Capitalist Ethic

Fed actions have also succeeded in undermining one of the foundation stones of the capitalist system. The traditional capitalist ethic is to work hard and save, but Fed actions have penalized savers. Low interest rates have forced investors to assume greater risk in order to achieve an adequate return on their capital. At the same time, inflation has forced investors to speculate to protect their capital. Their focus has switched from income yield to capital growth. What we now view as capital growth is often merely the re-pricing of assets for inflation.

Buy Low Sell High

The conservative risk-averse philosophy of past eras has been usurped by the "buy low - sell high" mentality of the current market. Unfortunately, for that to work, someone else has to buy high and sell low — implying far greater risk for investors. And you can bet which side of the deal Joe Public is going to be on. The retirement savings of the many are being stripped to amass fortunes for the savvy few. And the on-going inflationary activities of the Fed have facilitated this, robbing investors of their traditional safe haven.

A Simple Mandate for the Fed

It is time we recognized that the Fed is not suited to, and in fact is incompetent in, their broader role as economic manager. The only way to fix this is to restrict the Fed to a single mandate: "to promote stable prices". That would remove any confusion about their role and create a clear benchmark against which their performance can be measured. It would also remove any justification to create inflation or to enrich the banks at the expense of the general public.

We have involved ourselves in a colossal muddle, having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time — perhaps for a long time.

~ John Maynard Keynes: The Great Slump of 1930