Divergence warns of a correction

By Colin Twiggs

February 28th, 2011 12:30 a.m. ET (5:30 p.m. AEDT)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

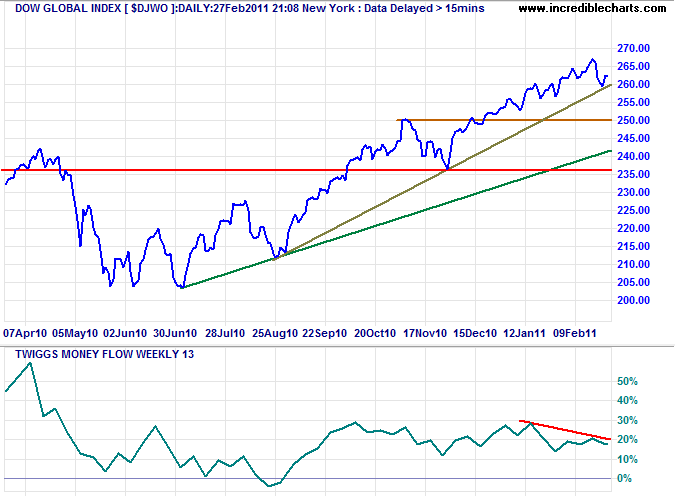

Global

The Dow Global index ($DJWO) having reached its target of 264* displays a bearish divergence on Twiggs Money Flow (13-week), warning of selling pressure. Penetration of the rising (olive) trendline would indicate a correction. The primary trend remains up, with support at 236.

* Target calculations: 250 + ( 250 - 236 ) = 264

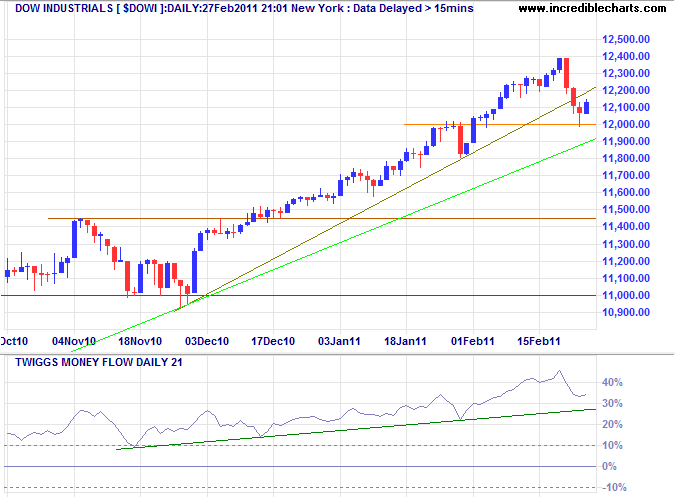

USA

Dow Jones Industrial Average

The Dow found support at 12000 after penetrating the (olive) trendline. There is no indication of selling pressure from Twiggs Money Flow (21-day), but reversal below 12000 would signal a correction.

* Target calculation: 11200 + ( 11200 - 9800 ) = 12600

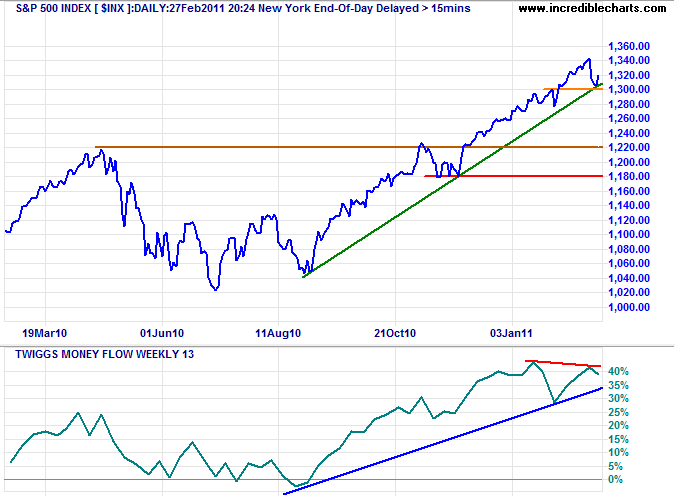

S&P 500

The S&P 500 gives a clearer warning of selling pressure, with bearish divergence on Twiggs Money Flow. Failure of support at 1300 would signal a correction.

* Target calculation: 1220 + ( 1220 - 1020 ) = 1420

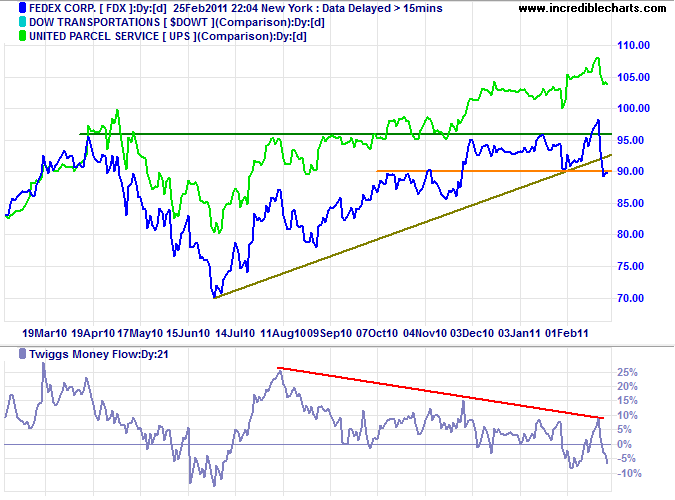

Transport

Fedex fell sharply after a false breakout above 96. Recovery above 90 would be reassuring, while follow-through would signal a correction — and suggest that economic activity is weakening.

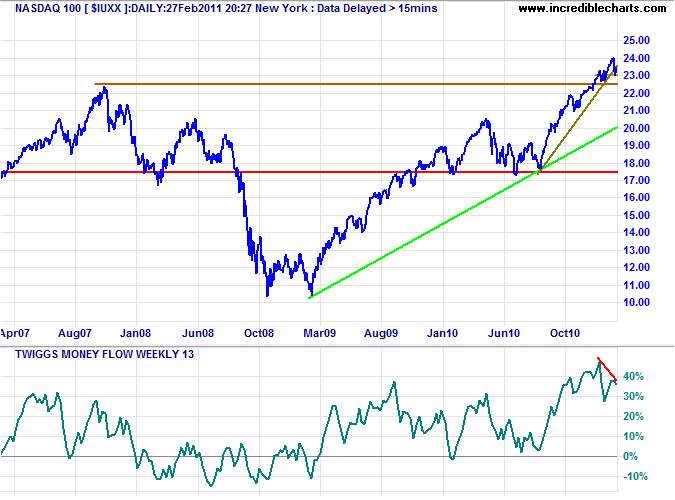

Technology

The Nasdaq 100 also displays bearish divergence on Twiggs Money Flow. Reversal below the 2007 high at 2250 would warn of a correction to the long-term trendline.

* Target calculation: 2050 + ( 2050 - 1750 ) = 2350

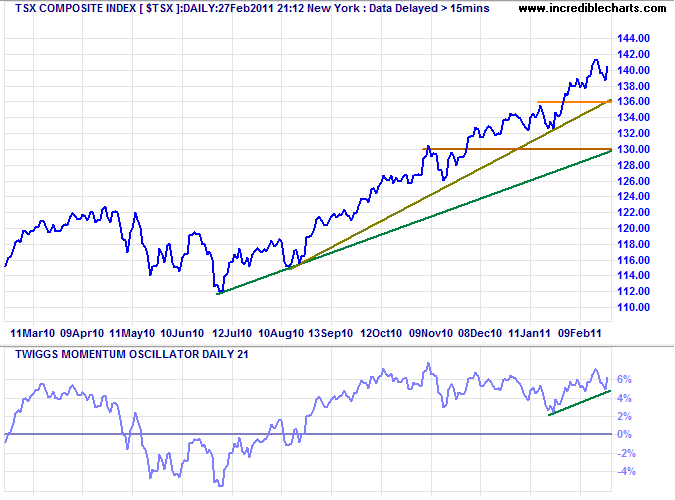

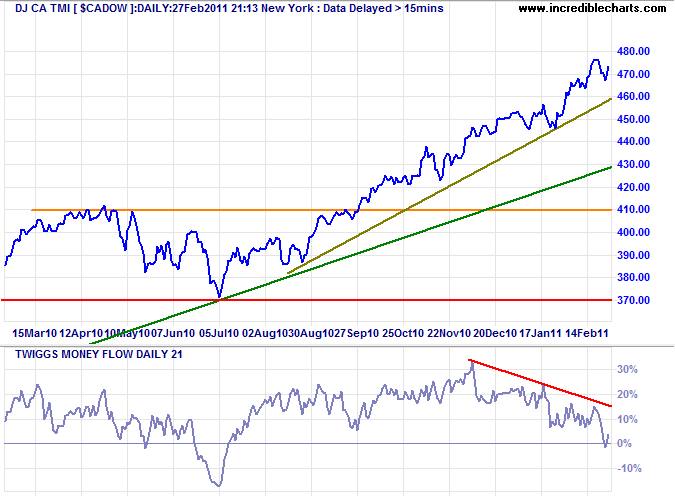

Canada: TSX

The TSX Composite displays rising Momentum....

..... but bearish divergence on Twiggs Money Flow from the $CADOW continues to warn of a correction. Penetration of the (olive) rising trendline would strengthen the warning, suggesting a test of the longer-term (green) trendline.

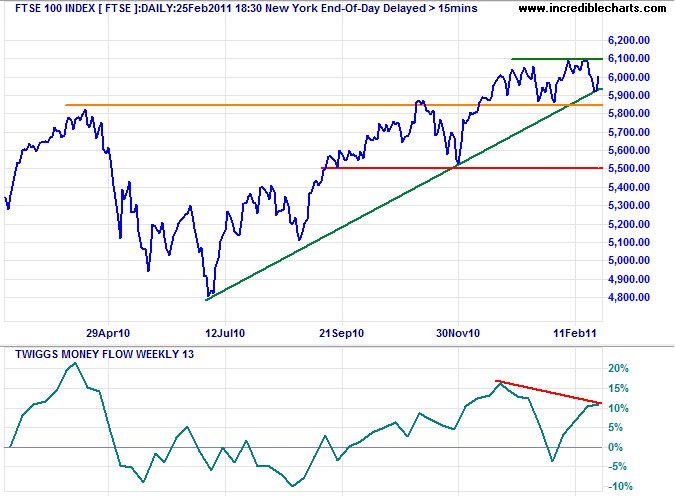

United Kingdom

Bearish divergence on 13-week Twiggs Money Flow warns of selling pressure on the FTSE 100. Failure of support at 5850 would warn of a correction, while breakout above 6100 would signal an advance to the 2007 high at 6750*.

* Target calculation: 5800 + ( 5800 - 4800 ) = 6800

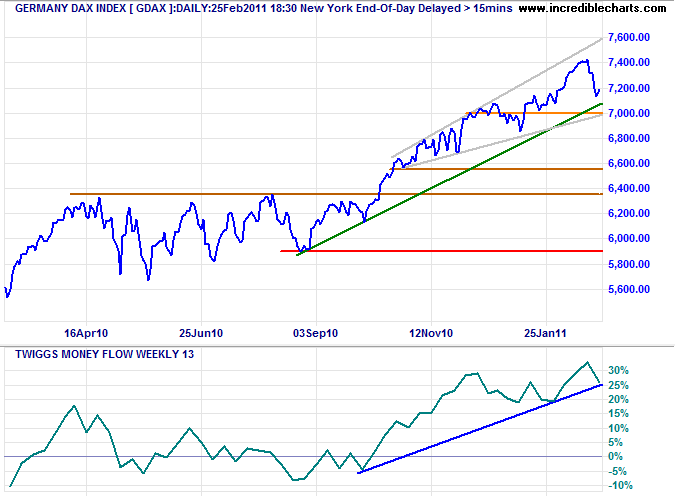

Germany

The DAX is testing support at 7000. Failure would breach both the rising (green) trendline and the lower border of the bearish ascending broadening wedge pattern, warning of a correction. Twiggs Money Flow (13-week), however, remains positive.

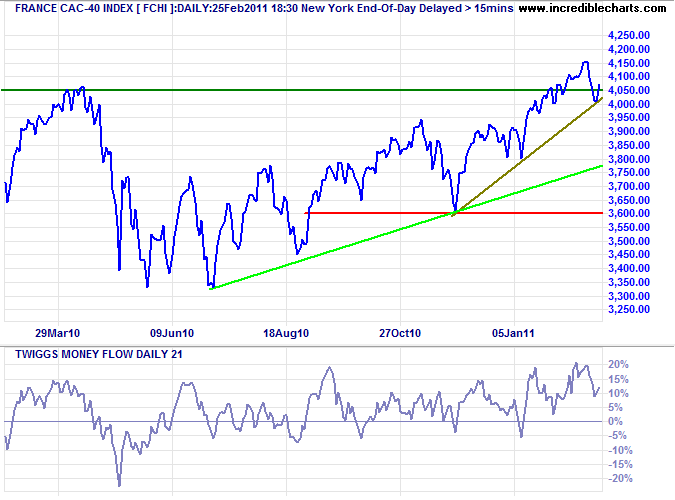

France

The CAC-40 found support at 4000 and rising Twiggs Money Flow (21-day) indicates buying pressure. Follow-though above 4150 would offer a long-term target of 4750*. Retreat below 4000 is less likely, but would warn of a correction to test the rising (light green) trendline around 3750.

* Target calculation: 4050 + ( 4050 - 3350 ) = 4750

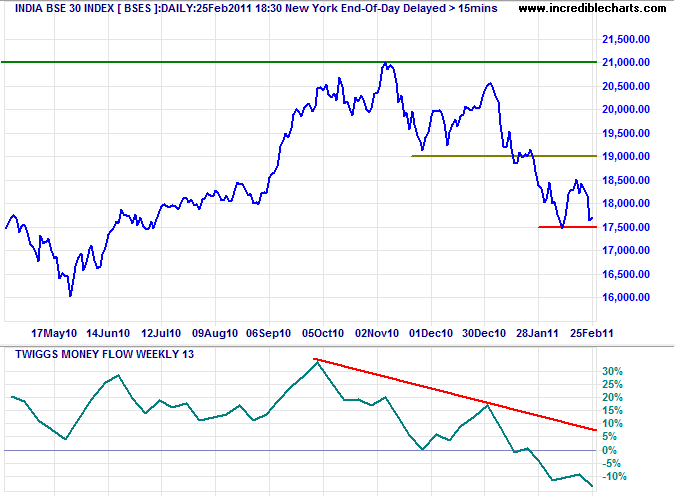

India

The Sensex remains in a primary down-trend, testing support at 17500. Failure would signal a decline to 16500*. Declining Twiggs Money Flow (13-week) below zero indicates strong selling pressure.

* Target calculation: 17500 - ( 18500 - 17500 ) = 16500

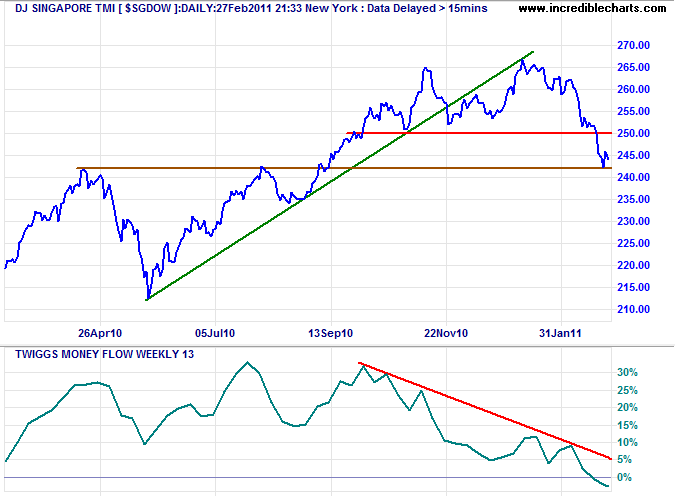

Singapore

The $SGDOW broke support at 250 to confirm the primary down-trend on the Straits Times Index. Declining Twiggs Money Flow (13-week) below zero indicates strong selling pressure.

* STI Target: 3100 - ( 3300 - 3100 ) = 2900

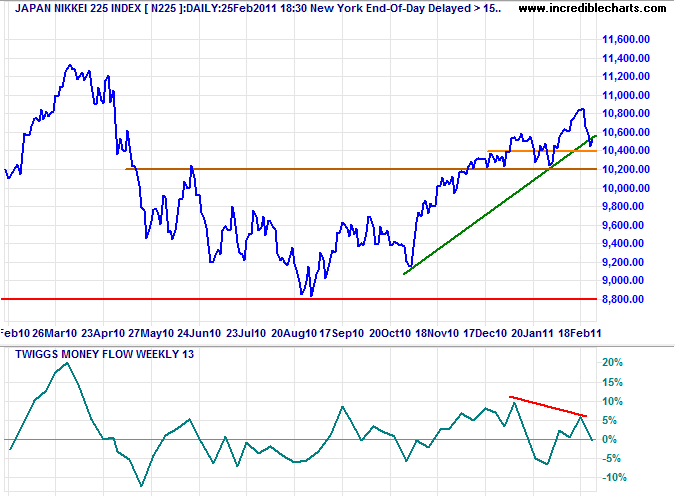

Japan

The Nikkei 225 penetrated its rising trendline to warn of slowing momentum. Bearish divergence on Twiggs Money Flow (13-week) indicates selling pressure. Reversal below 10400 would confirm a correction.

* Target calculation: 11400 + ( 11400 - 8800 ) = 14000

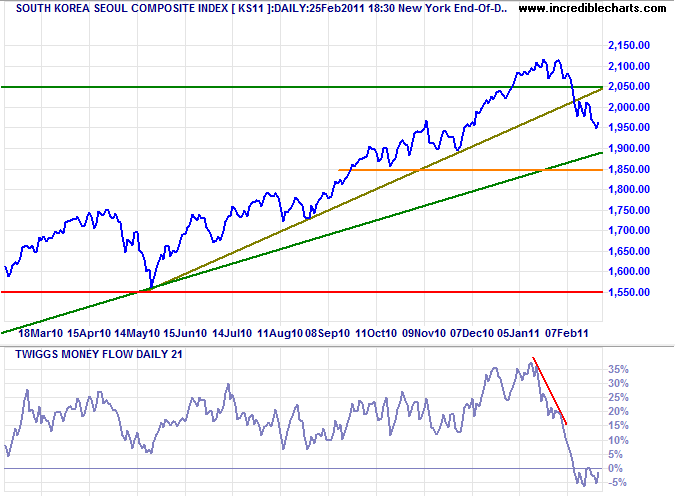

South Korea

The Seoul Composite Index is undergoing a correction. Expect a test of the long-term (green) trendline and support at 1850. Twiggs Money Flow (21-day) below zero indicates continued selling pressure.

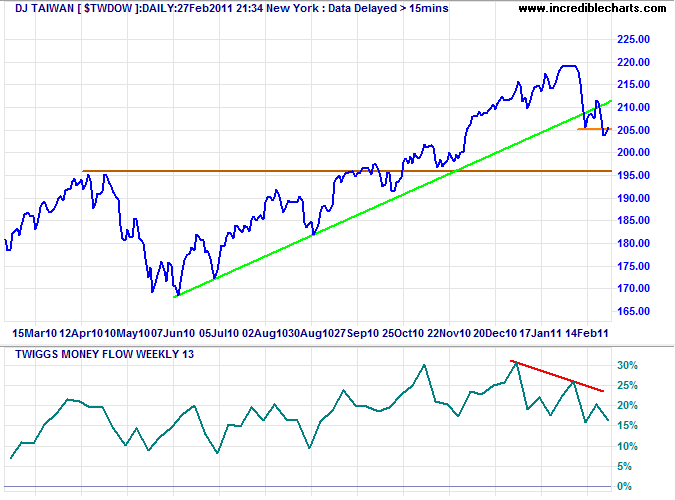

Taiwan

The Dow Jones Taiwan Index recovered above support at 205, but bearish divergence on Twiggs Money Flow (13-week) continues to warn of a correction. Reversal below 205 would confirm.

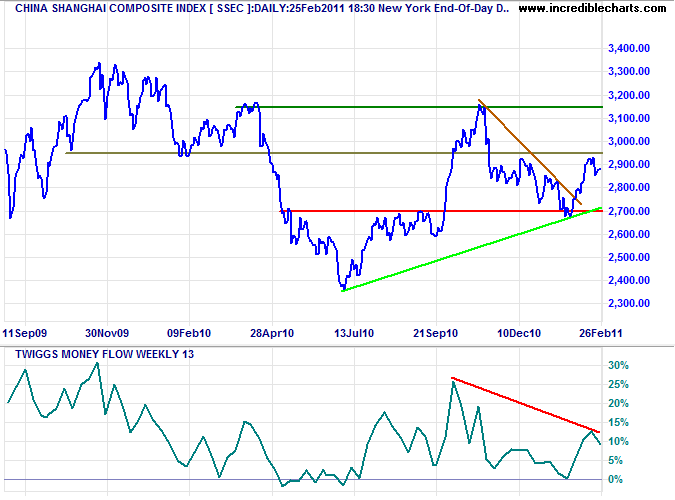

China

The Shanghai Composite Index is more positive, testing medium-term resistance at 2950. Breakout would mean a test of 3150 — and breakout above 3150 would signal a primary advance to 3500*.

* Target calculations: 3100 + ( 3100 - 2700 ) = 3500

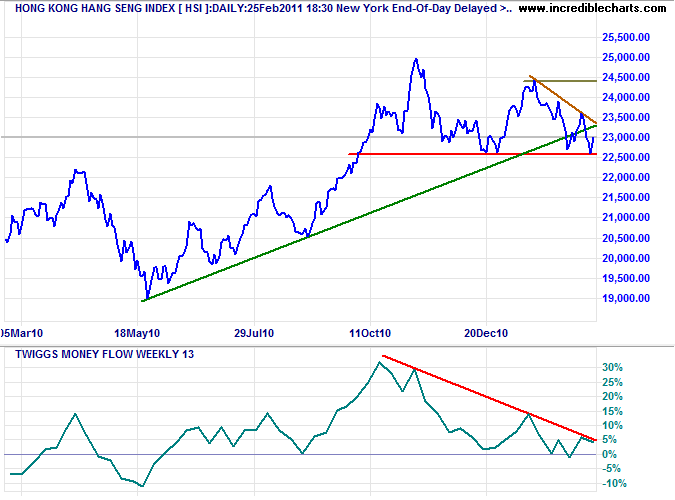

The Hang Seng Index is weaker, testing primary support at 22500. Failure would signal a primary decline to 20500*. Twiggs Money Flow (13-week) reversal below zero would signal a primary down-trend.

* Target calculation: 22500 - ( 24500 - 22500 ) = 20500

Brazil

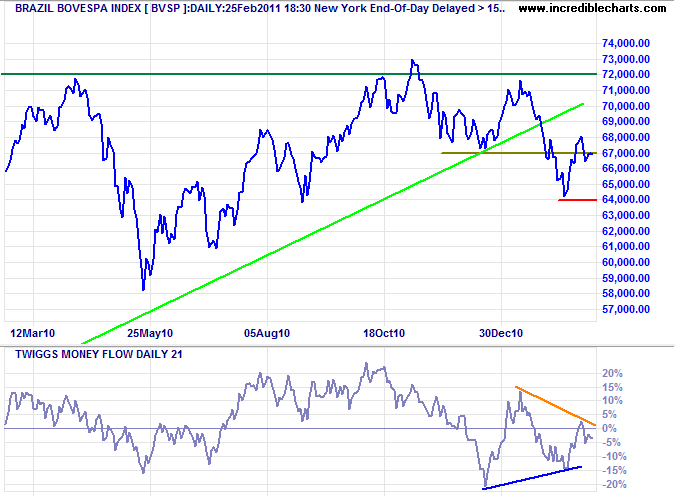

The Bovespa Index is in a primary down-trend, but Twiggs Money Flow (21-day) oscillating around zero signals uncertainty. Follow-through below 67000 would indicate another test of primary support at 64000; failure offering a target of 60000*.

* Target calculation: 64000 - ( 68000 - 64000 ) = 60000

Australia: ASX

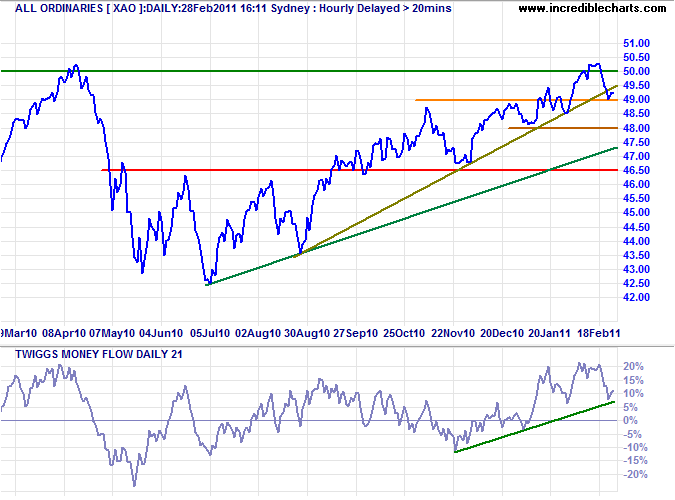

The All Ordinaries is testing support at 4900; failure would warn of a correction. Twiggs Money Flow (21-day) reversal below zero would confirm. Recovery above 5000 is less likely, but would offer a long-term target of 5750*.

* Target calculation: 5000 + ( 5000 - 4250 ) = 5750

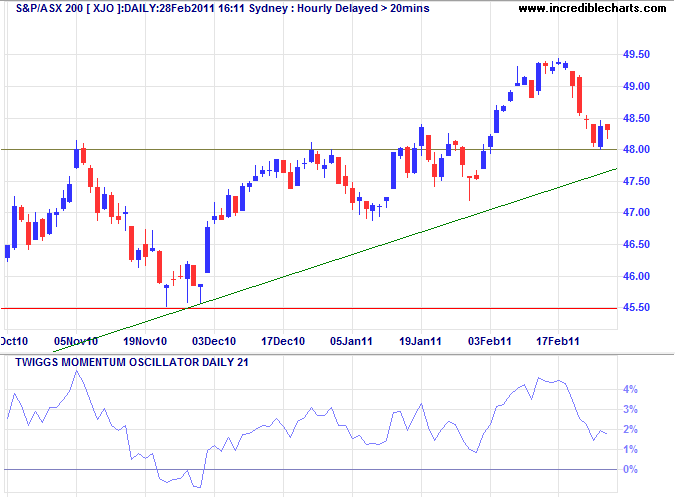

Twiggs Momentum on the ASX 200 continues to oscillate above the zero line, indicating a healthy up-trend. Breakout above 5000 would signal a fresh primary advance, while reversal below 4800 would warn of a correction.

* Target calculation: 4800 + ( 4800 - 4600 ) = 5000

Violence breeds violence...Pure goals can never justify impure or violent action...They say the means are after all just means. I would say means are after all everything. As the means, so the end....If we take care of the means we are bound to reach the end sooner or later.

~ Gandhi