Little Battler Makes A Comeback

By Colin Twiggs

July 8, 2010 8:00 a.m. ET (10:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

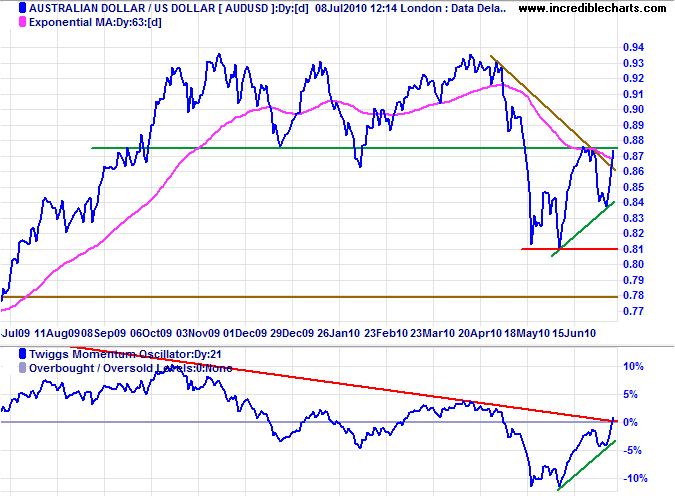

Australian Dollar

The Aussie battler rallied steeply to test resistance at $0.875; breakout would confirm that the down-trend has ended and signal an advance to $0.94. Twiggs Momentum respect of the zero line (from above) would strengthen the signal. Reversal below support at $0.84 and rising trendline, however, would warn that the down-trend will continue.

* Target calculation: 0.81 - ( 0.88 - 0.81 ) = 0.74

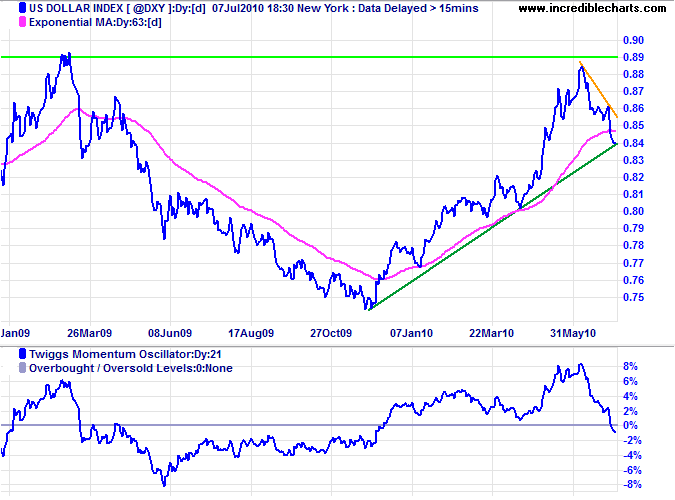

US Dollar Index

The US Dollar Index is undergoing a correction. Breakout below the rising trendline would warn that the primary up-trend is weakening — as would a Twiggs Momentum peak below the zero line. Recovery above the descending trendline, however, would suggest another test of 89.

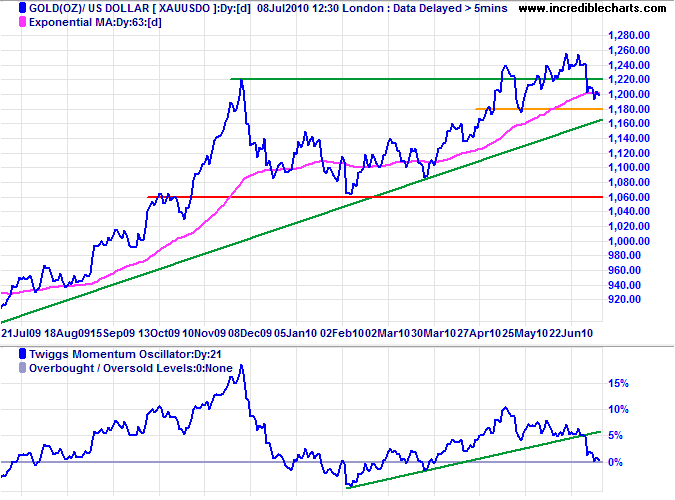

Gold

Gold lost momentum and is heading for support at $1180. Downward breakout would warn of a test of primary support at $1060. Recovery above $1260 is less likely, but would signal an advance to $1340*. Twiggs Momentum respect of the zero line would indicate continuation of the primary up-trend.

* Target calculation: 1260 + ( 1260 - 1180 ) = 1340

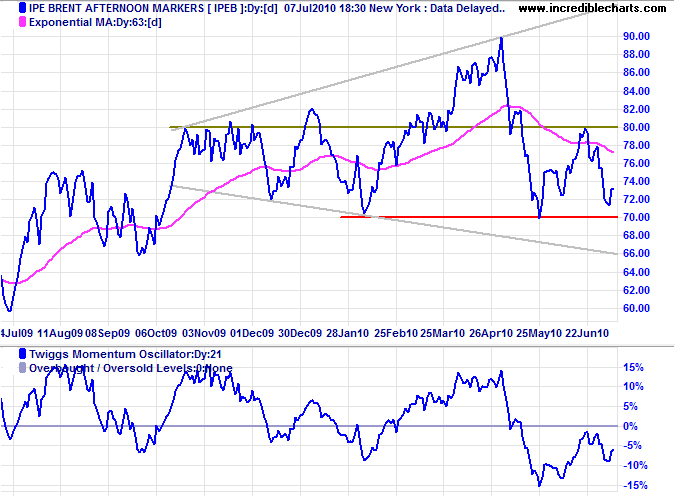

Crude Oil

Crude is testing primary support at $70. Breakout would signal a primary down-trend with an initial target of 60*. Twiggs Momentum respect of the zero line (from below) would confirm the signal. Recovery above $80 is less likely, but would indicate another test of $90.

* Target calculation: 70 - ( 80 - 70 ) = 60

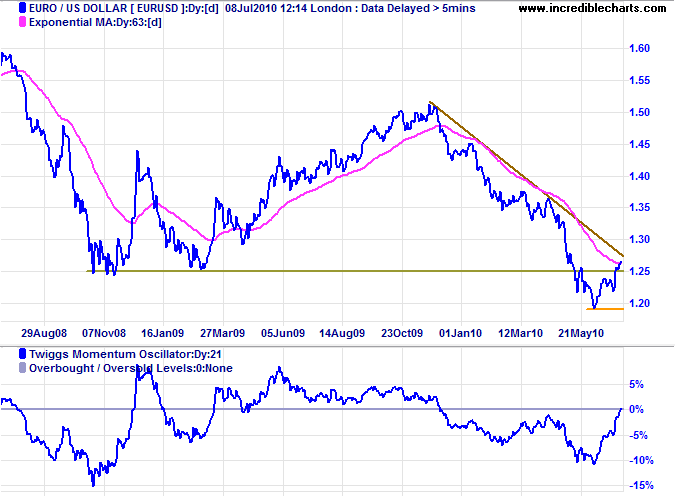

Euro

The euro recovered above its new resistance level at $1.25. Reversal below the former primary support level would confirm the primary down-swing with a target of parity*. Breakout above the declining trendline would suggest that the down-trend is weakening — confirmed if retracement respects the new support level or a Twiggs Momentum trough respects the zero line from above.

* Target calculation: 1.25 - ( 1.50 - 1.25 ) = 1.00

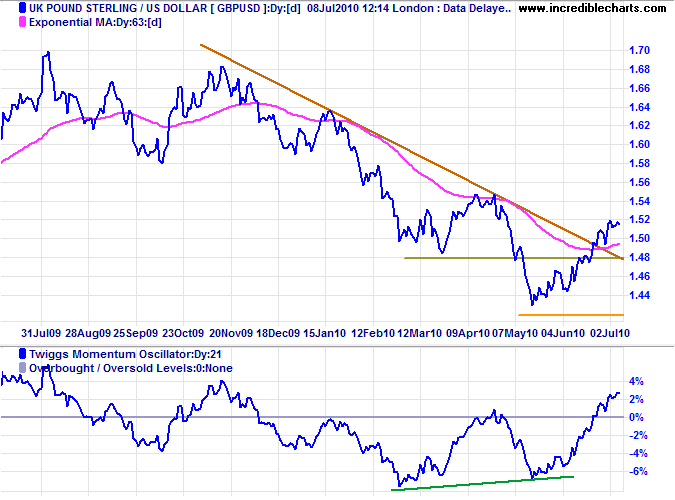

UK Pound Sterling

Breakout above the declining trendline and Twiggs Momentum recovery above zero indicate that the primary down-trend of the pound sterling is losing momentum. Retracement that respects the new support level of $1.48, or a Twiggs Momentum trough that respects the zero line from above, would signal a reversal. Retreat below $1.48, however, would warn of another test of support at $1.42.

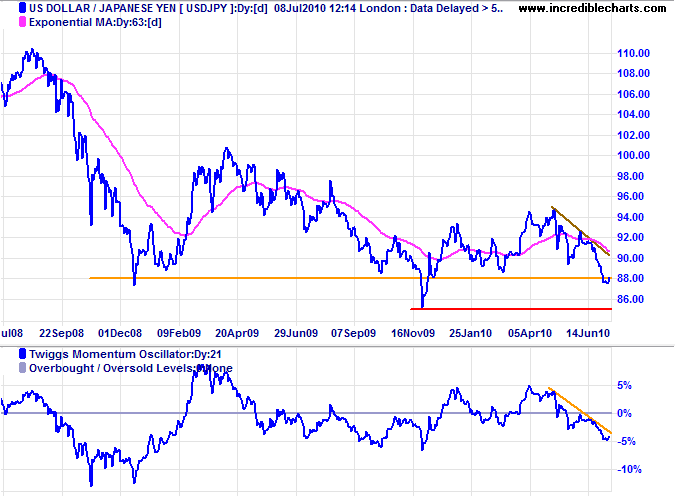

Japanese Yen

The dollar is testing support at ¥88; failure would confirm a test of primary support at ¥85. Declining Twiggs Momentum indicates that the down-trend will continue, and another peak that respects the zero line from below would strengthen the signal. Recovery above the descending trendline is less likely, but would indicate that the momentum is slowing. In the long term, failure of primary support at ¥85 would offer a target of ¥75*, while recovery above ¥95 would test long-term resistance at ¥100.

* Target calculations: 85 - ( 95 - 85 ) = 75

Right actions in the future are the best apologies for bad actions in the past.

~ Tryon Edwards