Gold & Dollar Tentative

By Colin Twiggs

March 10, 2010 10:00 p.m. ET (2:00 p:m AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

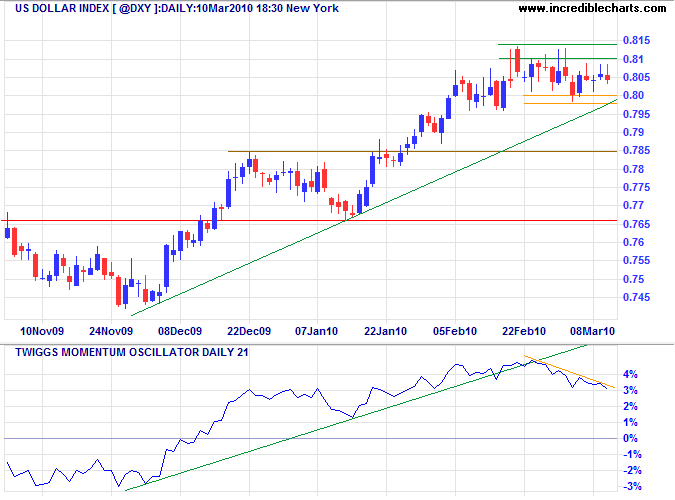

The US Dollar Index is consolidating above 80 while Twiggs Momentum (21-day) declines. Reversal below 80 and the rising trendline on the price chart would confirm that the primary up-trend is weakening. Breakout above 81.4, however, would signal another primary advance.

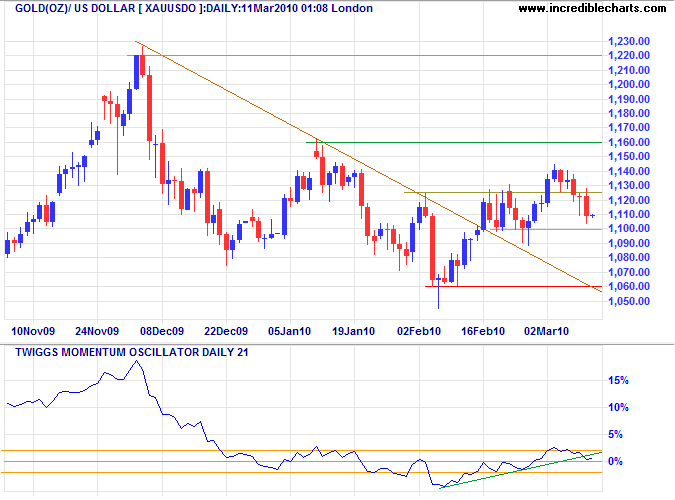

Gold

Gold retreated below $1125 while Twiggs Momentum (21-day) declined; respect of the zero line would be a positive sign. Reversal below $1100 would test primary support at $1060. Recovery above $1160, however, would indicate a primary advance to 1380*.

* Target calculation: 1220 + ( 1220 - 1060 ) = 1380

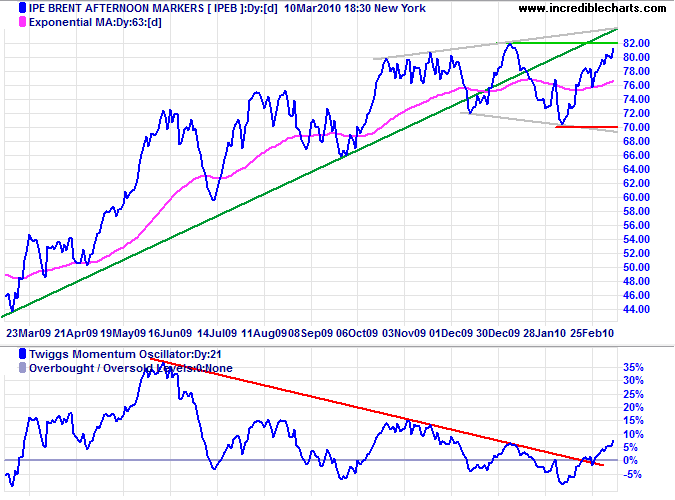

Crude Oil

Crude is headed for a test of the upper border of the large broadening wedge consolidation. Breakout or a failed swing would indicate future direction. On the Momentum chart, a large trough that respects the zero line would signal a primary advance. Reversal below $70 is unlikely, but would indicate a primary down-trend.

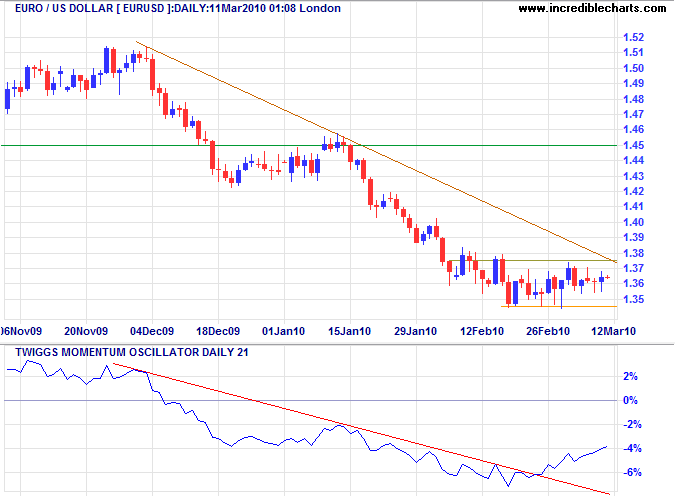

Euro

The euro is consolidating below 41.37 as Momentum rises. Breakout above the declining trendline would warn that the primary down-trend is slowing — as would a higher (large) trough on Twiggs Momentum (21-day). Reversal below short-term support at $1.345, however, would signal a primary decline to $1.28*.

* Target calculation: 1.35 - ( 1.42 - 1.35 ) = 1.28

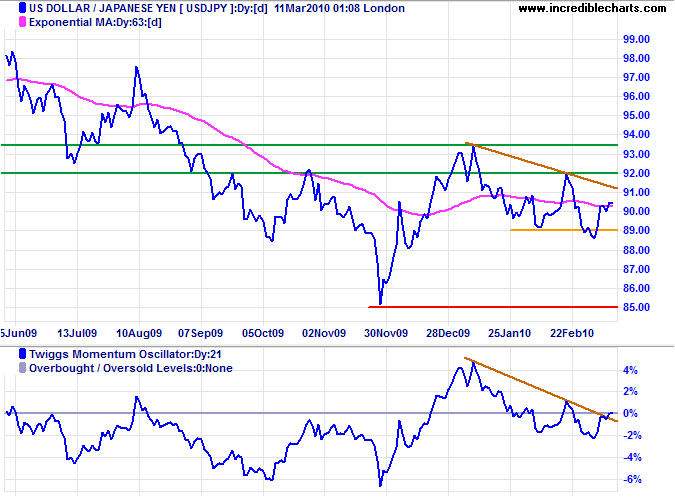

Japanese Yen

The greenback's marginal break below support at ¥ 89 indicates buying pressure. Breakout above the declining trendline would warn that the down-trend is weakening — and signal an advance to ¥97* if there is a breakout above ¥ 92. Reversal below ¥ 89, however, would signal a test of ¥ 85.

* Target calculation: 93 + ( 93 - 89 ) = 97

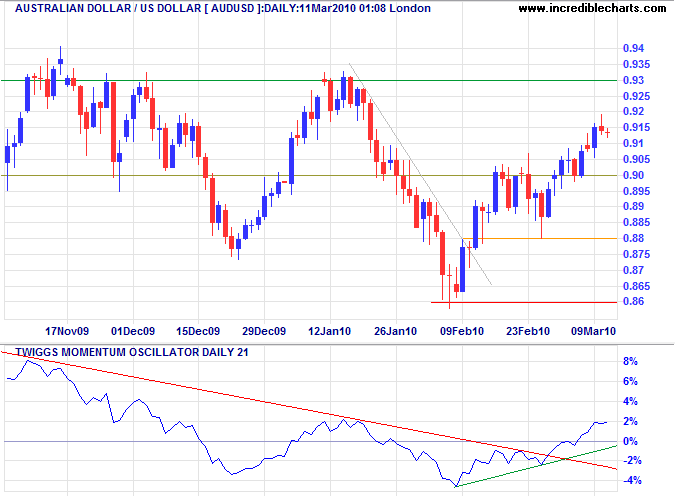

Australian Dollar

The Aussie dollar is headed for a test of $0.93, despite signs that the housing market may be cooling. Reversal below $0.90 is unlikely, but would warn that the up-trend is slowing. Rising Twiggs Momentum Oscillator (21-day) is a bullish sign and a large trough above zero would signal a primary advance.

No one is useless in this world who lightens the burden of it to anyone else.

~ Charles Dickens