Borrowing Your Way Out Of A Debt Crisis

By Colin Twiggs

November 25, 2008 5:00 a.m. ET (9:00 p.m. AET)

These extracts from my trading diary are for educational purposes and should not be interpreted as investment or trading advice. Full terms and conditions can be found at Terms of Use.

Barack Obama boasted that his new economic recovery program will create 2.5 million new jobs. The question is what kind of jobs? What the US needs are manufacturing jobs. Preferably in industries with strong export sales. What it does not need are more roads, more community halls, more schools, more dams or more bridges. These may stimulate consumption in the short term, but will have a negligible impact on GDP in the long run.

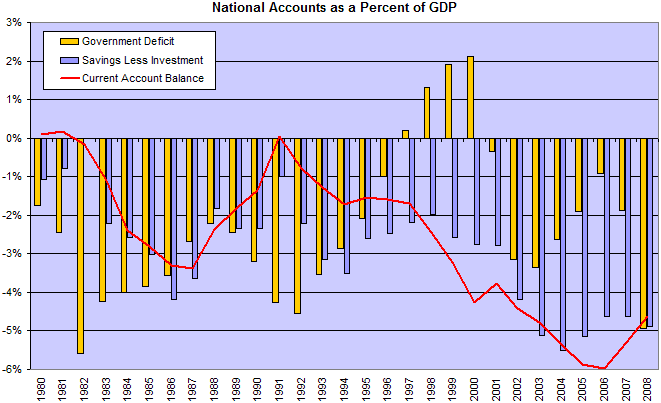

To restore long-term stability the program will need to address the "terrible twins": the current account deficit and the budget deficit. From the mid-1990s the burgeoning current account deficit reflected rising external debt, needed to maintain strong levels of new investment. External debt was needed for one simple reason: national savings were shrinking in response to artificially low interest rates maintained by the Fed to "stimulate" the economy.

In effect the US traded a higher exchange rate in return for cheap finance from China, Japan and other East Asian economies. Asian manufacturers benefited from the artificially low exchange rate which stimulated exports. The US financial sector in turn benefited from artificially low interest rates, encouraging consumers to borrow cheap money and invest in inflationary assets such as housing. While the financial sector and consumers gained in the short term, we are now aware of the long-term consequences. The strategy backfired with the collapse of the housing bubble damaging the financial sector, the housing market, the stock market and the manufacturing sector.

There is a further hidden cost of the earlier trade-off, however. That is the loss of manufacturing jobs. Manufacturers could no longer compete in export markets against the very same East Asian economies, due to the strong dollar. In short, the US traded cheap finance for manufacturing jobs. This appears to have been a conscious decision rather than gross stupidity. I suspect that the financial sector bought more influence in Washington than the manufacturing sector. And sold legislators on the idea that the future lay in the (then) rising share of GDP attributable to financial services: "Growing more high-paying white-collar jobs in the US and exporting cyclical blue-collar jobs to Asia will eliminate inflation and make us recession-proof". They drank the Kool-Aid.

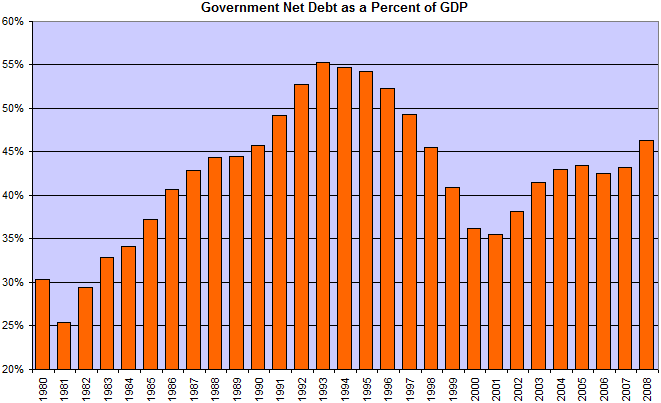

In 2001 private investment fell by almost 4 percent, which should have resulted in a smaller current account deficit, but was replaced by a growing federal budget deficit. In addition to artificially low interest rates, which discouraged savings, the Federal government also ran increasingly large deficits in an attempt to stimulate the economy, funding the shortfall with more external debt. The situation is now a whole lot worse with the federal government forced to run even larger deficits in order to shore up the banking system and create "2.5 million jobs". Funded by even more external debt.

A recession is supposed to reduce the current account deficit, but this was not allowed to happen during 2001 because of the strong dollar policy. And is unlikely to occur in 2008/2009.

David Axelrod, senior adviser to the president-elect, warned that automakers would have to come up with a long-term plan to restructure the industry before they received any federal assistance. I would suggest that the federal government faces similar tough decisions in order to assure their own long-term survival.

What is needed is a weaker dollar. To discourage imports and stimulate manufacturing exports. And to minimize federal budget deficits as far as humanly possible. The US has one major advantage over emerging economies who find themselves in a similar position: external debt is denominated in US dollars. Depreciation of the dollar would not result in an increase in external debt as with an emerging economy. Rather, the cost of the depreciation would be borne by creditors. While this may harm the dollar's status as a reserve currency, it should be weighed against the benefits of export-led growth.

For those interested in the nuts and bolts of current account deficits and capital account flows, I recommend this excellent though lengthy 2004 paper by Nouriel Roubini and Brad Setser

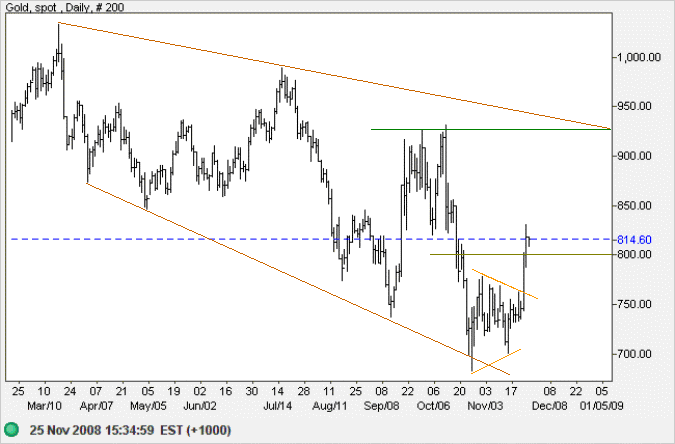

Gold

Spot gold broke through resistance at $800 and is now retracing to confirm the new support level. Respect of $800 would offer a target of $925: the upper border of the descending broadening wedge formation. The primary trend remains down. Breakout below the descending wedge would offer a target of the June 2006 low of $550; while upward breakout would suggest a target of $1200, calculated as 900 + ( 1000 - 700 ).

Source: Netdania

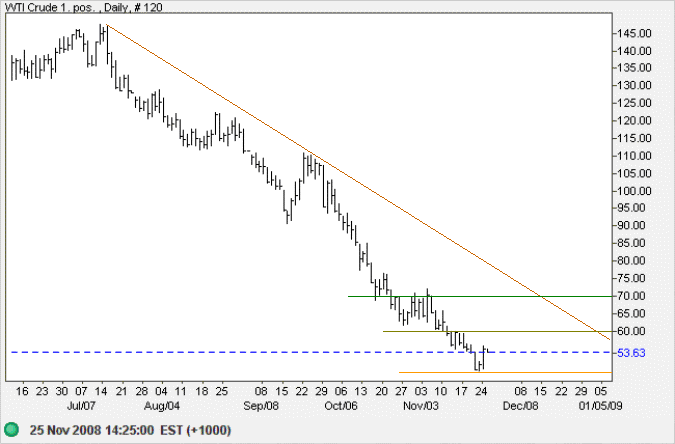

Crude Oil

West Texas Intermediate Crude is retracing after finding support between $48 and $50 per barrel, the 2007 low. Respect of resistance at $60 would signal a strong down-trend, while a test of $70 would indicate consolidation.

Source: Netdania

Currencies

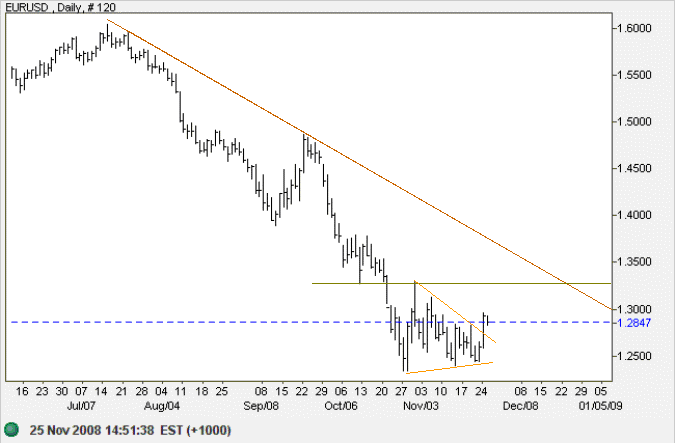

Euro

The euro formed a large pennant around support at $1.25. The upward breakout signals a bear rally to test the descending trendline.

Source: Netdania

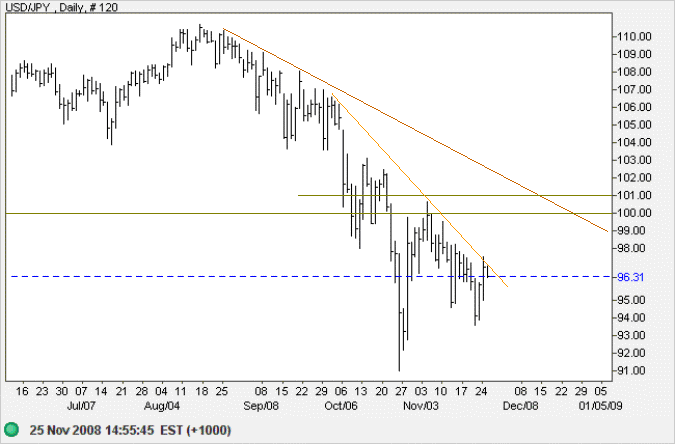

Japanese Yen

The dollar found short-term support at 94 against the yen. Reversal above the orange descending trendline would signal a test of resistance between 100 and 101 — as well as the long-term descending trendline. A fall below 94, however, would warn of another test of the October low of 91.

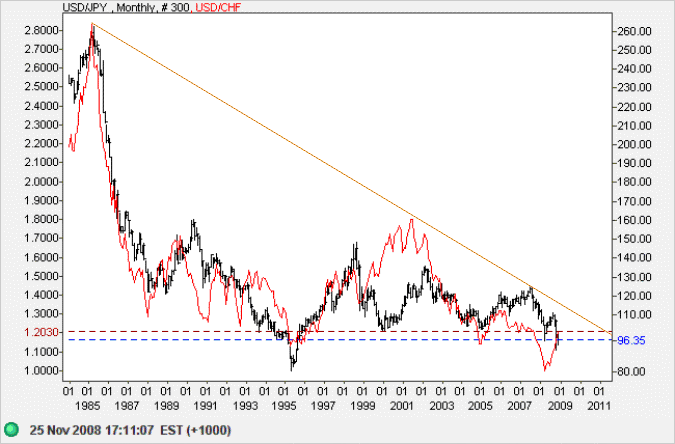

When we compare the greenback against the Yen and Swiss Franc, currencies which consistently maintain a current account surplus, we can see that the dollar has depreciated at about 4.0 percent a year over the last 25 years.

Source: Netdania

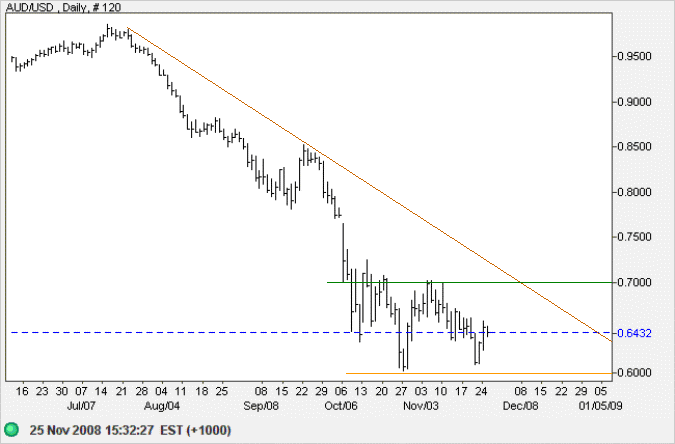

Australian Dollar

The Australian dollar respected support at $0.60, with the RBA stepping in to buy dollars at this level. Breakout above $0.70 would warn that the down-trend is weakening, while reversal below $0.60 would offer a target of $0.50.

Source: Netdania

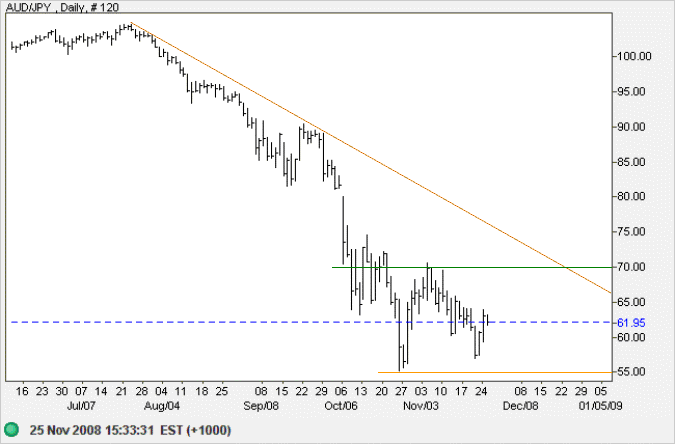

The Australian Dollar is also being supported against the yen. Expect further consolidation between 55 and 70.

Source: Netdania

This may be wishful, but I think in the next year, two years, five years, you're going to see both political parties floundering......

They're still trying to prop up the marketplace vision and make it work again. It's over.

I think events will demonstrate that. So if they're not willing to change then we need to change the politicians.

And that's all a bloody process and doesn't happen quickly. But that's why I'm optimistic.

~ William Greider in an interview with Bill Moyers