The Stop Loss Trap

For a market specialist, making money out of stop loss orders is as difficult as hunting dairy cows with a high-powered rifle and telescopic sights. How many times has this happened to you? You place your stop loss order below the lowest low in the last 2 to 3 weeks, outside of the normal market oscillation, but when the market is quiet the sell price drops and fills your order — only to immediately reverse and run up 10, 20 or even 30 pips. When you examine the tick chart for the day, you find that your stop order was the lowest price traded for the day. What happened?

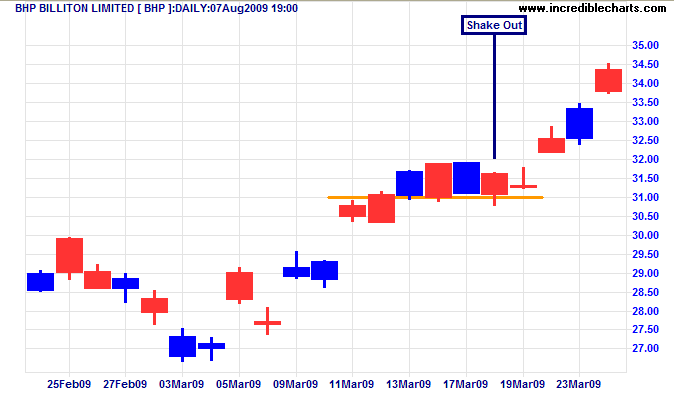

Imagine that you are the market maker with a list of client stop orders on your screen. You see that there are stop orders to sell 10,000 BHP shares between $30.80 and $30.75. Price has been consolidating in a narrow range above $31.00 for the last few days, a bullish sign, signaling buying support.

You allow your BHP short position to grow to 10,000 shares at an average price of say $31.20. Then, when the market is quiet, you lower your bid price — widening your spread to activate the stop orders. The normal bid/ask spread may be 5 or 10 pips but this can widen to 30 when the market is quiet. The market maker uses the activated stop orders to cover his short position, netting a tidy profit of $4000 for a few minutes work — with little or no risk. If he does that with 20 different stocks he has made $80,000 — in a day.

Predictable Stop Loss Levels

Even where the market maker or specialist does not have access to actual stop orders, he can predict where they are with reasonable accuracy. If we look at the earlier BHP example, the market maker can be pretty certain that there will be stop loss orders set below a 3- or 4-day low. Short-term traders keep their stops tight to protect their profits. The risk may be higher, but it is still a simple procedure to sell short and then try to shake out sufficient stops to cover your order.

When Is Your Stop Order Most Vulnerable

There are three times of the day when your stops are most at risk of being shaken out:

- Just after the open — in the first half hour;

- Between 12:00 midday and 1:00 p.m. when the morning rush is over; and

- In the 15 minutes before the market closes.

The first and last are periods of intense activity. Where there is a predominance of sell orders, the (higher) ask side of the spread can be widened to shake out any buy stop orders hanging over the market — making a tidy spread between the lower bid price and the high stop order price. The midday period is the opposite. The market is generally quiet: everyone is catching up on record-keeping after the busy morning session before pushing off to lunch. New buy orders slow to a trickle and the (lower) bid side of the spread can be widened to shake out stop loss orders.

How To Avoid Your Stop Loss Orders Being Exploited

There are few strategies that you can employ to make your stops less vulnerable to exploitation.

Avoid Stop Orders Altogether

Avoid using stop orders completely. Use alerts, preferably SMS alerts, to warn you when your stop level has been hit. You can then examine market action and make a decision whether to act or sit tight.

Advantages:

- You may be surprised at how many times price has already rallied by the time you open your trading screen — obviating the need to sell.

Disadvantages:

- Indecision. Price may continue falling while you struggle to make up your mind — stuck like a deer in the headlights. You have to be decisive. If the sell price is at or below your stop loss level when you open your screen — sell. Do not hesitate.

- You always have to be within reach of the market. If your mobile battery goes flat, you are in a meeting, out of range, or at the dentist, you may miss an important alert.

- It disturbs your peace of mind. Some traders might love the adrenaline rush of their mobile phone constantly beeping with fresh alerts, but I hate it. You risk losing your objectivity with all the excitement — and making poor decisions.

- In a fast-falling market you may find yourself at the back of the queue — and have to sell at a lower price.

Wider Stop Levels

Placing stops further from the market action has one huge disadvantage: you lose more money when you are stopped out — and make less money when you are stopped in (with a buy stop order).

Conditional Stop Orders

Some brokers offer conditional stop orders. For example, Sell BHP if more than 10,000 shares are sold at/below $31.75. This is an improvement, but may still be open to manipulation if there are other unconditional stop orders around the same price level. Or your stop may not be triggered if you set the volume condition too high.

Hidden Stop Orders

Some brokers offer hidden stop orders. The order remains hidden until the stop level is reached, at which point they are placed in the market. If you trust your broker — and remember: this is the piranha tank you are swimming in — then these are marginally safer than visible stop orders. If your stop is at an obvious level you are still vulnerable, but at least the market maker has to guess where they are.

Alternative Triggers

This is my own idea and I am still trying to convince my broker to offer them: allow stop loss orders to be triggered off the ask price (instead of the normal bid price) and buy stop orders to be triggered off the bid price (instead of the ask price). The mid-price (bid plus ask, divided by two) is a possible compromise.

Advantages:

- This would protect you from the spread being widened. The market maker cannot lower his ask price to trigger your stop loss without leaving himself vulnerable to buy orders. Nor can he raise his bid price to trigger your buy stop order without leaving himself open to sell orders.

Disadvantages:

- You would have to calculate the likely sell price by subtracting the normal spread from the trigger price.

- Wide spreads in a falling market would mean that your stop loss order is filled at a lower price. Likewise, wide spreads in a rising market would fill buy stop orders at a higher price. In a fast falling market, there is no guarantee that your stops will be filled at the trigger price. You may also be able to compensate for a fast falling market by allowing for a wider spread.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.