Volume Patterns

Volume is used for two major purposes:

- To confirm price changes: if the start of a trend is not accompanied by an increase in volume it is considered to be weak and lacking commitment.

- To anticipate changes in price: increases in volume often precede changes in price. See Accumulation and Distribution for more detail.

Trading Signals

Trending Markets

Short-term

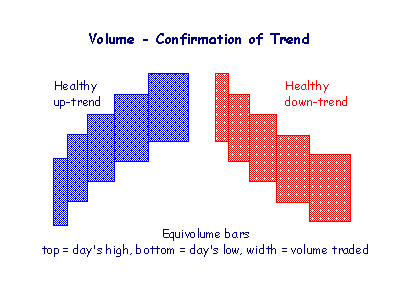

Trend confirmation:

- Rising prices and rising volume signal a healthy up-trend.

- Falling prices and rising volume signal a healthy down-trend.

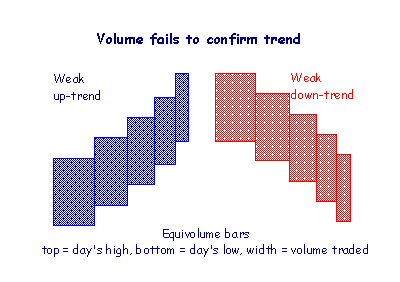

Trend weakness:

- Rising prices and falling volume signal trend weakness.

- Falling prices and falling volume may signal trend weakness. See Low Volume in Down-trends for further details.

A large range with low volume indicates a lack of interest from sellers (if price is rising) or buyers (if price is falling).

Long-term

Trend confirmation:

- Higher peaks with higher volume at peaks signal a healthy up-trend.

- Lower troughs with higher volume at troughs signal a healthy down-trend.

Trend weakness:

- Higher peaks with lower volume at peaks signal that the up-trend is weakening.

- Lower troughs with lower volume at troughs signal that the down-trend is weakening.

Accumulation and Distribution

Accumulation and distribution indicate who is in control of the market and often signal a reversal.

Trading ranges represent longer term accumulation or distribution.

Accumulation

Accumulation is when the market is controlled by buyers.

A down-trend that stalls while volume remains high signals that accumulation is taking place. Sellers have lost control to buyers and a reversal is likely.

An Accumulation Day occurs when either:

- Volume increases (compared to yesterday) and closing price moves higher, or

- After trending downwards, there is little or no price movement and an increase in volume.

Distribution

Distribution is when the market is controlled by sellers.

An up-trend that stalls while volume remains high is a sign that distribution is taking place. Buyers have lost control to sellers and a reversal is likely.

A Distribution Day occurs when either:

- Volume increases (compared to yesterday) and closing price moves lower, or

- After trending upwards, there is little or no price movement and an increase in volume.

Breakouts

When price is trading in a range, volume may indicate in which direction a breakout is most likely to occur:

- Higher volume before (leading up to) peaks means that an upward breakout is more likely

- Higher volume before troughs indicates that a downward breakout is more likely

Use volume to confirm the breakout:

- High volume immediately after the breakout indicates a healthy breakout.

- Low volume immediately after the breakout indicates weakness.

Trend Climaxes

After a trend has made substantial gains, there is often a surge in price and volume which may signal that the trend is about to expire. Look out for:

- Spikes,

- Wide-ranging days,

- Exhaustion gaps, and/or

- Reversal signals.

Low Volume in Down-Trends

Low volumes do not necessarily signal the end of a down-trend. Commitment from buyers is necessary to drive up prices. Prices can fall due to a lack of interest from both buyers and sellers.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.