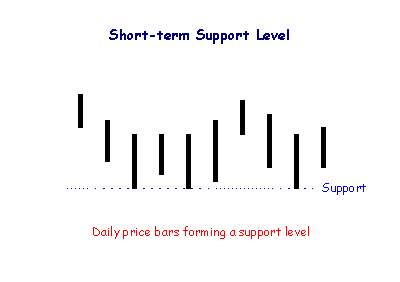

Short-Term Support & Resistance

When price falls to a new Low and then rallies, buyers who missed out on the first trough will be inclined to buy if price returns to that level. Afraid of missing out for a second time, they may enter the market in sufficient numbers to take control from sellers, creating a support level.

Similarly, when price makes a new High and then retreats, sellers who missed the previous peak will be inclined to sell when price returns to that level. Afraid of missing out a second time, they may enter the market in numbers sufficient to overwhelm buyers, creating a resistance level.

Role Reversal

Support levels, once penetrated, frequently become resistance levels and vice versa.

The market logic is fairly simple. Buyers who purchase near a support level, only to see price fall, are likely to sell in order to recover their losses when price rallies to near their break-even point. The support level then becomes a resistance level.

Likewise, stockholders who sell when price approaches a resistance level will be disappointed if price penetrates the level and continues to rise. They will be inclined to buy if price returns to the support level, fearing that they may miss out a second time. The resistance level thus becomes entrenched as a support level.

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.