Momentum Trading [Part 2 of 3]

By Dr. Bruce Vanstone

Introduction

This article is part 2 of a 3-part series. In this article, I will focus on using simulations to demonstrate the potential risks and rewards of the momentum approach. In the final part of the series, I will discuss the way in which investors can benefit from rule-based approaches to investment.

Creating Momentum Simulations

The results presented in this article are a quick demonstration of the potential of the momentum effect for Australian investors. I like to use simulations as they provide an excellent opportunity to see how well a strategy could have performed in the past. Simulations are also useful because they can give some clues as to how a strategy may perform in the future. However, we must always remember that past performance is no guarantee of future performance.

The simulation results in Table 1 have been created by calculating momentum on a historical rolling monthly basis for each member of the ASX200, and holding the top group of stocks each month. The data used contains delisted stocks, and is adjusted for survivorship bias as and where possible. Both simulations assume the same starting capital and account for transaction costs and slippage. The simulations cover the 10 year period from 2000 to 2009.

Applying Simulations to the ASX200

Table 1: Simulations of the Momentum Effect for Australian Investors

|

Historical Momentum Period |

Risk |

Reward (APR%) |

ASX200 benchmark Risk (Max DD%) |

ASX200 benchmark Reward (APR%) |

|

12 |

-60.07% |

18.54% |

-53.13% |

4.76% |

The columns contained in the table are explained below:

|

Historical Momentum Period |

The number of months over which historical momentum was measured |

|

Risk (Max DD%) |

Risk as measured by the maximum drawdown |

|

Reward (APR%) |

Reward as measured by APR (annual percentage rate) |

|

ASX200 benchmark Risk (Max DD%) |

Risk as measured by the maximum drawdown in the equivalent benchmark (XJO) |

|

ASX200 benchmark Reward (APR%) |

Reward as measured by APR in the equivalent benchmark (XJO) |

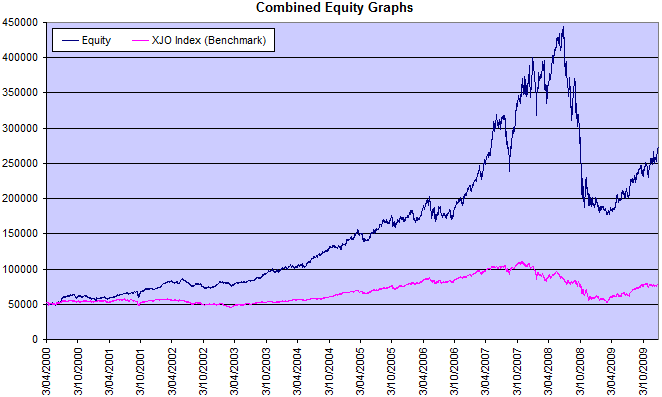

Figure 1 shows an equity graph plotting a simulated portfolio versus the ASX200 (XJO) index portfolio.

Conclusions we can draw from this

In the first article of this series, I pointed out that the momentum effect appears to be one of the most beneficial effects available to investors. The results in Table 1 and Figure 1 clearly confirm this observation.

The results above also confirm that to capture the benefits of a momentum approach, investors do not need to trade frequently, or with huge sums of capital, or in high-frequency timeframes. Instead, what is required is a disciplined, rules-based approach to investment, and a strong focus on risk management.

Although the momentum approach has slightly higher maximum drawdowns than the ASX200, the "potential" returns are substantially higher. Clearly though, investing using momentum alone is not a holy grail for investors! However, these results confirm that the momentum effect could be used to form the basis of an actively managed investment strategy, one that focused on trying to capture some of the outperformance, while still keeping an eye on risk.

In the third part of this series, I will discuss the benefits to investors of mechanical, rules-based trading approaches. Many investors receive sub-standard investment returns, particularly when managing their own capital. In some cases, it is not the strategy itself, but the way it is being implemented which is at fault. If you find yourself attempting to second-guess the way you trade, or you are unsure how to react during periods of market turmoil, then it is likely that you could benefit from the increased discipline and accountability that mechanical approaches can deliver.

Proceed to: Part 3

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.