Momentum Trading [Part 3 of 3]

By Dr. Bruce Vanstone

Introduction

This article is part 3 of a 3-part series. In this final article, I will summarize the key characteristics of investing using momentum based approaches. I will also discuss some approaches to managing risk in momentum models, and the benefits investors can expect when investing with rules-based funds.

Key Characteristics of Momentum Approaches

Perhaps one of the main benefits of the momentum approach is that it actually makes sense! It is not overly complicated to understand, it doesn't rely on split second timing, and it doesn't need huge sums of money to implement.

From a quantitative point of view, momentum trading also carries a number of clear benefits. It is simple to quantify, it is non-subjective, and it is robust to parametric modelling changes. The momentum approach also has academic credibility, and is the subject of ongoing research by some of the worlds best finance academics. The simulations in Part 2 showed that although there is slightly more "raw" risk than pure index investment, there is the potential for substantially higher returns.

It is precisely this possible mismatch between risk and reward which qualifies momentum as an approach worth further study. It's no wonder academics call momentum, "the premier anomaly"!

Managing Risk

Fortunately, there are a number of ways to manage risk that fit with the momentum approach. Distinguished academics like Andrew Lo have published useful research on the potential benefits of stop loss structures on momentum investment, demonstrating, at least in theory, that stop-losses can be of benefit to momentum based systems [1]. Other academic studies have investigated approaches like long-short investing, and hedging, which are techniques that have traditionally been used to reduce trading risk.

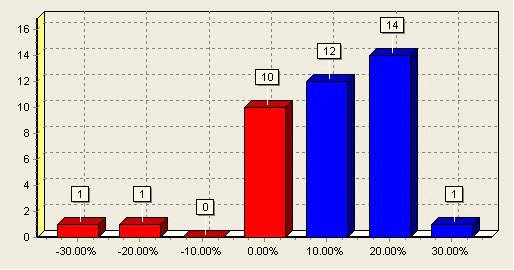

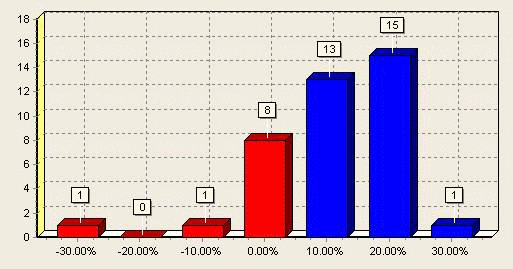

Another way of managing risk is to focus on investing when momentum models work the best. The time that momentum models outperform is when there is a clearly defined direction for the overall stockmarket. When the market direction tends to be sideways, it may be better to convert a momentum portfolio back to cash. In the shorter term, this may increase the number of months when small losses occur. However, in the longer term, it will help preserve capital during periods when there is no real expectation from the momentum approach. This ensures that when the market clearly establishes its overall direction, the investor is ready and able to take advantage of it. This is the approach employed by Porter Capital Management. I have included 2 graphs of quarterly returns for the simulation performed in article 2 of this series. The first graph shows the effect of keeping a momentum portfolio fully invested. The second shows the benefits derived by converting the portfolio back to cash when the market shows no clear direction. It is clear in the second graph that several of the quarterly returns have been shifted in a positive direction.

Figure 1: Portfolio fully invested

Figure 2: Portfolio converted to cash when market 'directionless'

Perhaps the most important consideration when using a momentum based approach is the idea of using models and rules to frame the way risk and returns are managed. Research tells us that to be successful in trading and investing requires a well defined plan, which encompasses not only entry and exit decisions, but also covers risk and money management. Having such a plan helps investors cope with the inevitable volatility that markets bring, especially during times when financial markets are under stress.

Importance of rules-based investment

For the average investor, trading and investing are difficult propositions. The average investor needs to invest a significant amount of time to develop the level of market expertise required to be successful.

As I have suggested in Part 2, many investors receive substandard investment returns, and in many cases, it may well be that the investors own behaviour is to blame. Research tends to show that investors have a number of well documented behavioural problems! For example, it has been shown that investors tend to overtrade their accounts to their detriment [2], and, that although investors may pick good stocks they tend to sell winners too early and sell losers too late [3].

Rules based investment allows the investor to specify the conditions under which he will buy or sell stock, and how much stock will be bought or sold. Using rules to quantify your trading decisions leads to clear entry and exit points, and reduces subjectivity, and worry. From a funds management point of view, well-defined rules reduce key man risk, and allow for using quantitative techniques to improve model performance.

Conclusions

During this 3-part series of articles, I have tried to describe the key benefits of momentum investing, and why it may offer potential advantages to investors. I have also tried to describe what I think are the primary benefits of a rules-based, or quantitative style of investment, and how the quantitative style works in with the momentum approach.

I would welcome any questions or feedback you may have on this series of articles.

Bruce

References

[1] Kaminski, Kathryn and Lo, Andrew W., When Do Stop-Loss Rules Stop Losses? (January 3, 2007). EFA 2007 Ljubljana Meetings Paper. Available at SSRN: http://ssrn.com/abstract=968338

[2] Barber, Brad M and Odean, Terrance, Trading is Hazardous to your Wealth: the Common Stock Investment Performance of Individual Investors, The Journal of Finance, Vol. LV, No. 2, April 2000

[3] Odean, Terrence, Are Investors Reluctant to Realize their Losses?, The Journal of Finance, Vol. 53, No. 5, October 1998, pp. 1775-1798

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.