The Shakeout

(Tricks of the Trade)

A market professional may want to accumulate a large position in a stock that is trending strongly; either for his own account or for a major client. How does he/she do this? If he starts placing buy orders in the pool, he will chase the stock up sky high, without being able to build a big enough line. The golden rule is: buy into weakness.

Patience

The professional bides his time, waiting for the stock to consolidate or start a short-term correction. He knows that trading will be quiet during this phase: buyers lose interest for a while and look elsewhere. He also knows where most traders have their stops.

A few well-placed sell orders on a quiet day will drive the stock below its' support level. Stops are triggered, sending a flood of sell orders into the market. Everyone takes fright while our market professional steps forward and scoops the pool; buying in the face of the correction. Selling dries up when the stops are filled and the stock soon recovers back into its normal trading range. Everything returns to normal; except that our market professional now has a sizeable parcel of stock, accumulated at bargain-basement prices; and a group of punters curse their luck while the stock soars into the stratosphere.

Example

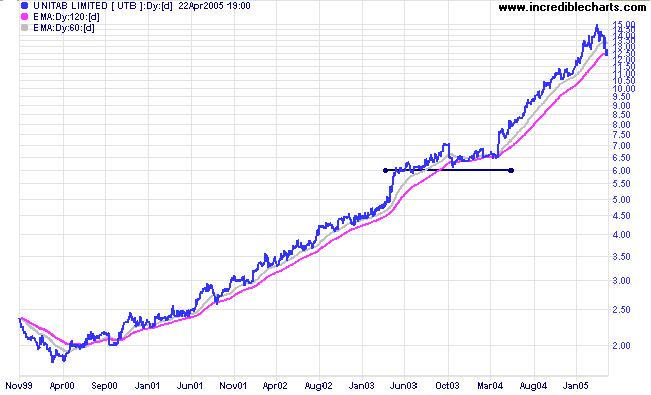

Unitab Limited holds various gambling monopolies in Australia. The stock had been in a strong up-trend for several years before a consolidation around $6.00.

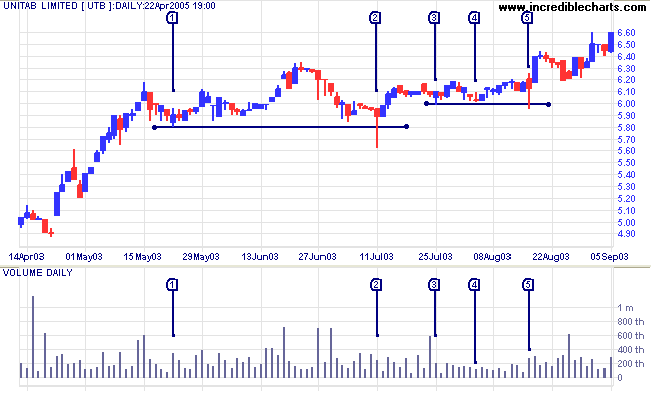

After a brief low (at [1] on the chart below) the stock consolidated for 2 months around the $6.00 mark before stops were triggered at [2] by a fall below $5.80. There was a flurry of selling, quickly scooped up by the market pros, with the stock retreating back above the support level before the close.

A further support level was established at $6.00, by lows at [3] and [4], before another shakeout at [5].

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.