Force Index Indicator

Developed by Dr Alexander Elder, the Force index combines price movements and volume to measure the strength of bulls and bears in the market. The raw index is rather erratic and better results are achieved by smoothing with a 2-day or 13-day exponential moving average (EMA).

- The 2-day EMA of Force is used to track the strength of buyers and sellers in the short term;

- The 13-day EMA of Force measures the strength of bulls and bears in intermediate cycles.

If the Force index is above zero it signals that the bulls are in control. Negative Force index signals that the bears are in control. If the index whipsaws around zero it signals that neither side has control and no strong trend exists.

- The higher the positive reading on the Force index, the stronger is the bulls' power.

- Deep negative values signal that the bears are very strong.

- If Force index flattens out it indicates that either (a) volumes are falling or (b) large volumes have failed to significantly move prices. Both are likely to precede a reversal.

The 2-day Force index is used as part of Dr Eder's Triple Screen trading system.

Force Index Trading Signals

Only trade in the direction of the trend - indicated by the slope of the 13-day EMA.

- Go long if the Force index is below zero and there is a bullish divergence.

- Go short if the Force index is above zero and there is a bearish divergence.

Complete trading rules for the Force index can be found in Trading For A Living by Dr Alexander Elder.

Example

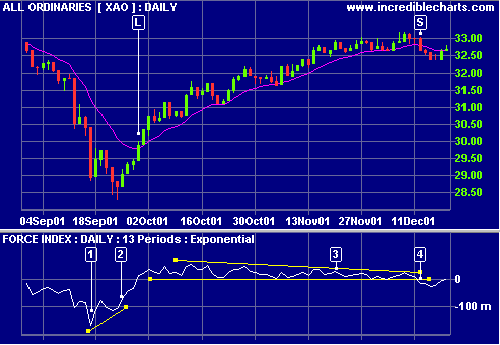

The All Ordinaries Index (Australia) is shown with 13-day exponential moving average (EMA) and Force Index.

Mouse over chart captions to display trading signals.

- A deep spike marks the end of a down-trend but it also warns traders to expect a re-test of the previous bottom.

- Go long [L] on the bullish divergence. Wait for the EMA to turn upwards.

- Declining peaks signal that bulls' strength is fading. No action is taken on the bearish divergence - the EMA is still rising.

- The Force index falling below zero indicates that the bulls have lost control. On the strength of the bearish divergence - go short [S] when the EMA turns downward.

Setup

See Indicator Panel for directions on how to set up an indicator. The default settings for the Force index are :

- 13-day exponential moving average.

To alter the default settings - Edit Indicator Settings.

Force Index Formula

The Force index is calculated by subtracting yesterday's close from today's close, before multiplying by volume:

Force index = (Close [today] - Close [yesterday]) * Volume

Author: Colin Twiggs is a former investment banker with almost 40 years of experience in financial markets. He co-founded Incredible Charts and writes the popular Trading Diary and Patient Investor newsletters.

Using a top-down approach, Colin identifies key macro trends in the global economy before evaluating selected opportunities using a combination of fundamental and technical analysis.

Focusing on interest rates and financial market liquidity as primary drivers of the economic cycle, he warned of the 2008/2009 and 2020 bear markets well ahead of actual events.

He founded PVT Capital (AFSL No. 546090) in May 2023, which offers investment strategy and advice to wholesale clients.