How to Trade Trends

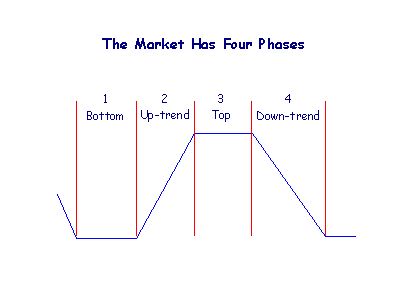

The market has 4 basic phases and no trading system is suited to all of them. Some systems are suited to Phases 1 and 3, when the market is ranging, while others are designed to trade the trends in Phases 2 and 4. Trend-trading systems are more popular as they require less time and normally generate larger returns.

Trading Trends

The object of trend-trading is to go long at the transition from Phase 1 to Phase 2 and to exit before Phase 4. Some models also short the market during Phase 4, but this should be left to experienced traders .

Successful systems are built around the following principles:

- Selecting securities.

Use the Stock Screener to identify potential Market Leaders.

- Market direction.

(a) Decide on the Time Frame that you are trading.

(b) Confirm the Market Direction using a suitable trend indicator. - Trend direction.

Using the same indicator, check the Trend Direction of each security.

- Entry signals.

(a) Take Entry Signals from a suitable momentum oscillator.

(b) Use Trailing Stops to time entry and exit points. - Stop losses.

(a) Set Stop Loss Orders as soon as your trade is confirmed.

(b) Do not exceed the Maximum Acceptable Loss.

(c) Be technically consistent when Setting Stop Levels.

(d) Adjust Stop Levels over time to protect your profits. - Exit signals.

Take Exit Signals from a suitable trend indicator.

1. Market Leaders

When selecting stocks, focus on market leaders rather than laggards.

Only

invest in businesses that you understand. If

you are not confident in your ability to separate the good from the bad then

use a stockbroker's or financial advisor's recommendations.

Alternatively, consider investing in a good growth fund and switch in/out with

the primary trend.

Market Leaders

Use the Stock Screener to compare the relative performance of all stocks over the past 12 months. Analyze the top 10 per cent:

- Have sales and earnings per share grown strongly over the past 3 years?

- Have sales and earnings per share growth accelerated in recent quarters? Be

on the alert for cost reductions and layoffs that may enhance

short-term performance at the expense of long-term growth.

-

Look for sustainable competitive advantage and strong growth prospects.

Does the company have a competitive edge? Examine their products or services: do they have better technology; stronger brands; copyrights or patents; or greater expertise; that gives them an advantage over competitors?

Industry Sectors

Use the Stock Screener to identify the industry sectors that show the best relative performance. Select stocks from top industry sectors:

- Look for two or more market leaders in the same industry sector.

- Compare the relative performance of industry sectors over the last 3 years and look for market leaders from these sectors.

Resistance Levels

Select stocks that are clear of major resistance

levels. Look for market leaders that have recently made new highs or turnarounds that

are well below major resistance levels.

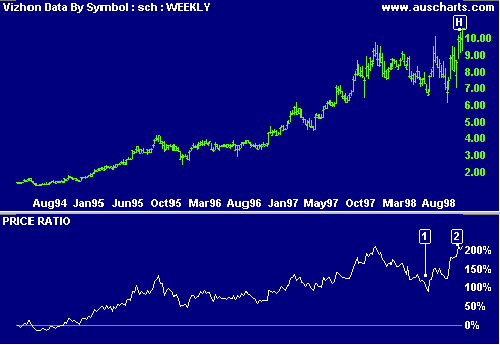

Example

Charles Schwab is charted below with weekly Price Ratio showing performance relative to the S&P 500.

Securities Brokers were one of the leading industry sectors in the 90's. Charles Schwab reached a new high on 20 October 1998 on the back of strong earnings growth.

- The Price Ratio, depicting stock performance relative to the S&P 500, fell sharply during the mid-1998 correction [1].

- Price Ratio recovers sharply in the third quarter [2], making a new high [H] on 20 October.

2. Market Direction

The overall market influences the performance of smaller markets and individual stocks. Study the big picture first before looking at any shares in isolation.

(a) Time Frame

Decide on the cycle that you are going to trade:

- Long-term (or primary) trends that are measured in years;

- Intermediate (or secondary) trends of 3 weeks up to 6 months;

- Short-term cycles of less than 3 weeks; and

- Intra-day trends.

This will influence your indicator settings. More details can be found at Time Frames and Indicator Time Frames.

(b) Trend Indicator

Trade only in the direction of the overall market:

- Use a trend indicator to determine the direction in which the market is trending.

- Chart either the Dow Industrial Average, Standard &

Poor 500 or the NASDAQ index.

The Dow comprises the top 30 blue chip industrial stocks while the S&P 500 is more representative of the entire market. The NASDAQ has more influence on tech stock prices. - In addition, chart a local market index such as the FTSE 100 for the UK market or the ASX 200 for Australia, if you are trading outside the USA.

Reading The Market discusses a number of systems used to determine market direction.

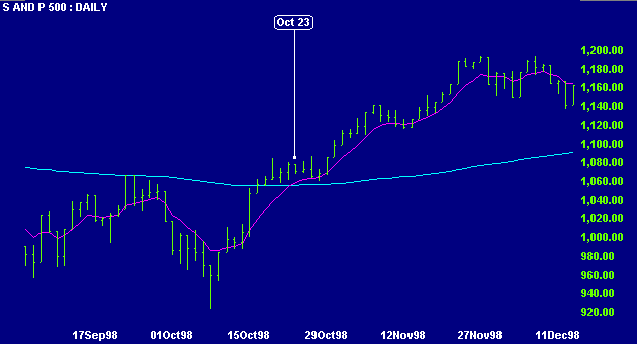

Example

The Standard & Poor 500 is charted with 7-day and 150-day exponential moving averages, used to track the primary trend.

An up-trend is signaled on October 23rd when:

3. Trend Direction

Trade only in the direction of the trend:

Use a trend indicator to identify whether the security is trending or ranging. Only take signals if the security is trending upwards.

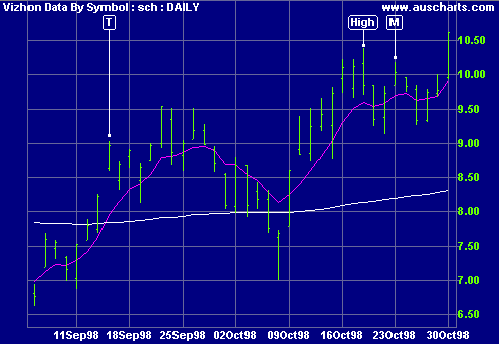

Example

Charles Schwab is charted with 7-day and 150-day exponential moving averages, used to track the primary trend.

By October 23rd, when the market signals an up-trend [M], the stock is trending strongly upwards:

This is also evident from the successively higher peaks and troughs on the secondary cycle and the new High reached on October 20th.

4. Entry Signals

(a) Entry Signals

The merits of the different oscillators are discussed at Momentum Indicators. It is also possible to use an oscillator such as the Money Flow Index or MACD to time your entry points. In fact, some analysts do not use indicators at all and base their entry points on breakouts above resistance levels.

Set the Indicator Time Frame to suit the cycle being traded. There is a trade-off between indicator responsiveness and reliability: a very short time frame may provide earlier, but occasionally incorrect, signals. Trailing stops help to compensate for this.

(b) Trailing Stops

Trailing Stops are useful for weeding out premature or false signals and help to alleviate some of the psychological pressure on traders - by providing automatic entry and exit points.

Example

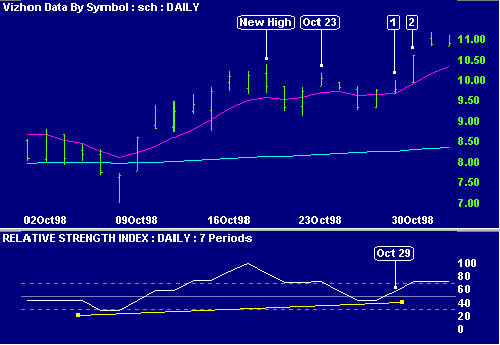

Charles Schwab with 7-day and 150-day exponential moving averages and 7-day relative strength index.

- Favorable trading conditions (from Steps 2 & 3) commence on October 23rd. Shortly thereafter the

RSI crosses to below zero and turns back above the zero line, giving a signal to go long [Oct 29].

The signal is strengthened by a failure swing, shown by the trendline.

Place a buy stop order above the High on the signal day [1]. - We are stopped in on day [2] when price rises above the High of the previous day. By the close the stock had formed a new High, surpassing the High of October 20th.

5. Stop Loss Protection

A Word Of Caution

These are typical steps that a trader will follow in deciding what stocks to buy, when to buy them and when to sell. It is not a magic formula, but consistent use should enhance your investment performance.

Trading methods can be compared to a carpenter's tools: Skilled use can produce outstanding results but unskilled use may lead to injury. Learn to use your trading tools properly before committing any capital. Study the behavior of the indicators over several years, learn their strengths and weaknesses and how they interact with each other and with the market. Start with a small amount of capital and only increase this when you are confident that you have a winning strategy.