Moving Average Indicator

Moving averages provide an objective measure of trend direction by smoothing price data. Normally calculated using closing prices, moving averages (MAs) can also be used with median, typical , weighted closing, and high, low or open prices as well as other indicators.

Moving Average Time Frames

Shorter length MAs are more sensitive and identify new trends earlier, but also give more false alarms. Longer MAs are more reliable but less responsive, only picking up the big trends.

Use a moving average that is half the length of the cycle that you are tracking. If the peak-to-peak cycle length is roughly 30 days, then a 15 day moving average is appropriate. If 20 days, then a 10 day moving average is appropriate. Some traders, however, will use 14 and 9 day moving averages for the above cycles in the hope of generating signals slightly ahead of the market. Others favor the Fibonacci numbers of 5, 8, 13 and 21.

- 100 to 200 Day (20 to 40 Week) are popular for longer cycles;

- 20 to 65 Day ( 4 to 13 Week) are useful for intermediate cycles; and

- 5 to 20 Days for short cycles.

Trading Signals

The simplest moving average system generates signals when price crosses the MA:

- Go long when price crosses to above the MA from below.

- Go short when price crosses to below the MA from above.

The system is prone to whipsaws in ranging markets, with price crossing back and forth across the moving average, generating a large number of false signals. For that reason, moving average systems normally employ filters to reduce whipsaws.

More sophisticated systems use more than one moving average.

- Two Moving Averages uses a faster moving average as a substitute for closing price.

- Three Moving Averages employs a the third moving average to identify when price is ranging.

- Multiple Moving Averages use a series of six fast moving averages and six slow moving averages to confirm each other.

- Displaced Moving Averages are useful for trend-following purposes, reducing the number of whipsaws.

- Keltner Channels use bands plotted at a multiple of average true range to filter moving average crossovers.

- The popular MACD ("Moving Average Convergence Divergence") indicator is a variation of the two moving average system, plotted as an oscillator which subtracts the slow moving average from the fast moving average.

Types of Moving Averages

There are several different types of moving averages, each with their own peculiarities.

- Simple are the easiest to construct, but also the most prone to distortion.

- Weighted are difficult to construct, but reliable.

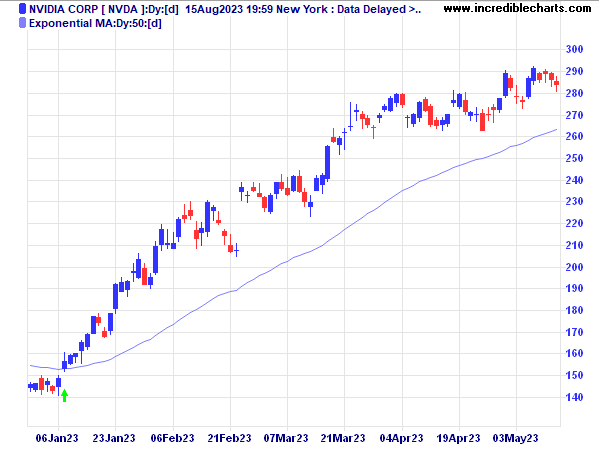

- Exponential achieve the benefits of weighting combined with ease of construction.

- Wilder moving averages are used mainly in indicators developed by J. Welles Wilder. Essentially the same formula as exponential moving averages, they use different weightings — for which users need to make allowance.

- Hull moving average was developed by Alan Hull to be "responsive to current price activity while maintaining curve smoothness."

Setup

Indicator Panel shows how to set up MAs.

The default setting is a 21 day exponential moving average.