6. Exit Signals

Trade Indicators

Use a Trend Indicator to exit from the trend. Adjust the Indicator Time Frame to suit the cycle being traded.

Example

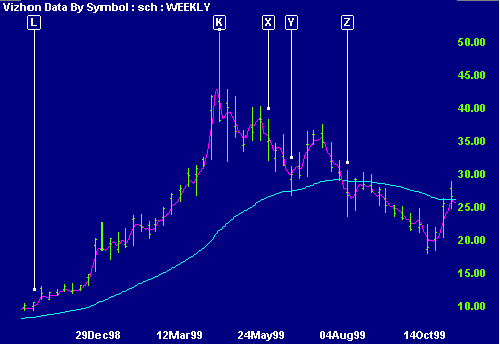

Charles Schwab with weekly price bars and 7-day and 150-day exponential moving averages.

- Entry [L] on 30 October 1998 at $10.13.

- Exit on Key Reversal at [K] on 15 April 1999 at $44.75.

- Remaining position stopped out at [X] on 25 May 1999 at $33.13.

- Price crosses below MA150 at [Y] on 14 June 1999 at $27.25.

- MA7 crosses below MA150 at [Z] on 4 August 1999 at $24.50.

If no stops had been activated, the position would have been closed either:

- At [Y] when price fell below the 150-day moving average; or

- At [Z] when the 7-day MA fell below the 150-day MA,

depending on the exit strategy.

Trade Summary

| Entry [L] | October 30, 1998 | $10.13 |

| Key Reversal [K] | April 15, 1999 | $44.75 |

| Stopped Out [X] | May 25, 1999 | $33.13 |

| Price crosses below MA150 [Y] | June 14, 1999 | $27.25 |

| MA7 crosses below MA150 [Z] | August 4, 1999 | $24.50 |

Returns vary between 440 per cent and 240 per cent.

Note how important it is to exit at the right time in addition to timing the entry: the correction retreated to below $18.00.

[ Back ]